Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Place Your Bet...

Who will be the next stock to join the $1 Trillion market cap club? source : stockmktnewz

The World’s Biggest Fashion Companies by Market Cap 👔

Source: Visual Capitalist

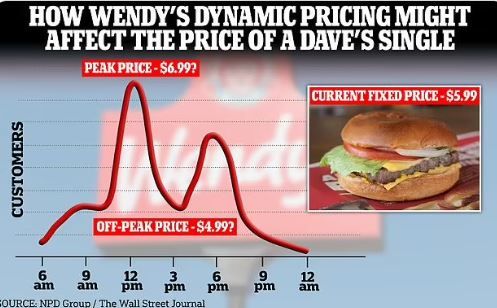

Wendy’s might try Uber-style surge pricing for burgers

Wendy's wants to use new digital menu boards to change prices based on overall demand. Wendy's will start experimenting with surge pricing, much like Uber and Lyft, as the company rolls out digital menus to all its United States restaurants by 2025. source : quartz

BREAKING >>> THE NANCY PELOSI EFFECT ! Palo Alto Networks stock, $PANW, is now up 10% today after Nancy Pelosi bought call options on the stock.

The call options are reportedly worth up to $1.25 million. This comes just days after $PANW fell over 30% following their earnings results. Markets are effectively treating Pelosi's trades like an activist hedge fund took a stake in the company. Her track record on buying many large cap tech stocks at their lows, including $NVDA, is largely why... Is Nancy ‘Gordon Gecko’ Pelosi the new Cathie Wood ??? Source: The Kobeissi Letter

As the stock market opens today, Amazon will officially become a member of the Dow Jones Industrial Average.

#newmembers #finance

JPMorgan CEO Jamie Dimon sells $150M of stock in nation’s largest bank for the first time

JPMorgan Chase chief Jamie Dimon cashed in about $150 million of his stock in the bank — the first time the head of the largest US lender has sold shares since taking charge in 2005. Dimon, one of the longest-serving chief executives on Wall Street, unloaded 821,778 shares of JPMorgan, according to an SEC filing Thursday. The selloff is part of a larger plan the bank revealed in an SEC filing in October to sell 1 million of the 8.6 million shares . Dimon and his family own. source : nypost

Chinese Authorities froze a quant hedge fund's account for 3 days after it dumped more than $360 million worth of stocks within the first minute of trading.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks