Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

S&P 500 technicals

$SPX has reversed near the top of the range and is now breaking below the short-term trend line. Zooming out, the market still lacks a clear medium-term trend, with price sitting right on the 50-day and RSI suddenly at its most oversold since the December shakeout. First meaningful support comes in around 6,800 (futures). Source: LSEG, TME

Emerging Market Stocks have formed a Potential Inverse Head & Shoulders Pattern against the S&P 500

Source: Barchart

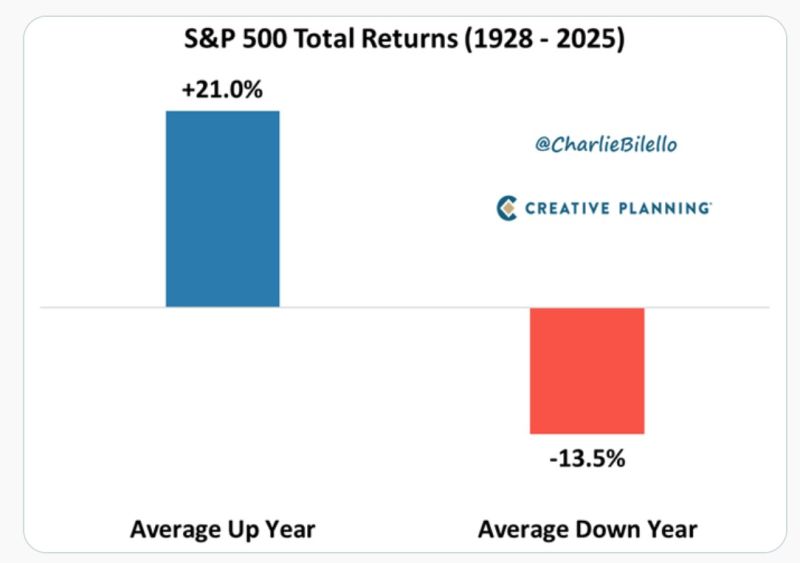

The average stock market return of 10% is misleading

Most years aren’t average - they’re extreme. Big gains. Sharp losses. That’s how long-term returns are made. Source: Peter Mallouk @PeterMallouk

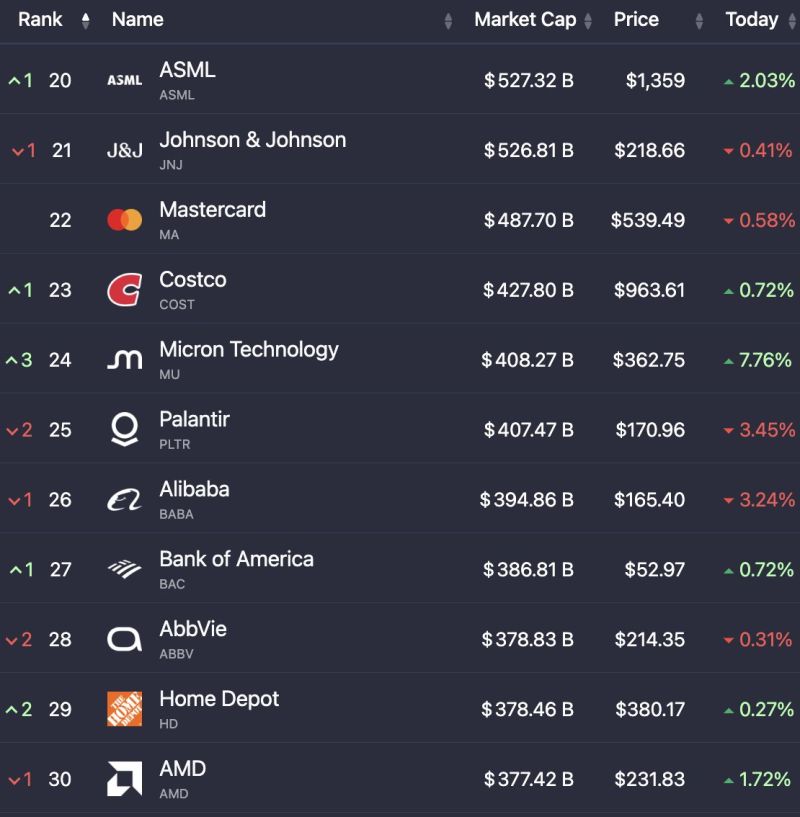

Micron $MU is now one of the top 25 largest companies in the world

Source: Evan, @StockMKTNewz

One channel. Six years of price action. Now testing the limits. $SPX

Source: Trend Spider

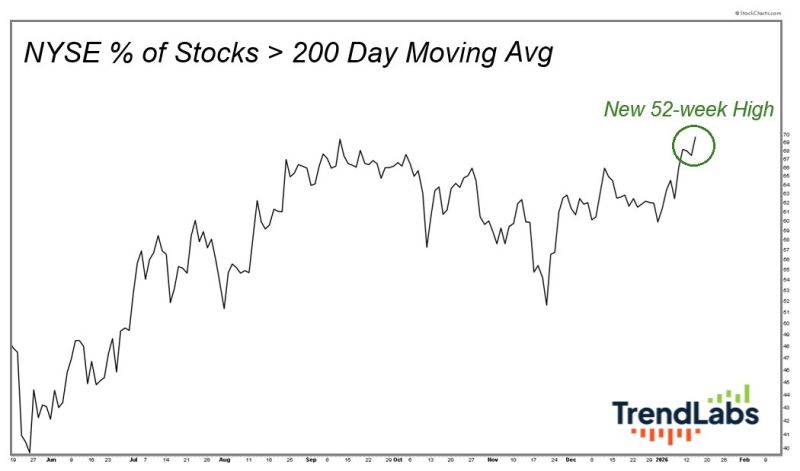

There are more stocks on the NYSE in uptrends right now than an any other point since 2024. Is so much winning a bad thing for investors?

Source: J.C. Parets @JC_ParetsX

Investing with intelligence

Our latest research, commentary and market outlooks