Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

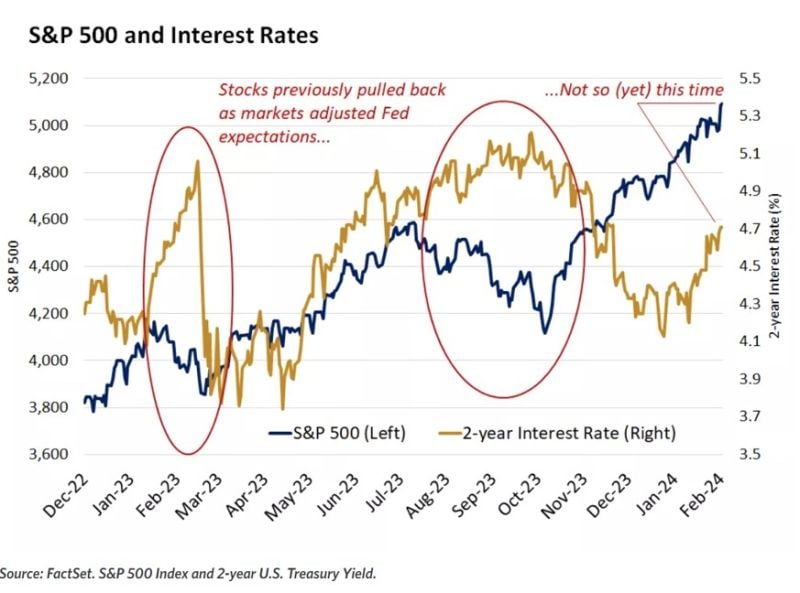

US equities are shrugging off higher rates.

The chart below shows the level of the S&P 500 Index and the 2-year U.S. Treasury yield. Yields have risen in 2024 but unlike prior episodes of rising yields last year, the S&P 500 has moved higher as well. Past performance does not guarantee future results. Source: Edward Jones

While markets are hitting all-time-highs, some insiders are off-loading their stocks

Source: Genevieve Roch-Decter, CFA

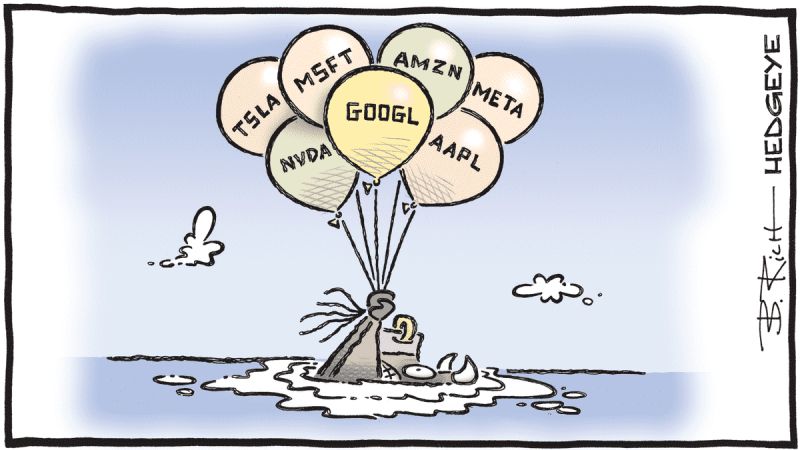

Yesterday was one of the most distorted markets we've seen yet. Just 2% of the index contributed over 60% of the bullish momentum.

That means ONLY TEN companies were the cause of well over half of the move in $SPX yesterday. $NVDA single handedly contributed an additional 50bps to the return in $SPX. Source: Hedgeye

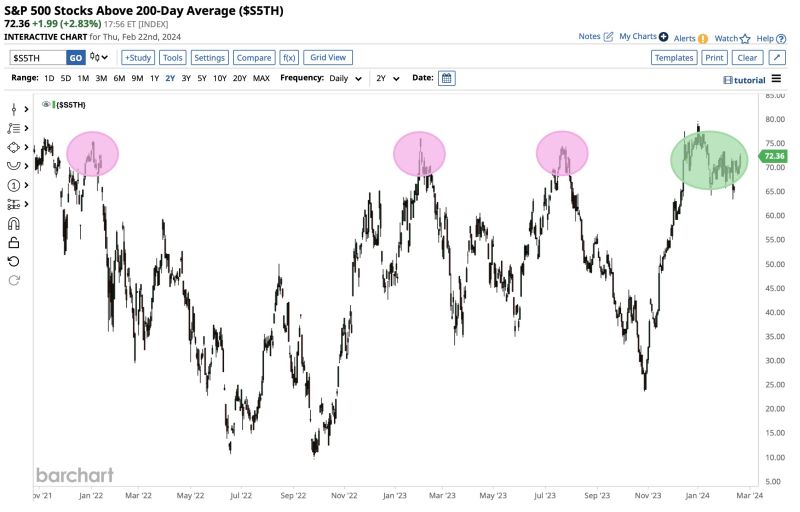

Market Breadth continues to look strong!

More than 72% of sp500 stocks are now trading above their 200D moving average. Source: Barchart

Reddit made its IPO filing public ahead of a planned stock market debut in March.

It also disclosed $90.8 million in losses and revenue growth of roughly 21% in 2023. REDDIT IPO STATS: Ticker: $RDDT Exchange: NYSE Deal size: $100m (we est. $750m) Mkt Cap: Est. ~$5+ billion Annual Sales: $804m Net Loss: -$91m IPO Timing: Est. mid-March

The chart is a log graph of $1 invested in the S&P 500 in the year 1950 by Personal Finance Club.

They listed all of the market crashes that were 15% or more. They removed the Y-axis, but it shows $1 growing to over $1,000! Note that there were many -10% corrections over the period but that only -15% and worse are listed below

Investing with intelligence

Our latest research, commentary and market outlooks