Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Chinese Households now have available cash totaling 160 TRILLION Yuan, the equivalent of more than $22 Trillion USD 🚨📈🤑🥳

Source: Barchart, Financial Times

US oil stocks react to Venezuela:

1. Chevron, $CVX: +11% 2. Valero, $VLO: +11% 3. ConocoPhillips, $COP: +10% 4. Marathon, $MPC: +10% 5. Exxon Mobil, $XOM: +7% 6. Phillips 66, $PSX: +6% 7. Occidental Petroleum, $OXY: +4% 8. EOG Resources, $EOG: +4% 9. Devon Energy, $DVN: +4% 10. Kinder Morgan, $KMI: +3% These stocks have now added +$100 BILLION in market cap on the news President Maduro being captured by the US. US big oil has won again. Source: The Kobeissi Letter

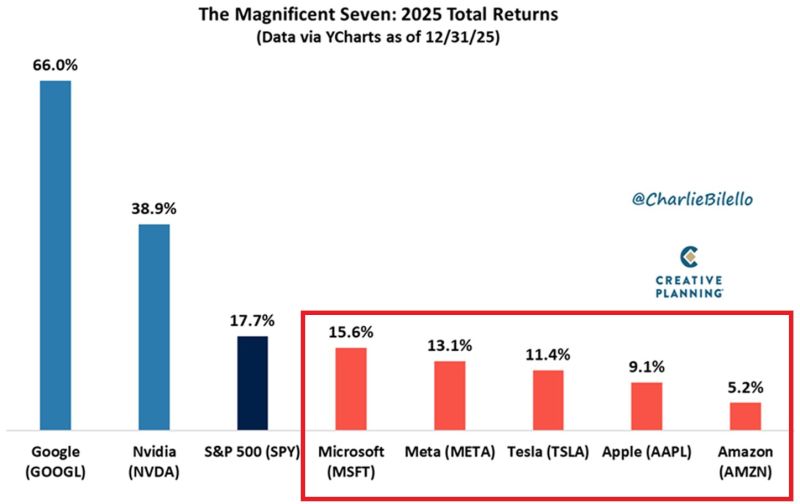

⚠️Most of the Magnificent 7 stocks actually LAGGED the S&P 500 in 2025.

Out of the 7 Magnificent stocks, only Google, $GOOGL, and NVIDIA, $NVDA, outperformed the broader US stock market index last year with +66% and +39% gains, respectively. This means Microsoft, Meta, Tesla, Apple, and Amazon finished 2025 below the S&P 500. The Magnificent 7 are not so magnificent anymore. Will this continue? What do you think? Source: @charliebilello, Global Markets Investor

New all-time high for $XOM!

The chart shows Exxon Mobil’s total return, including dividends This happened in a year where oil prices fell below $60, and Exxon Mobil raised its 2030 free cash flow targets by $35 billion Now imagine what happens if oil prices start rising again Source: Karel Mercx @KarelMercx

All major equity markets outperformed the US in 2025

Source: Goldman

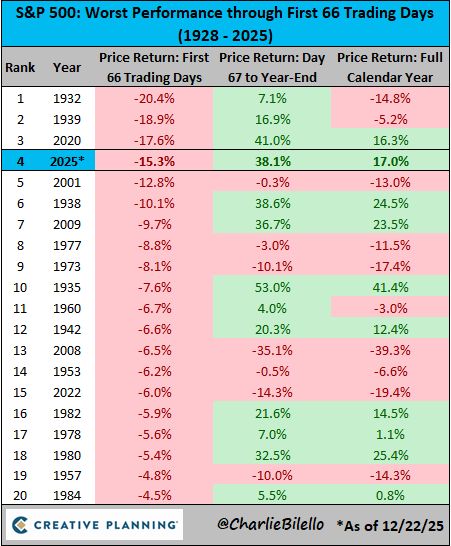

One of the greatest market comebacks in history

On April 8, the S&P 500 was down over 15% on the year, its 4th worst start to a year ever. But after a 38% rally, it's now up 17% on the year, hitting 37 all-time highs along the way. Source: Charlie Bilello

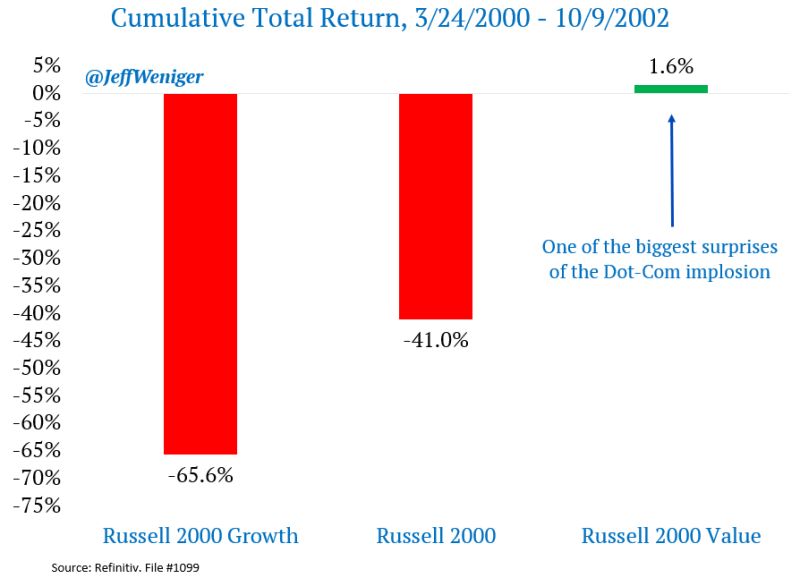

The day the AI bubble implodes, let's keep this in mind

Yes it happened Source: Jeff Weniger

Investing with intelligence

Our latest research, commentary and market outlooks