Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

President Trump announces steps to ban large institutional investors from buying single-family homes.

"People live in homes, not corporations." Blackstone shares are tumbling. Source: Brew markets

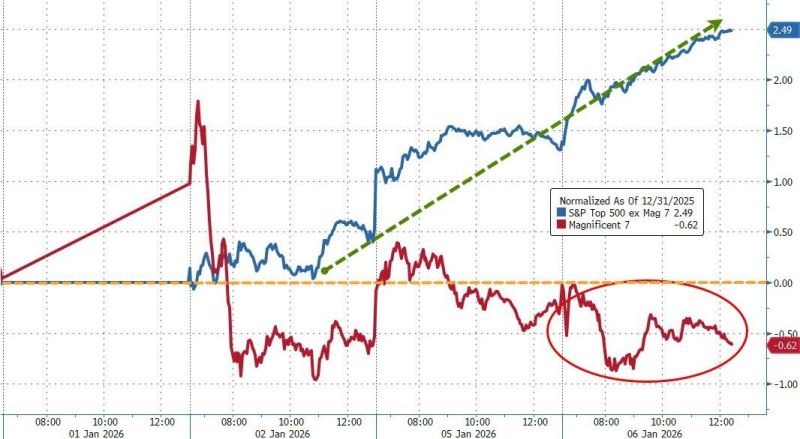

From Mag7 to Lag7...

Mag7 stocks have significantly lagged the rest of the market in 2026 so far... The S&P 493 is up 2.5% YTD, Mag7 -0.6%... Source: www.zerohedge.com, Bloomberg

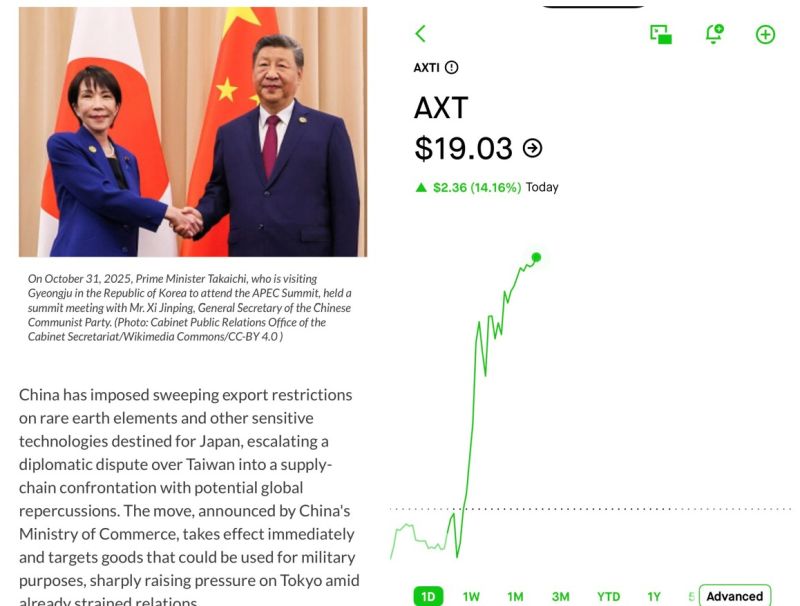

Nvidia CEO said yesterday that the “Memory Bottleneck is Severe”

SK Hynix ($330B) $MU ($355B) Samsung ($595B). Wait and see the look on everyone’s face when they find out the entire AI buildout will be bottlenecked by the tiny $AXTI ($1B) after the China’s new export controls. Source: Serenity @aleabitoreddit

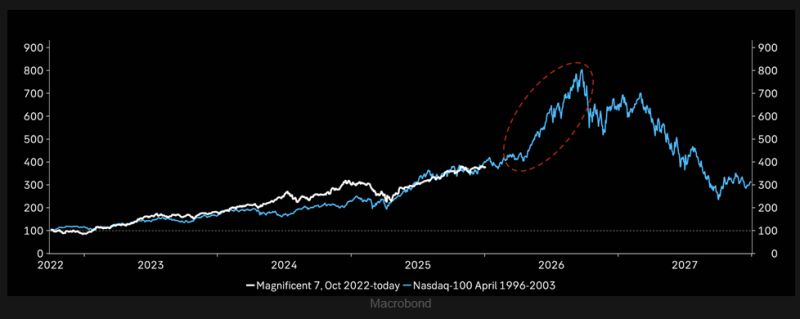

Is the mania with us in the room right now?

Last time around... Nasdaq jumped 100% last six months ahead of peak, this is the tricky part. Source: Macrobond, TME

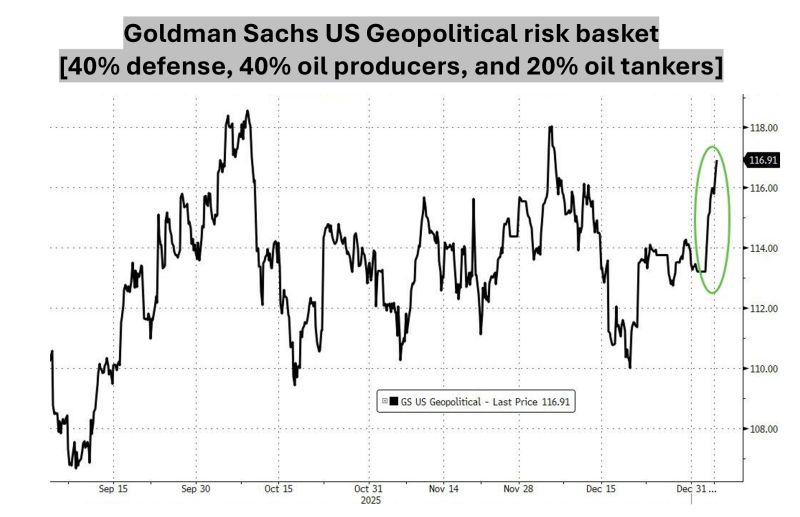

How to go long geopolitical risk...

Goldman's US Geopolitical Risk basket (composed of US-listed equities that are sensitive to geopolitical risk, diversified across 40% defense, 40% oil producers, and 20% oil tankers) has surged to start 2026... Source: zerohedge, Bloomberg

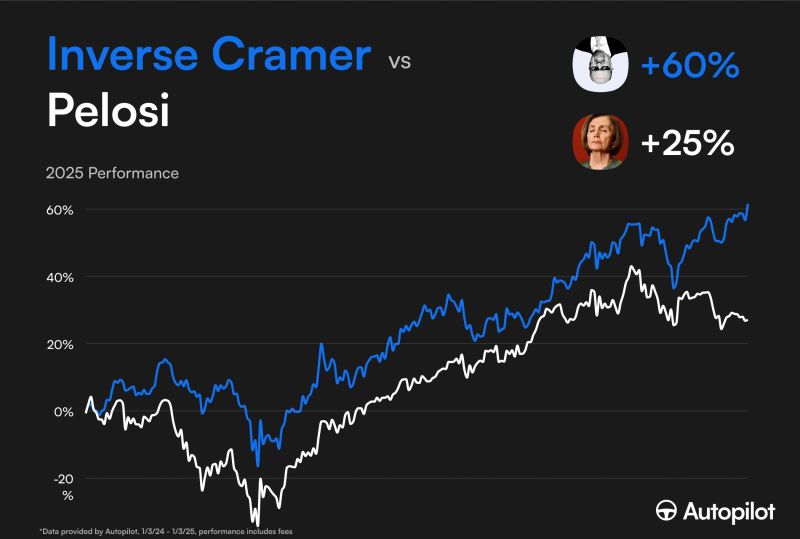

The Queen has been dethroned

Inverse Cramer officially beats out Pelosi for the top portfolio on Autopilot Source: Nancy Pelosi Stock Tracker ♟ @pelositracker

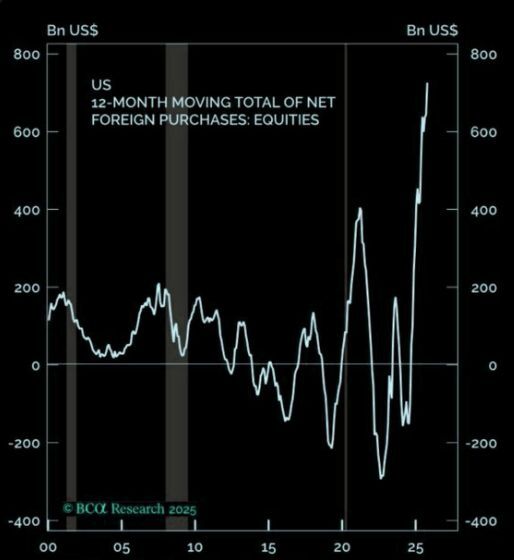

Foreigners net bought more than $700 Billion worth of U.S. Stocks over the last 12 months, the largest inflow this century 🚨👀📈

Source: Barchart

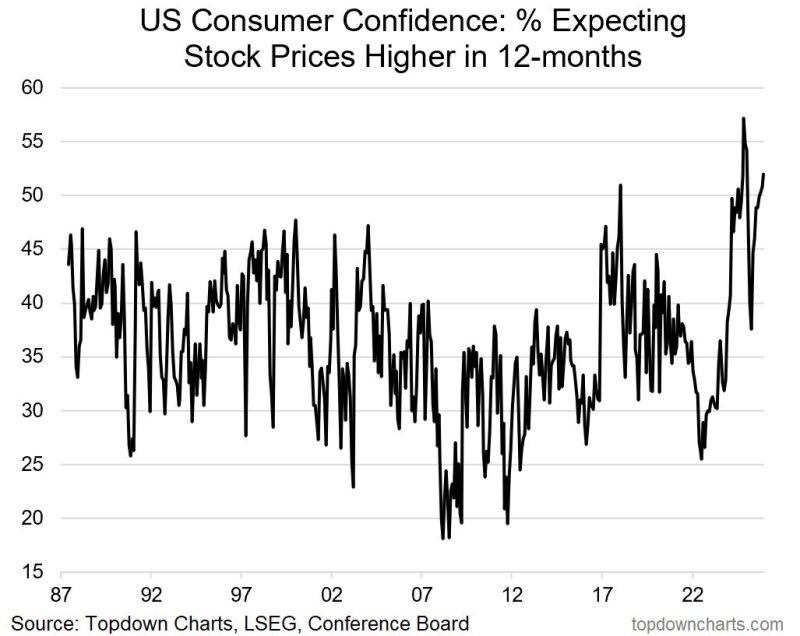

More than 50% of consumers expect higher stock prices over the next 12 months, one of the highest readings in history 🚨📈🤯

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks