Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

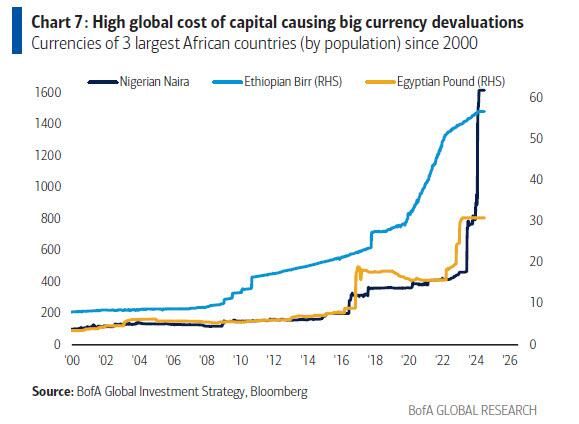

High global cost of capital hurts weak global balance sheets

Pakistan, Nigeria, Ethiopia, Egypt, DRC, Iran, Türkiye, Argentina account for 12% of world population (>1bn people) and they are all hit by inflation rates >30% (Argentina 250%, Türkiye 60%, DRC 50%), interest rates >20% & pressure of currencies. Source: BofA

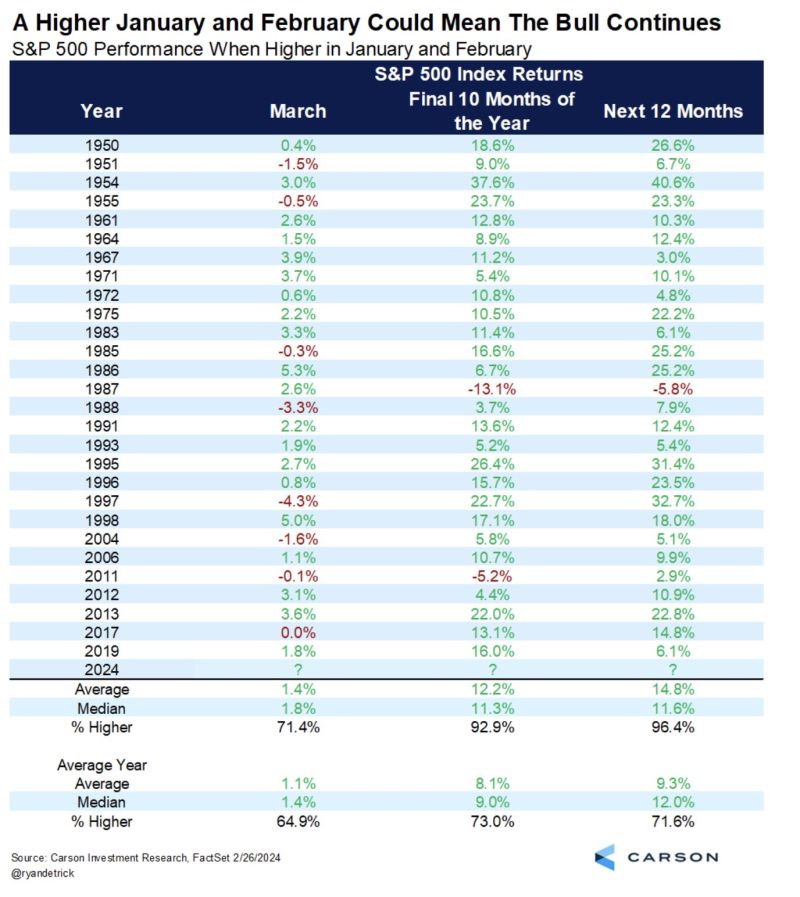

The SP500 has now traded green in both January and February

When that has occurred (data going back to 1950), the $SPX finished the rest of the year higher 27/28 times with the final 10 months being higher 26/28 times. Seems pretty good for Bulls! 🐂 Source: barchart, H/T Ryan Detrick

🚨 February numbers are in and the Mag 7 are now the 𝗙𝗮𝗻𝘁𝗮𝘀𝘁𝗶𝗰 𝟰 year to date

Nvidia , Meta , Microsoft and Amazon driving all the gains while Apple , Google and Tesla fall out of the 7. Source: John Haslett, CA(SA), FRM

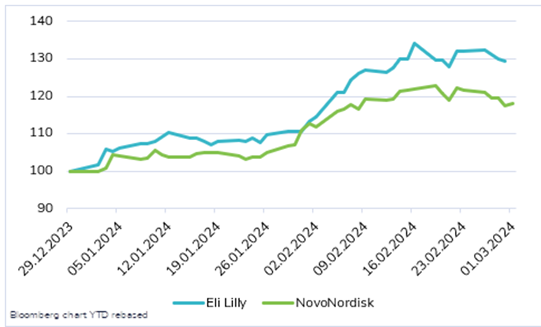

One billion obese in the world according to a large study published today by British medical journal The Lancet

The study showed an acceleration of the epidemic in low-income countries. Even more worrying, in 30 years, the obesity rate among children and adolescents has quadrupled and doubled among adults. NovoNordisk and Eli Lilly the two main pharma companies in the weight loss race

Is Nivdia $NVDA - cheap? Via Bear Traps: "NVDA is now trading at a lower multiple than the NDX: fwd P/E is ~29 vs 32x for the NDX

NVDA is expected to grow earnings at 78% y/y for the current year and the Nasdaq 100 EPS growth is an estimated 17%." Source: TME

Investing with intelligence

Our latest research, commentary and market outlooks