Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

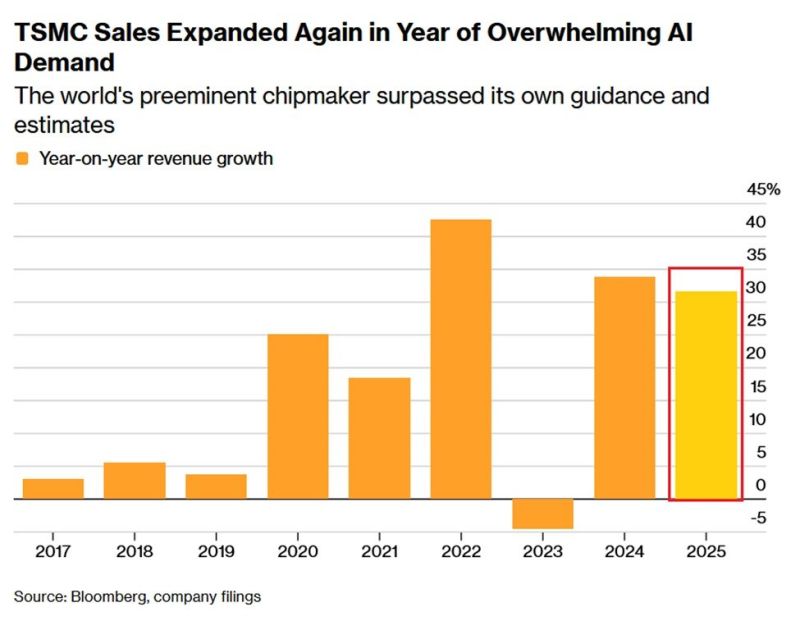

BREAKING: The AI chip boom shows no signs of slowing.

Taiwan Semiconductor, $TSM, reported a +35% YoY increase in net profit for Q4 2025, driven by surging AI chip demand. Asia’s most valuable company has now posted YoY profit growth for 8 consecutive quarters. At the same time, revenue grew +21% YoY in Q4 2025, to $33.7 billion. Both revenue and profit beat analyst estimates. Full-year 2025 revenue jumped +32% YoY and surpassed $100 billion for the first time in company history. TSMC also expects record CapEx in 2026, at $52-56 billion, up +32% YoY, to expand global manufacturing capacity. Source: The Kobeissi Letter

Q4 earnings season officially kicks off yesterday.

Source: Brew markets

The Great American Oil Paradox

The U.S. is executing a unique energy “double-play,” exporting massive amounts of light, sweet shale crude while still importing heavy, sour oil to match its legacy refinery infrastructure. This paradox being both a top exporter and importer makes the country the central hinge of the global oil market. Far from a weakness, this interdependence gives the U.S. leverage, allowing it to balance supply and influence prices worldwide as we head into 2026. Source: Jack Prandelli

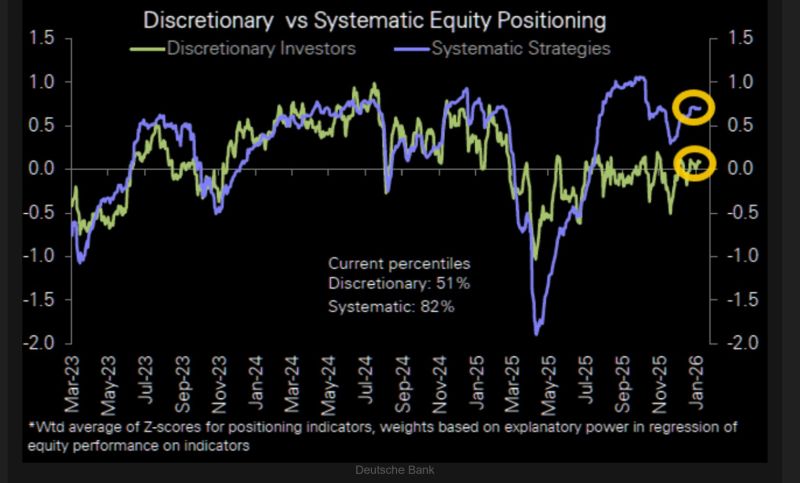

Believe it or not, investor's positioning on equities is still not over-extended.

Deutsche Bank: "Notably, while investor sentiment has risen meaningfully over the last 6 weeks, positioning in our reading has not yet followed, with discretionary investors are still holding cautiously near neutral (0.09sd, 51st percentile). Systematic strategy positioning though is higher (0.71sd, 82nd percentile)." Source: DB, TME

Long EM. Short US large caps.

Is the Dalio playbook about to break out? Source: Trend Spider

VIX seasonality is about to kick in right here...

Source: Equity clock, The Market Ear

The defense squeeze

European aero and defense index, SXPARO, has surged by some 13% YTD. The squeeze has been absolutely huge since the start of the week, with RSI now trading at 80! Source: The Market Ear, LSEG Workspace

President Trump says he is banning dividends and buybacks for Defense companies.

📉 $LMT | $RTX | $NOC | $GD Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks