Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

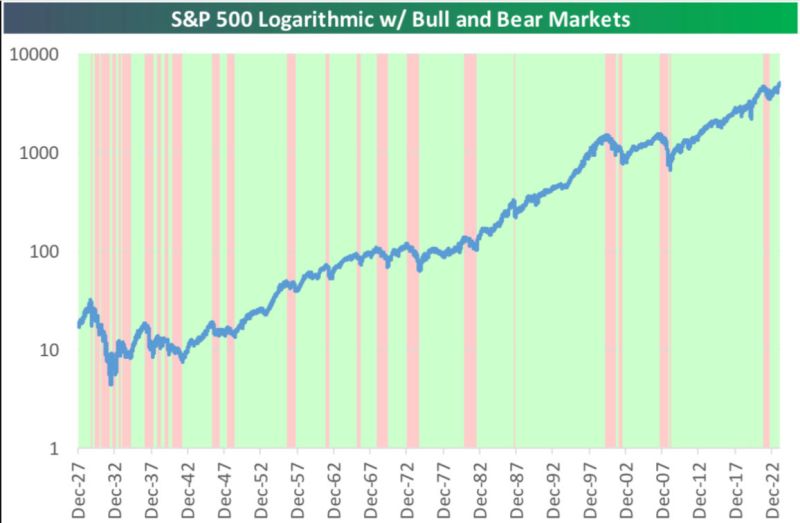

A little History in a Chart.

Green=Bull Markets 🐂 Red=Bear Markets 🐻 source : bespoke

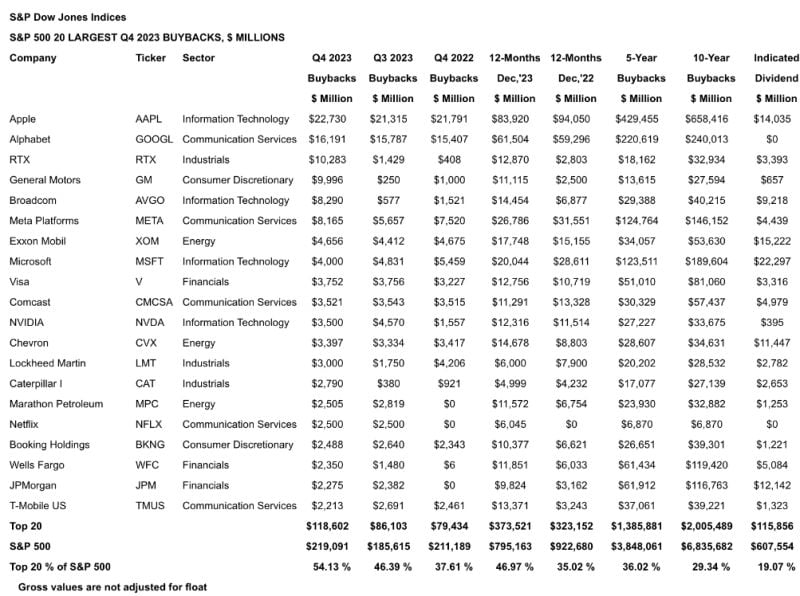

Here's the S&P 500 stocks that bought back the most shares in Q4 2023

1 Apple $AAPL: $22.7B 2 Google $GOOGL: $16.2B 3 Raytheon $RTX: $10.3B 4 General Motors $GM: $10B 5 Broadcom $AVGO: $8.3B 6 Facebook $META: $8.2B 7 Exxon Mobil $XOM: $4.7B 8 Microsoft $MSFT: $4b 9 Visa $V: $3.8B 10 Comcast $CMCSA $3.5B source : StockMKTNewz

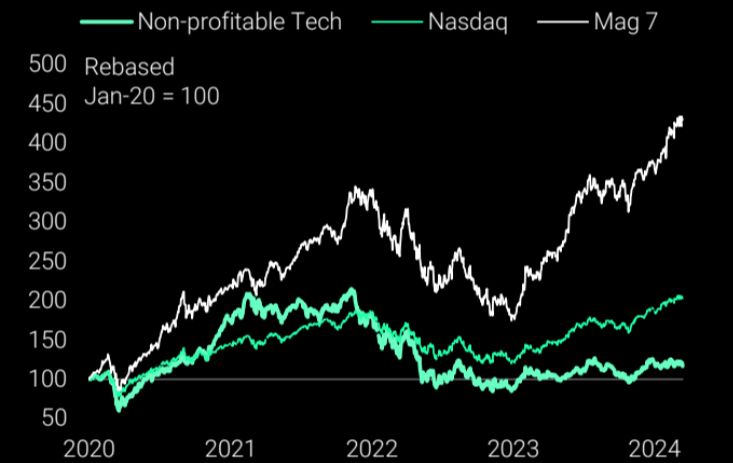

Remember when unprofitable tech was all the rage in 2021?

It never really recovered. All the money went into the Mag7 stocks instead, and to a lesser extent profitable NASDAQ companies. Chart: TS Lombard thru Markets & Mayhem

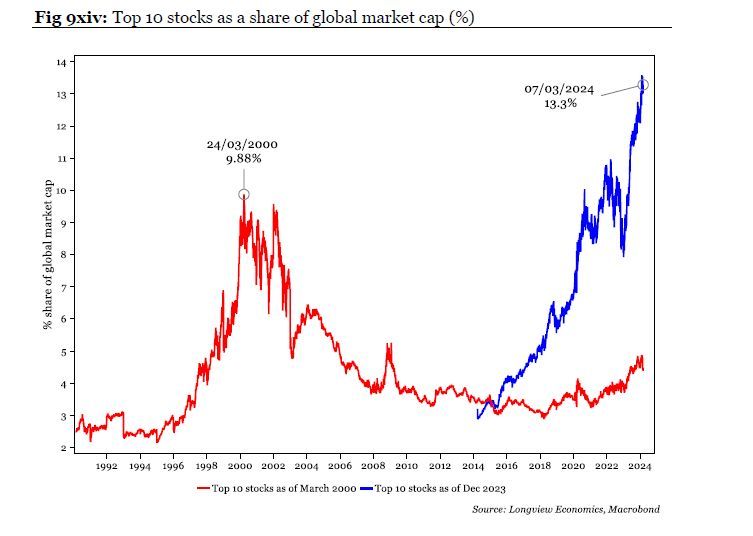

Brilliant chart by the wonderful folks at Longview Economics showing the Top 10 stocks as a share of global market cap (%).

Source: Longview Economics

$SPX/GDP, the 'Buffet' indicator, is back near the 2021 highs

Source: Swordfishvegetable

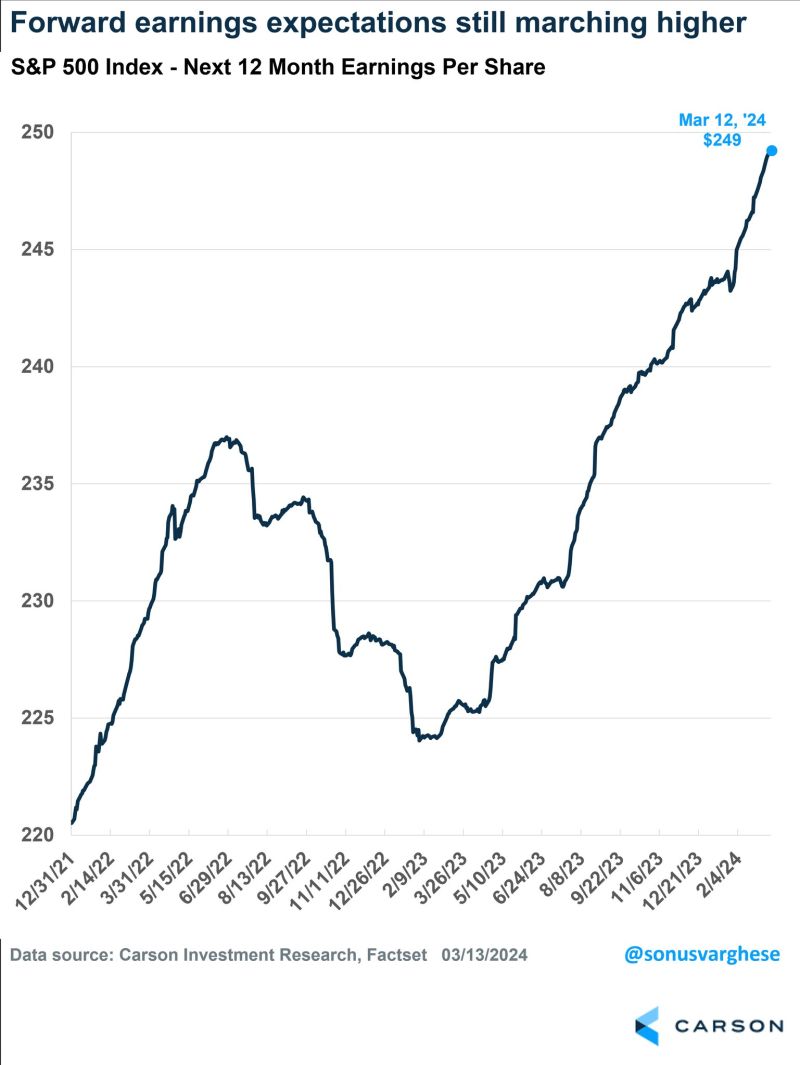

Why has the sp500 been moving higher despite rate cuts expectations being revised downward?

It is as simple as EPS 12 month estimates have soared. Up another 2% the past 12 months. Source: Ryan Detrick

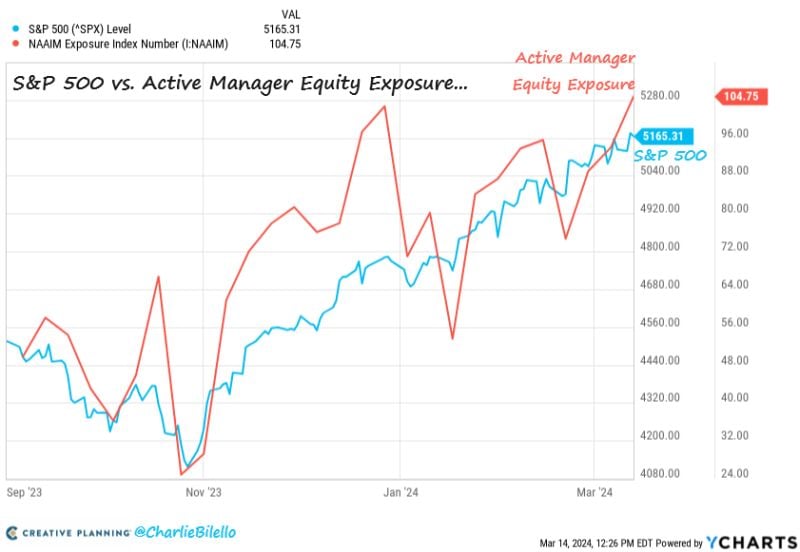

Active managers had less than 25% exposure to equities in late October when the S&P 500 was at 4,100.

Today their equity exposure has jumped to 104% (leveraged long) with the S&P 500 above 5,100. This is their highest exposure since November 2021. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks