Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

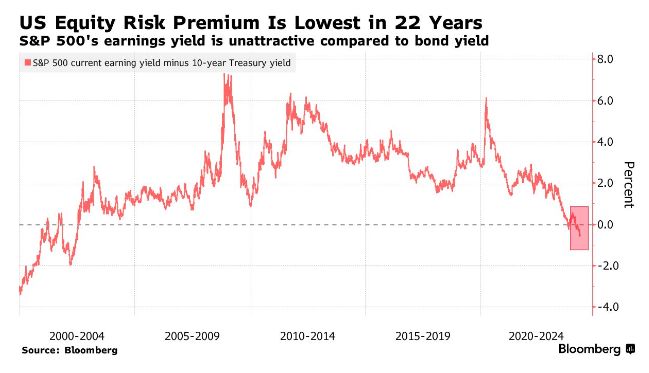

Equity Risk Premium (the benefit of owning stocks over treasuries) has fallen to its lowest level in 22 years

Source: Barchart, Bloomberg

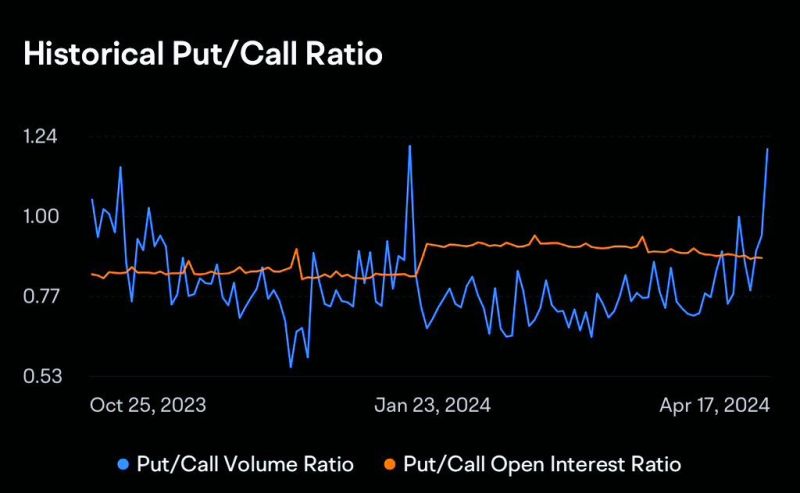

SP500 Put/Call Ratio has risen to multi-year highs amid the recent market sell off.

Source: David Marlin

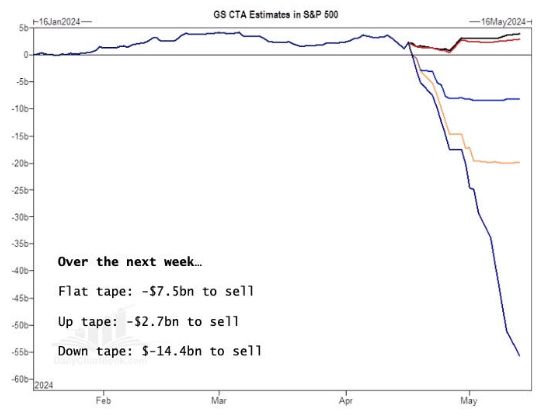

CTAs will dump billions worth of stocks over the next week in EVERY SINGLE SCENARIO warns Goldman Sachs

Source: Barchart

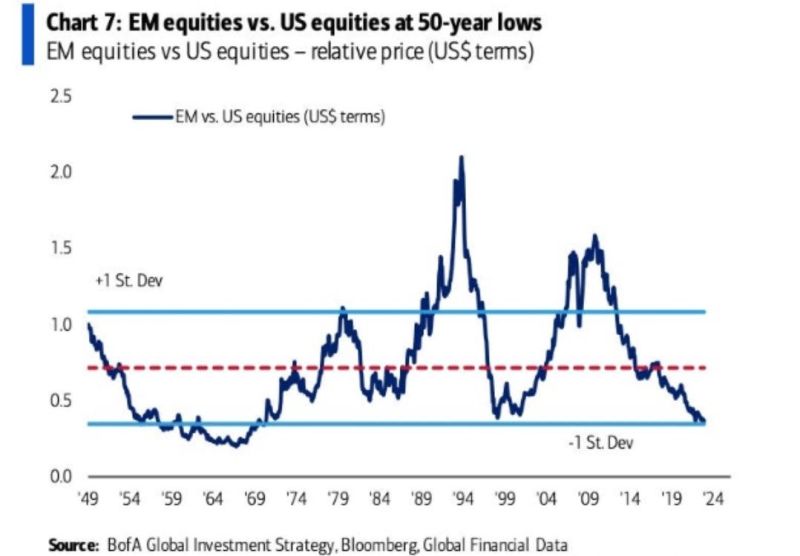

US big tech revolution steamrolling emerging markets equities in one chart.

What would make this trend reverse? Source: BofA, Michel A. Arouet

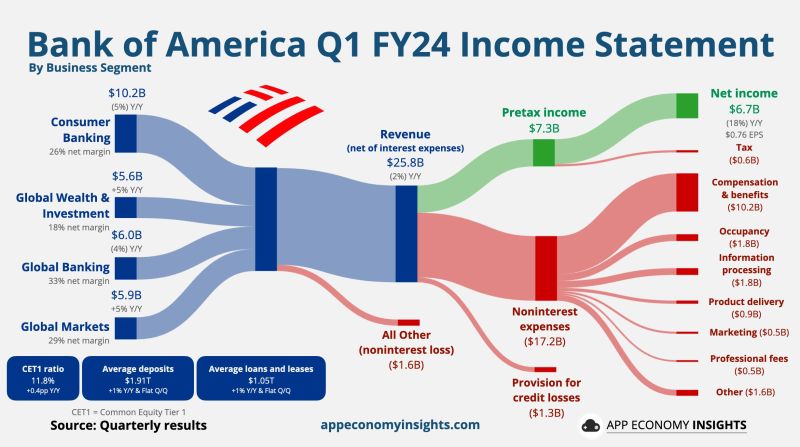

BANK EARNINGS >>> Bank of America $BAC stock is down -4% today after reporting earnings down -18% yoy.

$BAC Bank of America Q1 FY24. Revenue -2% to $25.8B ($0.4B beat): • Net Interest income: $14.0B (-3% Y/Y). • Noninterest income $11.8B (-0% Y/Y). Net Income $6.7B (-18% Y/Y). Non-GAAP EPS: $0.83 ($0.06 beat). CET1 ratio of 11.8%. Source: App Economy Insights

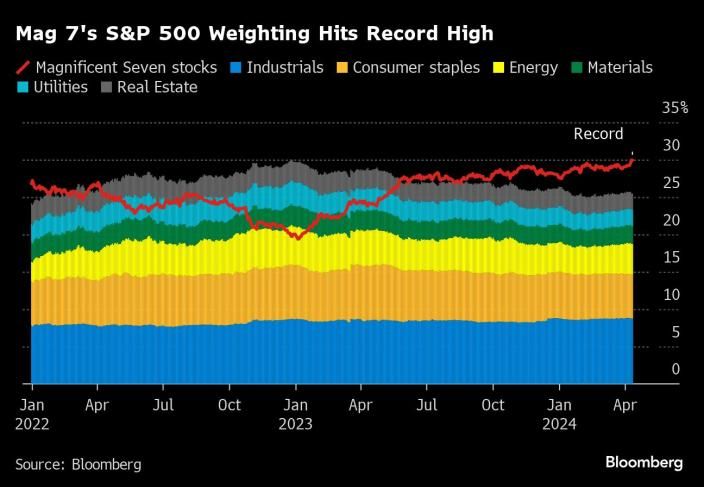

The Mag7's weighting in the SP500 just hit another new high

Source: Cheddar Flow

Investing with intelligence

Our latest research, commentary and market outlooks