Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

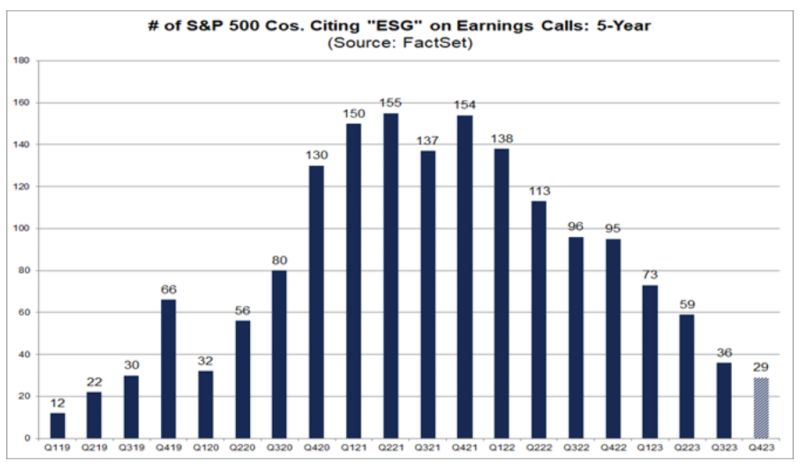

Lowest Number of S&P 500 Companies Citing “ESG” on Earnings Calls Since Q2 2019

Through Document Search, FactSet searched for the term “ESG” in the conference call transcripts of all the S&P 500 companies that conducted earnings conference calls from December 15 through March 7. Of these companies, 29 cited the term “ESG” during their earnings calls for the fourth quarter. This number is below the 5-year average of 82 and below the 10-year average of 43. In fact, this is the lowest number of S&P 500 companies citing “ESG” on earnings calls going back to Q2 2019 (22). Since peaking at 155 in Q4 2021, the number of S&P 500 companies citing “ESG” on quarterly earnings calls has declined (quarter-over-quarter) in nine of the past ten quarters. At the sector level, the Financials (6), Utilities (5), and Health Care (4) sectors have the highest number of S&P 500 companies citing “ESG” on earnings calls for Q4. On the other hand, the Utilities (17%) and Energy (15%) sectors have the highest percentages of S&P 500 companies citing “ESG” on earnings calls for Q4. source : factset

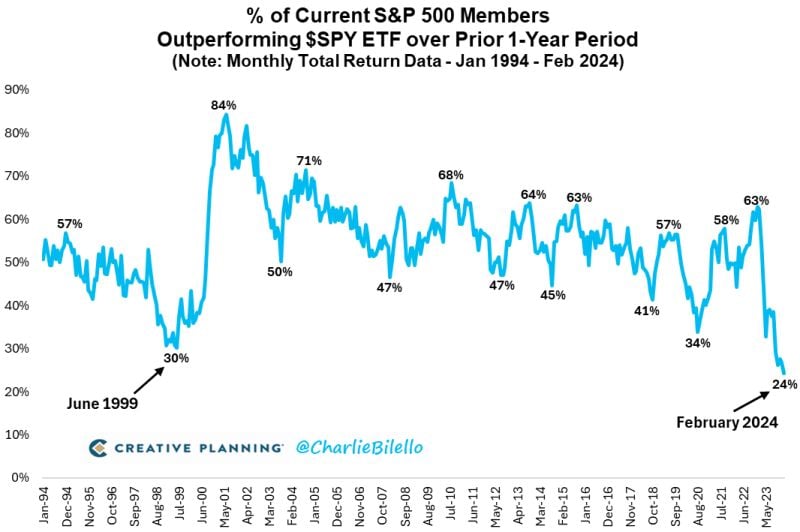

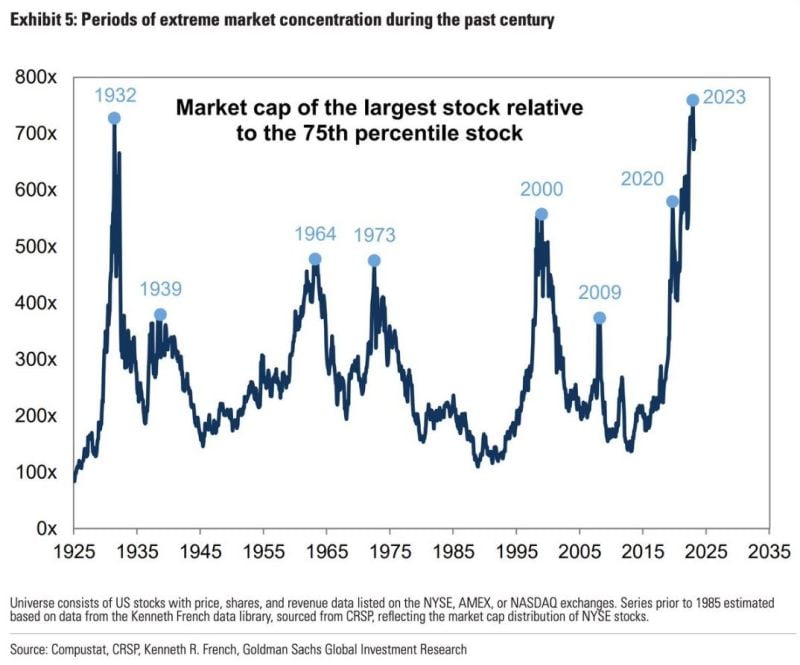

Only 24% of S&P 500 members outperformed the index over the last year, the lowest % on record w/ data going back to 1994.

Source: Charlie Bilello

What are the stocks favoured by retail investors?

$NVDA, $TSLA, $AMD, and $SMCI Source: Markets & Mayhem, Vanda Research

It's starting to feel a bit more crowded

Source: mayhem4markets

Europe's leading stock index reaches 500 points for the first time, 24 years following its achievement of 400 points

source : Bloomberg

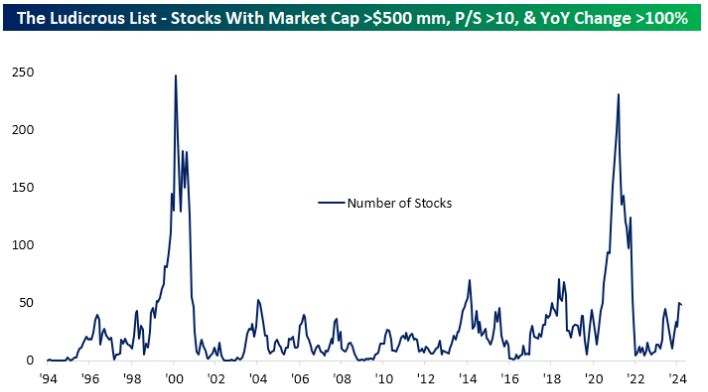

Interesting chart showing the # of stocks that are up 100%+ YoY with a price to sales ratio greater than 10 over time.

Currently not nearly as frothy as the Dot Com bubble peak months and the peak months during the meme stock rally in late 2020/early 2021. Source: Bespoke

Investing with intelligence

Our latest research, commentary and market outlooks