Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

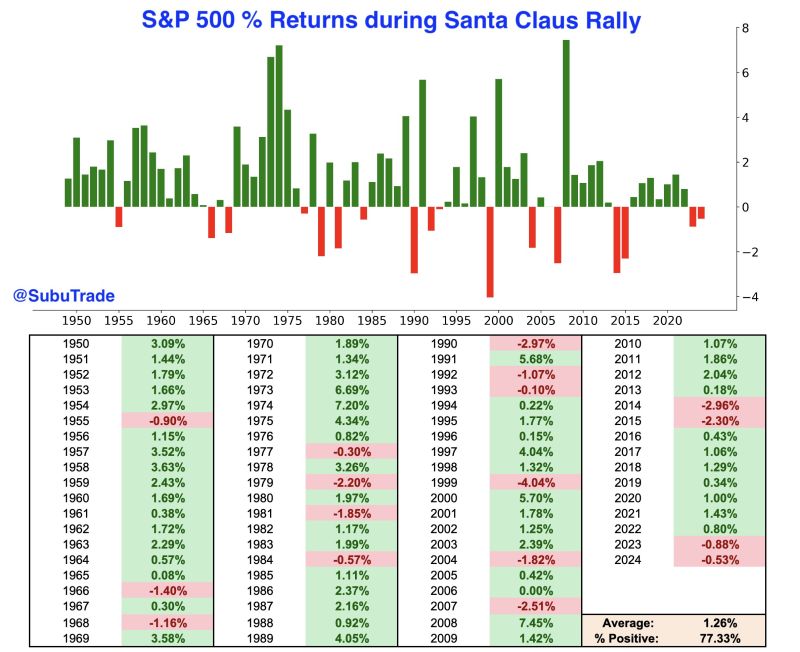

The 'official' Santa Claus Rally begins on December 24

It covers the last 5 trading days of December + the first 2 of January. $SPX was up 77% of the time. The last 2 were negative, but there has never been a third straight down Santa Claus Rally. Source: Subu Trade @SubuTrade

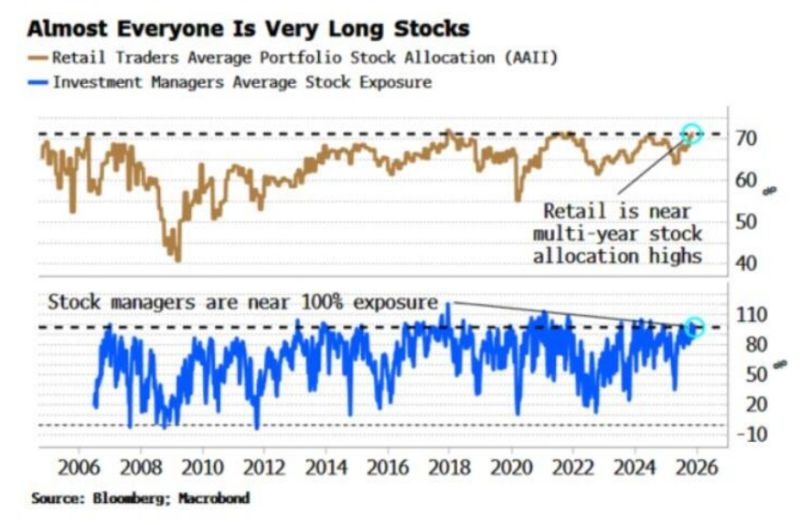

Risk appetite is through the roof.

Stock market investment is at 20+ year highs. Meanwhile, retail asset allocation to stocks is up to ~70%, near the highest in 20 years, according to the AAII survey. This is in-line with the highs seen during the 2021 meme stock frenzy. To put this into perspective, stock allocations were just ~55% during 2020 and fell to ~40% at the 2008 low. At the same time, average stock exposure among investment managers is up to nearly ~100%, one of the highest readings over the last 20 years. This has risen ~65 percentage points since the April low. Source: The Kobeissi Letter, Bloomberg

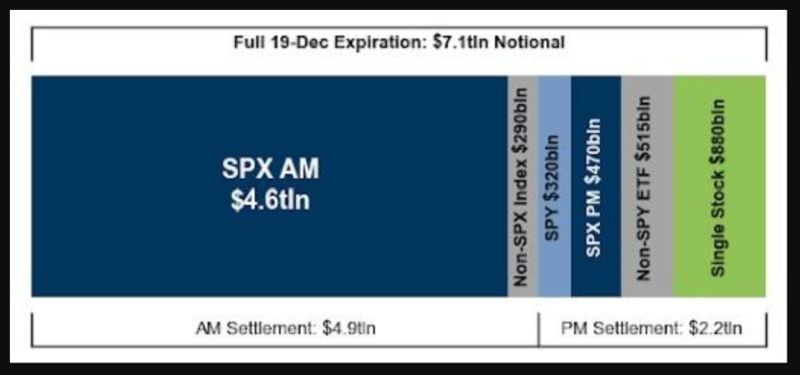

Today is the largest options expiration in history...

Goldman's options guru John Marshall estimates that this December options expiration will be the largest ever with over $7.1 trillion of notional options exposure expiring, including $5.0 trillion of SPX options and $880 billion notional of single stock options. Source: zerohedge

🚨 BREAKING: Oracle just became the backbone of TikTok U.S.

$ORCL 🟢 +6.4% after hours. Source: Trend Spider

BREAKING 🚨: Oracle

$ORCL has now plunged 48% since its all-time high on September 10, a total market cap loss of $475 Billion 📉📉 Note that the stock is UP 6% after-markets on TikTok deal + OpenAI securing $100B in funding from UAE sovereign wealth fund. Source: Barchart @Barchart

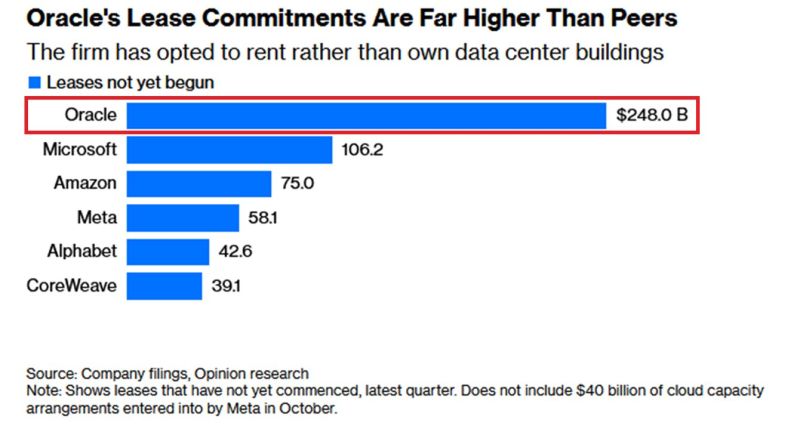

Is Oracle a ticking time bomb? 💣

Most people are blinded by the AI hype. But if you look at the balance sheet, the red flags are screaming. 🚩 Here is the $248 BILLION reality check that nobody is talking about: 1. The Off-Balance-Sheet Trap Oracle has committed to $248 billion in lease commitments for AI data centers. These aren't just numbers—they are massive legal obligations that kick in fully by 2028. 2. The Cash Flow Problem Capex is set to double to $50 billion. Meanwhile, Free Cash Flow (FCF) is expected to stay NEGATIVE for years. They are spending money they haven't made yet to build infrastructure they hope people will use. 3. The "Duration Mismatch" This is the silent killer. Oracle is signing long-term leases (decades) to support short-term AI contracts (months/years). If AI demand softens? The revenue vanishes. The lease payments? They stay forever. The Bottom Line: Oracle is betting the entire farm on the AI revolution. If the bubble bursts—or even just leaks—their solvency isn't just "threatened." It's in danger. 📉 We’ve seen this movie before (1999, anyone?). Leverage is a great tool until the music stops. Is Oracle the first domino to fall, or is this just the price of winning? 👇 Let’s discuss in the comments. Source: Global Markets Investor

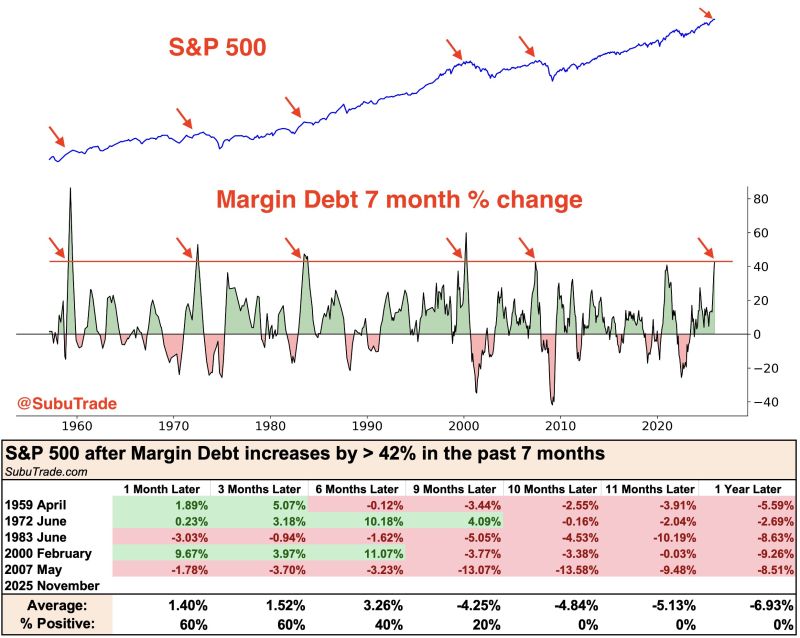

Margin Debt increased +42% in the past 7 months. Investors went all-in.

This only happened 5 times before, and the S&P 500 was lower 1 year later every time. The last 2 times? February 2000 & May 2007 Source: Subu Trade @SubuTrade

Oracle’s primary data center partner, Blue Owl Capital, has officially walked away from a $10B deal to fund a massive 1GW facility in Michigan.

Why? Because the "growth at all costs" era of AI is meeting a harsh new reality: Debt. The Breakdown: 🚀 The Ambition: Oracle is trying to build a $300B infrastructure bridge for OpenAI. 💸 The Debt: Oracle’s net debt has ballooned from $78B to $105B in just one year. Forecasts show it hitting $290B by 2028. 🛑 The Pivot: Lenders are getting nervous. They are demanding stricter terms, higher rates, and more collateral. The Lesson for Leaders: Even the giants aren't immune to market sentiment. Blue Owl—the pioneer of these massive sale-leaseback deals—decided the risk no longer matched the reward. While Oracle says they are moving forward with a new (unnamed) partner, the message from Wall Street is clear: The blank check for AI infrastructure is being cancelled. Investors are no longer just asking "How fast can you build?" They are asking "How are you going to pay for it?" We are moving from the Hype Phase of AI into the Sustainability Phase. Only those with the strongest balance sheets will survive the transition. Oracle $ORC stock is down -5% on the news!

Investing with intelligence

Our latest research, commentary and market outlooks