Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

What are the biggest shorts?

Microstrategy $MSTR is one of the biggest shorts in the entire US market. Nvidia $NVDA is currently leading the pack. Source: Bloomberg

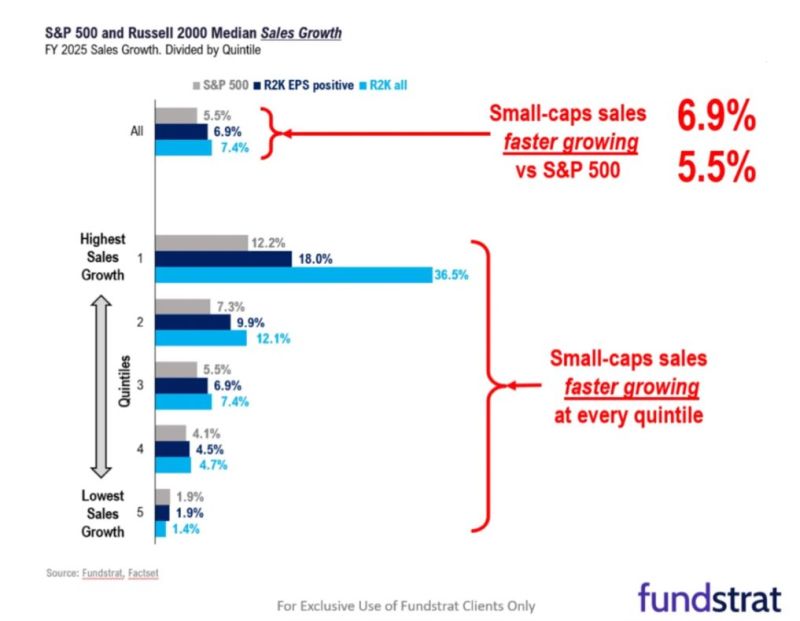

A contrarian idea on us small caps?

=> FUNDSTRAT: “.. Our top idea for 2024 is small-caps, where we see at least 50% upside .. Russell 2000 companies are set to grow .. faster than the $SPX .. Valuations are far more attractive .. when CEO confidence recovers, we also see the low valuations as setting the stage for synergistic M&A ..” Source: Carl Quintanilla, Fund strat

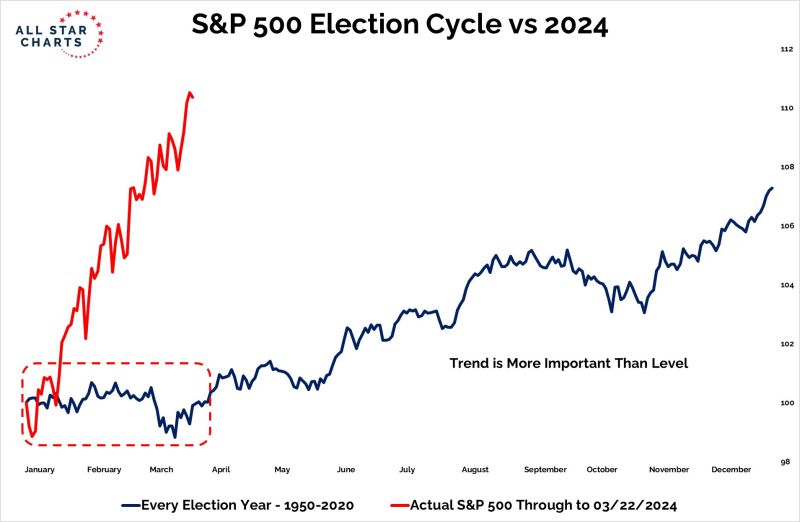

BREAKING: The Nasdaq Composite index is officially up 30% from its October 2023 low.

That's a 30% gain in 5 months or an average of 6% per month since October. To put this in perspective, the median ANNUAL return for the S&P 500 is 10%. This means that the Nasdaq has TRIPLED the median sp500 return in just 5 months. The top 10% of stocks in the S&P 500 also now reflect 75% of the index. Tech stocks have never been more powerful. Source: The Kobeissi Letter

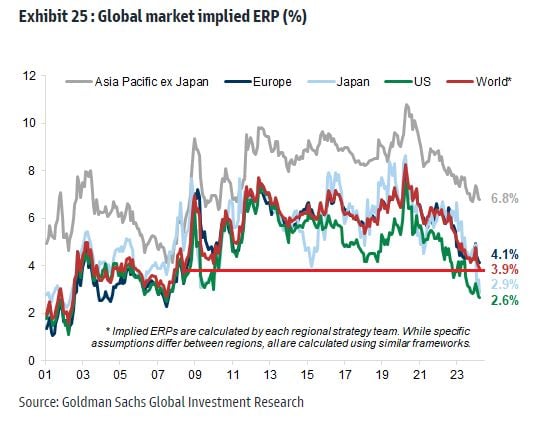

Global equity risk premium are now at the lowest since 2008.

Source: Mike Zaccardi

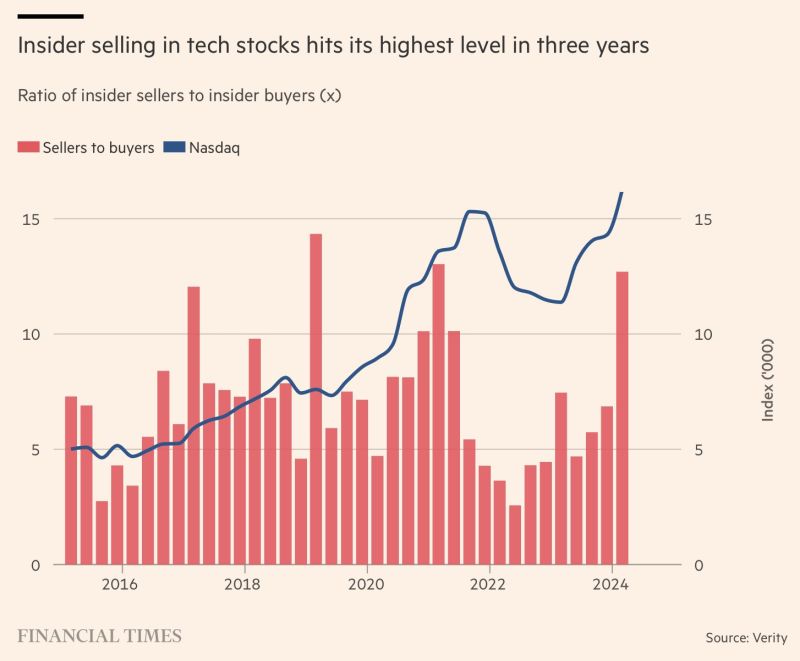

FT: 'Peter Thiel, Jeff Bezos and Mark Zuckerberg are leading a parade of corporate insiders who have sold hundreds of millions of dollars of their companies' shares this quarter

In a signal that recent stock market exuberance could be peaking. https://t.co/lFp5iOD53j Source: FT Activate to view larger image,

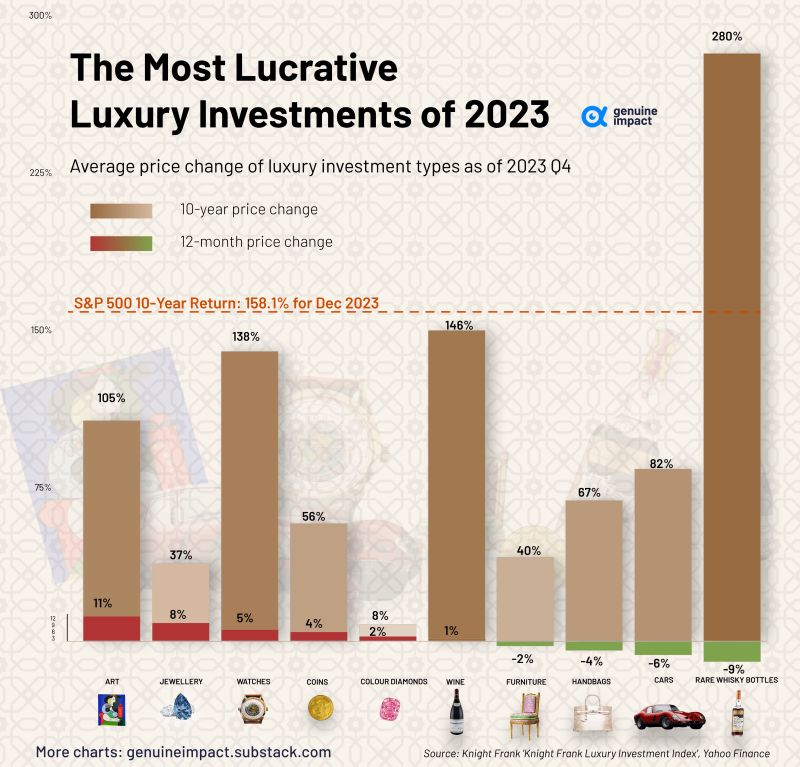

Returns on different types of luxury goods have ranged from 8% to 280% over the last 10 years, compared to 158.1% for the S&P 500.

However , only one has outperformed the S&P 500 in terms of 10-year returns: Rare whiskey🥃, boasting an impressive 280% return. Source: Genuine Impact

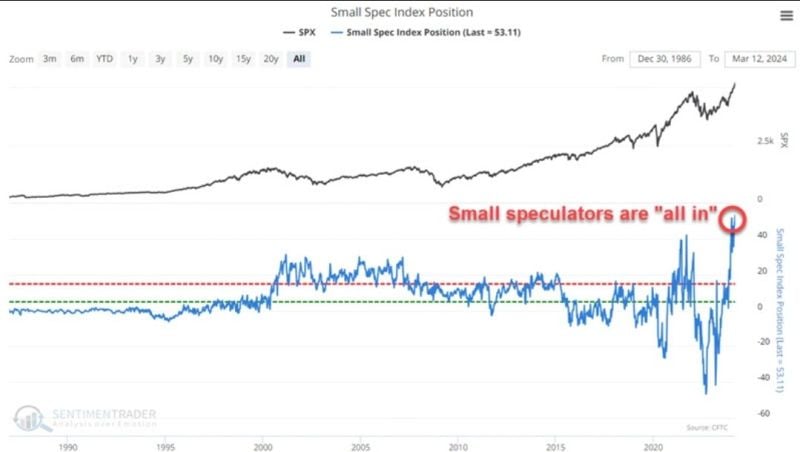

Small speculators in stock indexes have reached their most bullish net position ever.

Source: WinSmart

Investing with intelligence

Our latest research, commentary and market outlooks