Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

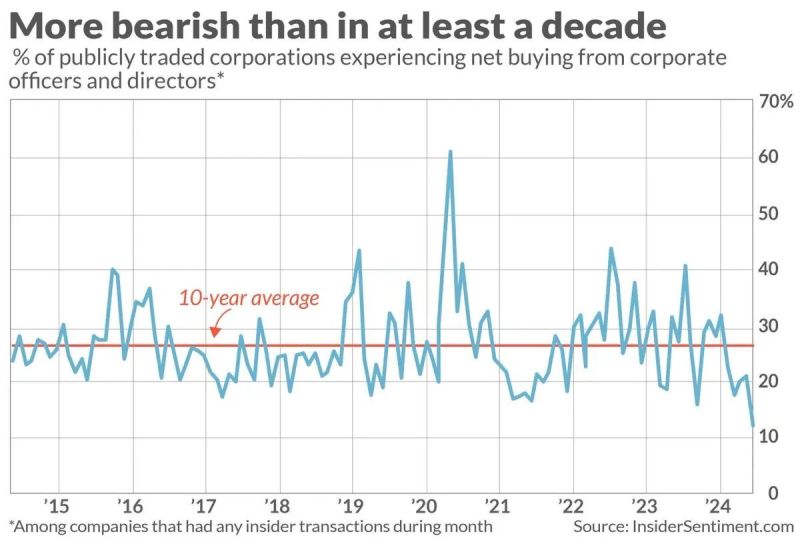

Corporate insiders are more bearish than they have been in at least one decade

Source: InsiderSentiment.com

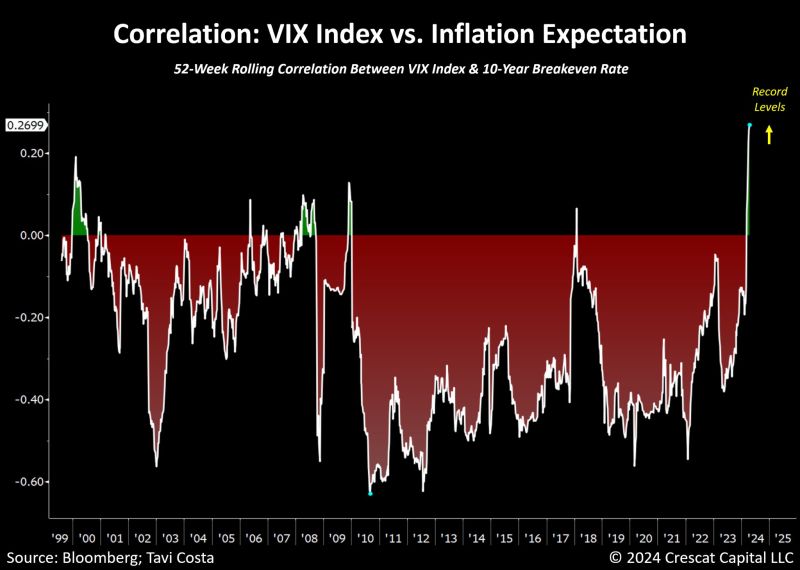

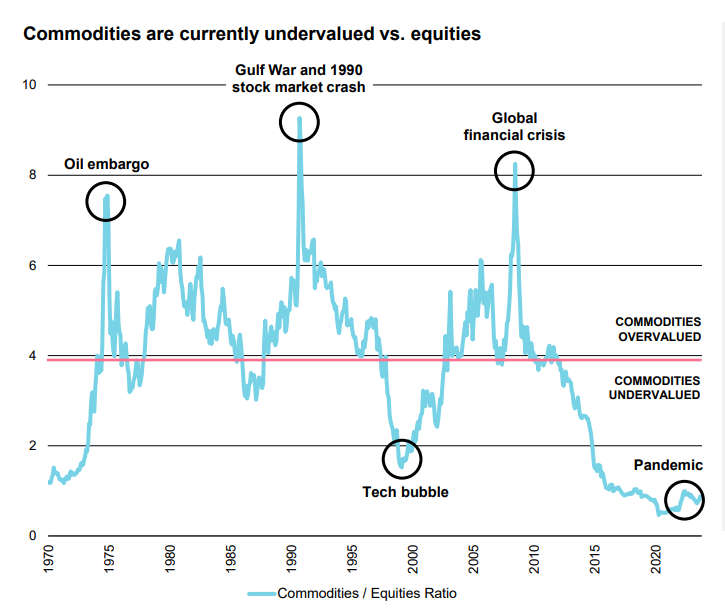

The correlation between equity market volatility and inflation expectations is at the highest level we've seen in decades.

Although the chart below doesn't extend as far back, a similar phenomenon occurred in 1973-1974 as markets faced difficulties whenever inflation reaccelerated. This is especially pertinent now, with energy prices, agricultural commodities, precious metals, copper, global freight costs, and other inflation indicators showing significant resurgence. Source: Tavi Costa, Crescat Capital, Bloomberg

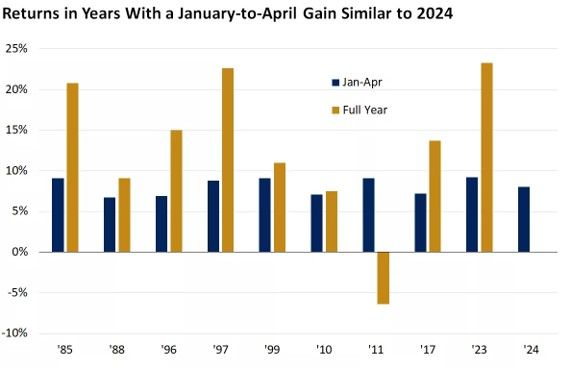

Healthy gains heading into May have historically been a good signal of a positive year for stocks.

Since 1982, when the stock market was higher on the year heading into May, it went on to post a full-year gain roughly 90% of the time. In that period, 1987, 2011 and 2015 were the only years in which the market was higher from January to April but finished the year lower.1 There were nine years in which the year-to-date increase heading into May was in the 6.5%–9.5% range, comparable to 2024’s 8% year-to-date gain. In those instances, the stock market went on to post an average full-year increase of 13%. Source: Edward Jones

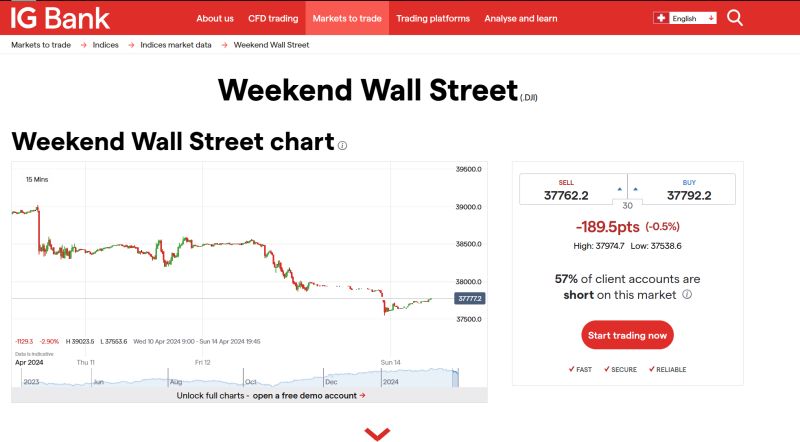

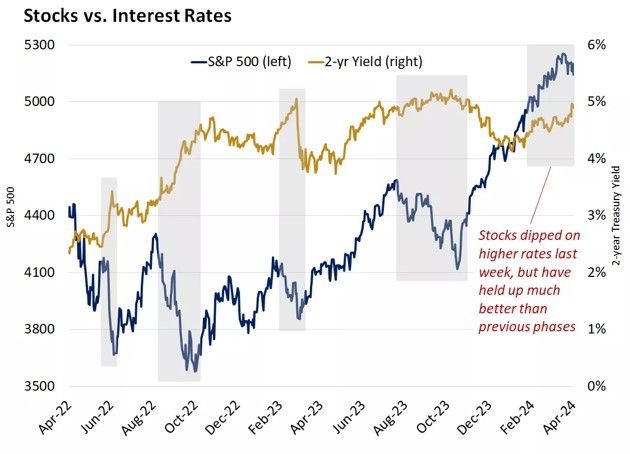

Yes, this week was painful for stocks.

But putting things into perspective, equities have been more resilient to higher rates recently versus previous periods of rising rates. Source: Edward Jones

Commodities are currently undervalued vs. equities

Source: Vontobel

Investing with intelligence

Our latest research, commentary and market outlooks