Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

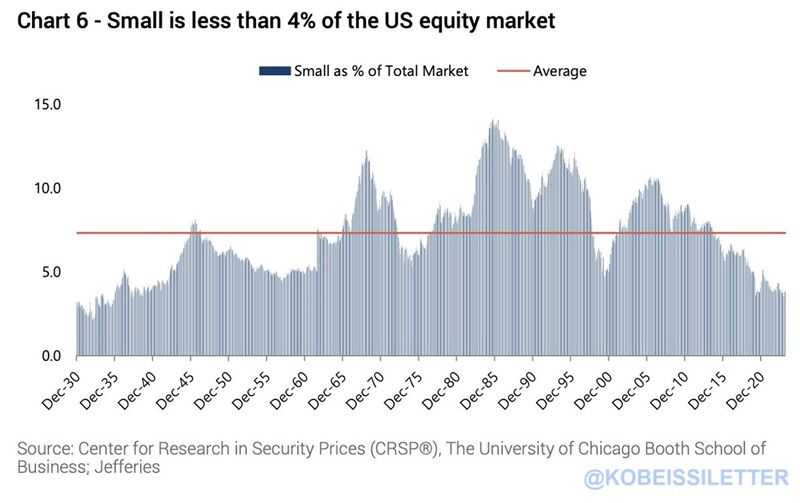

US smallcap stocks now account for less than 4% of the entire US equity market.

They now reflect the same percentage of the market as 1930 before the Great Depression. As AI-hype as spreads, small cap stocks have significantly underperformed large caps. Currently, more than one-third of the Russell 2000 index has negative earnings, down from ~45% in 2020. Small-cap stocks are now hated more than ever. Source: The Kobeissi Letter

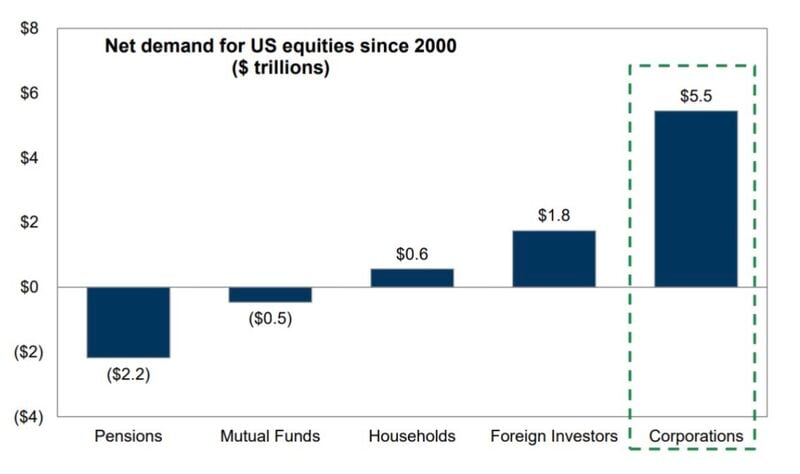

We are currently in the corporate buyback blackout period for most of the $SPX.

Since 2000, US corporations have bought back $5.5T of stock. This has amounted to more demand than any other market participant, and it’s not even close. 👇 Source: David Marlin, Goldman Sachs

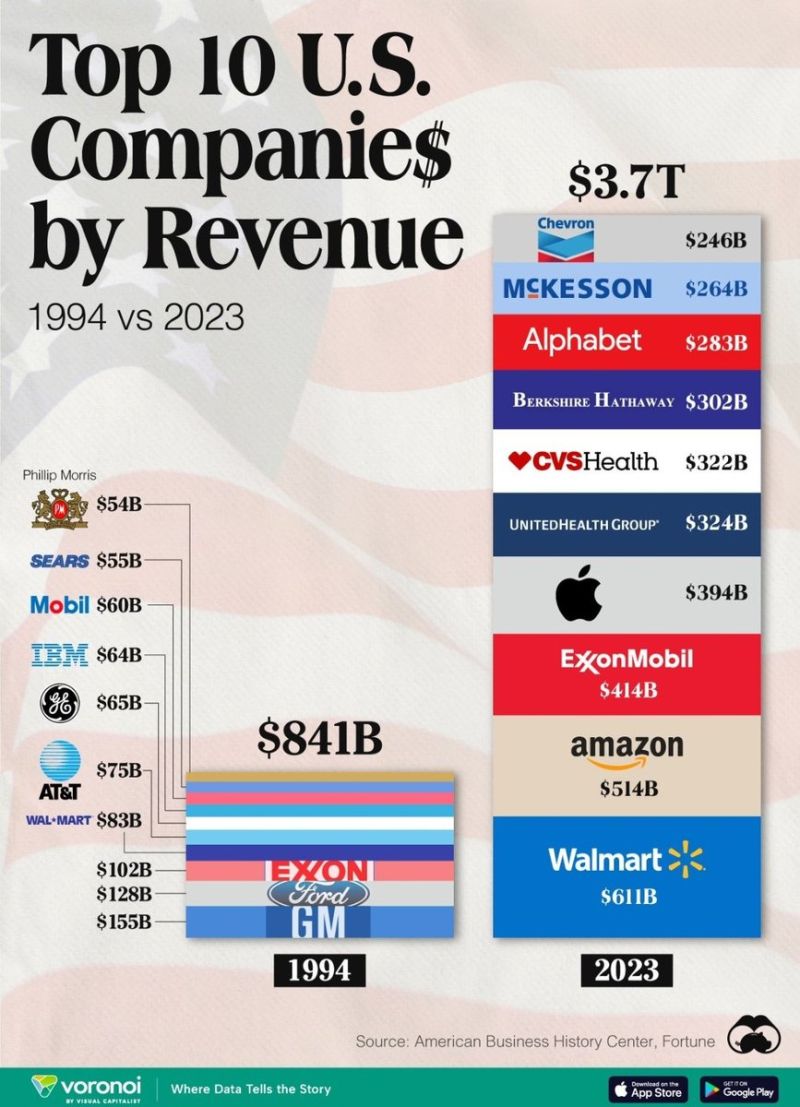

Top Companies by Revenue - Now vs. 3 Decades Ago

Source: Visual Capitalist thru Win Smart

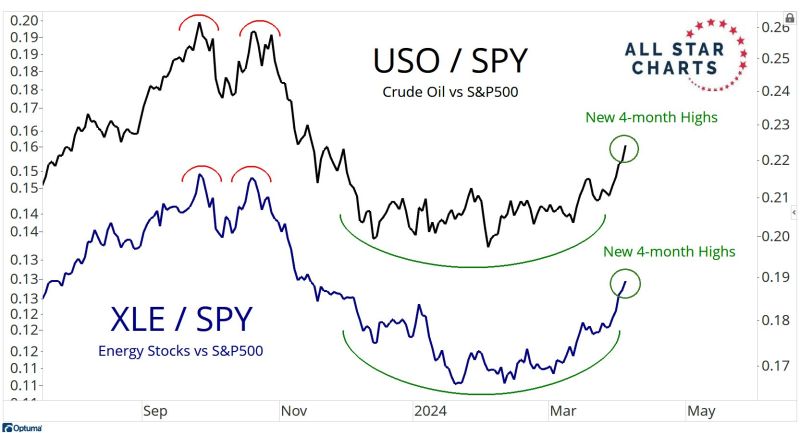

Below the relative chart of oil ETF $USO vs. S&P 500 ETF $SPY and the relative chart of oil stocks XLE vs. S&P 500 ETF $SPY.

Both just hit a 4.month relative high Source: J-C Parets

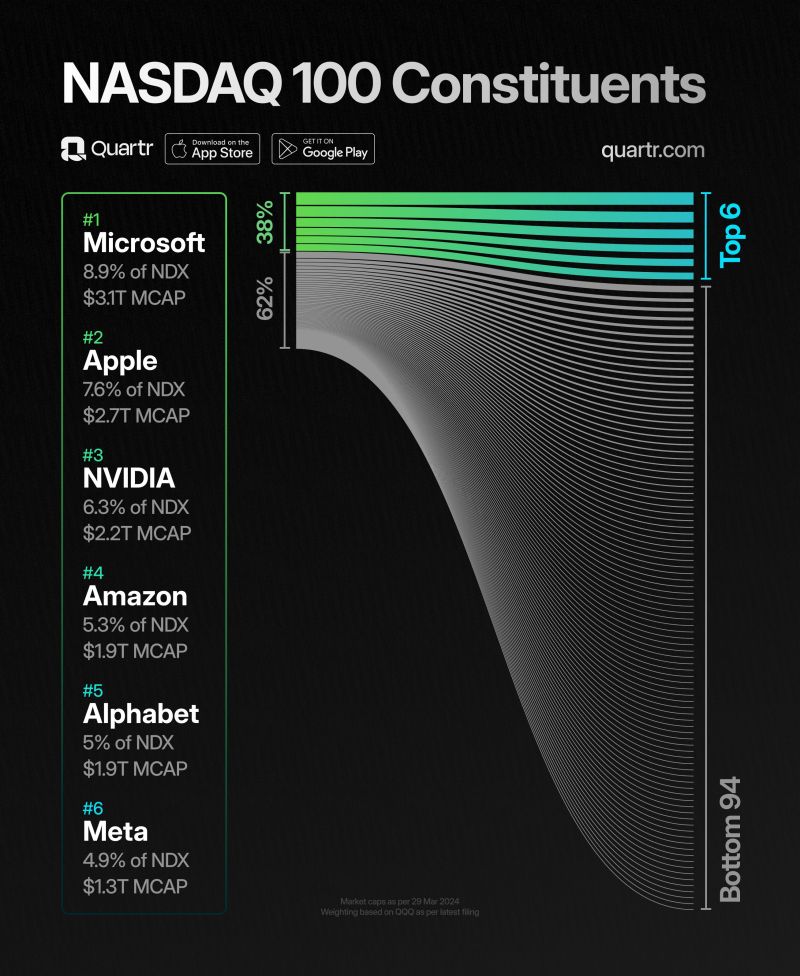

Amazing chart by Quartr.

It's quite astonishing: despite the NASDAQ 100's special mid-2023 rebalancing, the combined weight of $MSFT, $AAPL, $NVIDIA, $AMZN, $GOOGL, and $META still constitutes a substantial 38% of the index. Without this rare adjustment, the second of its kind in the last 25 years, these companies would currently represent 58% of the index.

The S&P 500 has not had a weekly drop of 2% or more since the week of October 23rd, 2023.

There have only been a total of TWO weekly drops in the entire 2024 so far. Since October 2023, the S&P 500 has added almost $11 TRILLION in market cap. That's more than 4 TIMES the value of the Canadian stock market added in 5 months. $11 trillion in market cap is also the same value of China's entire stock market. Source: The Kobeissi Letter

Maybe we have hit the pain threshold...

i,e the hashtag#nasdaq green line) can not move higher as the number of rate cuts expected for this year (red line) keeps decreasing... Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks