Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it. Chinese stocks have now fully recovered from all year-to-date losses and are now green on the year.

Source: Barchart

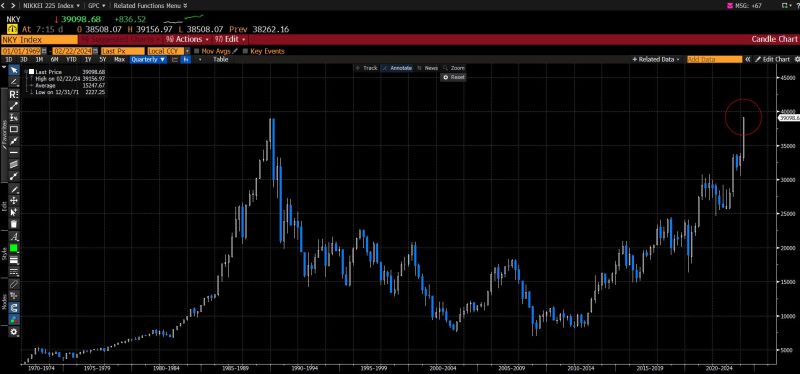

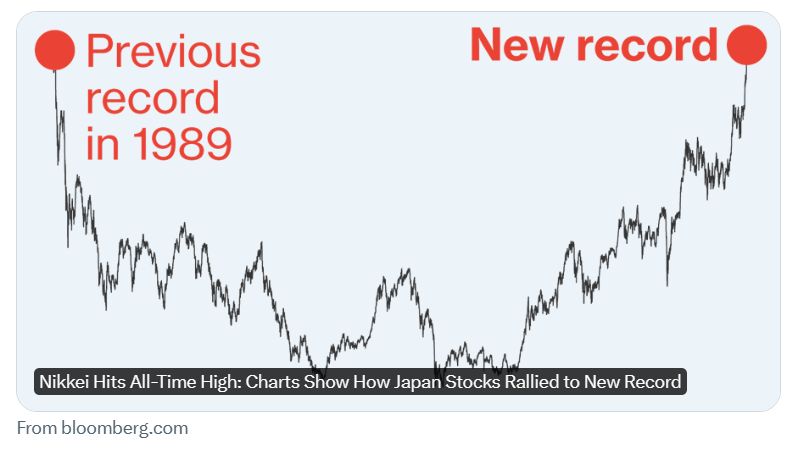

Nikkei Parties Like It's 1989

A lot of attention has been focused on the Nikkei 225 index, which topped its all-time high, surpassing 39,000 and breaking the previous record of 38,957 set on the final trading day of 1989. The 34 years it has taken to regain its footing is also a record for a major market, and it's a decade longer than Wall Street took to recoup its losses from the 1929 crash and the Great Depression. source : bloomberg, reuters

Japan's Nikkei has hit a historic high not seen since 1989, marking an epic come-back for the country's stock market.

The Nikkei 225 hit an all-time high of 38,924.88 as robust corporate earnings and steps aimed at boosting investor returns fuel a blistering rally in Japanese equities this year. Nikkei and Topix have been standout outperformers in Asia Pacific, up more than 10% in 2024 after surging more than 25% in 2023 — their respective best annual gain in at least a decade. Source: Bloomberg, CNBC

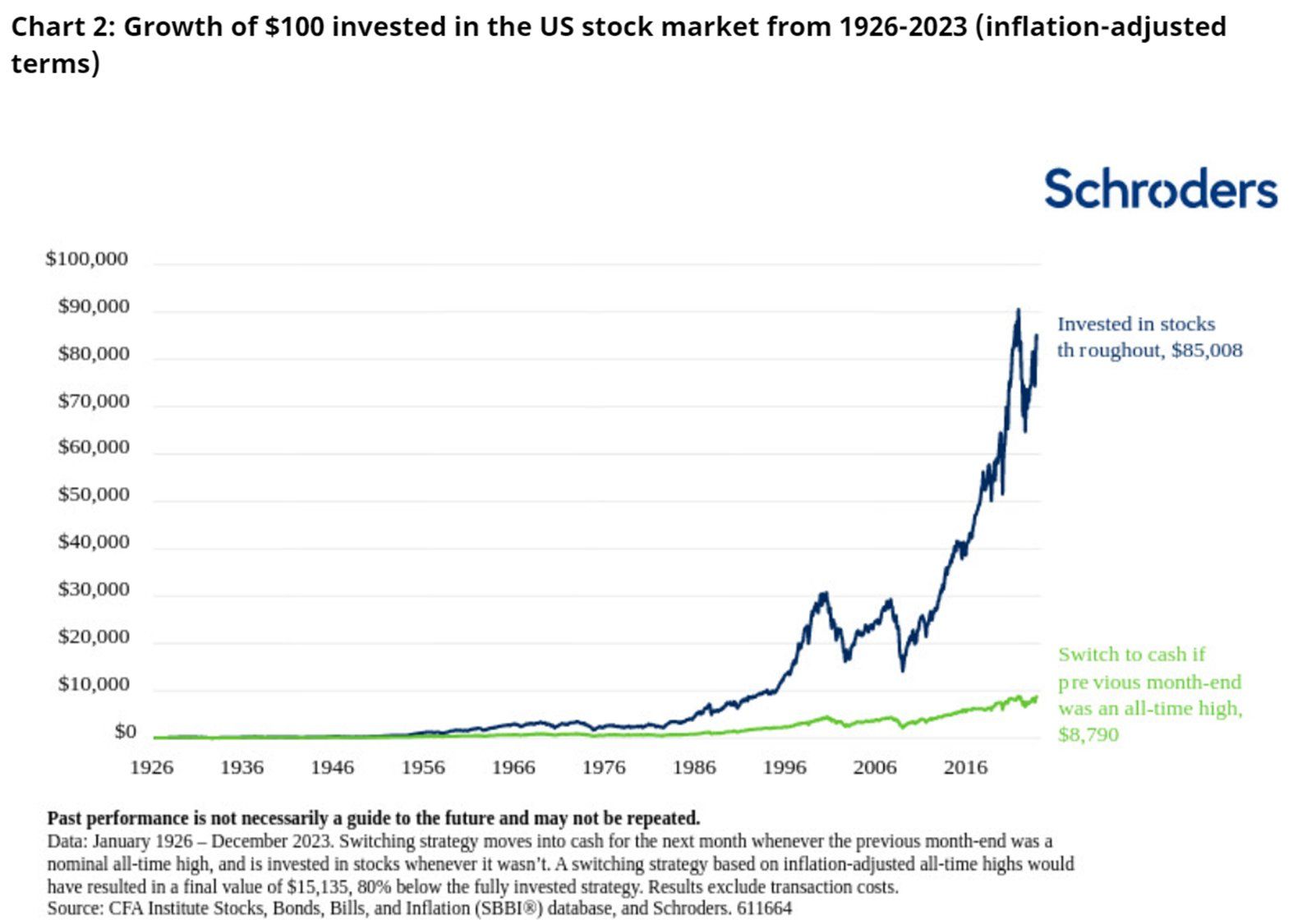

Should you exit equities (or avoid investing into equities) when they hit all-time high?

The answer is 'NO'. Returns have been higher than average, following all-time highs. More importantly, exiting at all-time highs is disastrous for your return! Massive chart by Duncan Lamont / Schroders thru Jeroen Blokland.

UBS hikes its S&P 500 target to 5,400, highest on Wall Street

UBS raised its S&P 500 year-end target for the second time in little over a month, from 5,100 to 5,400. It argues that hot inflation driven by strong demand is actually positive for stocks. The new target, which is roughly 9% above current levels, is the highest on Wall Street. Source : ubs

Walmart beats Wall Street’s holiday expectations as e-commerce sales soar.

Walmart shares closed 3% higher Tuesday to a new record high. Share are up more than 11% this year. - Walmart said Tuesday that quarterly revenue rose 6%, as shoppers turned to the big-box retailer throughout the holiday season and the company’s global e-commerce sales grew by double digits. - The retail giant also announced Tuesday that it would acquire smart TV maker Vizio to accelerate growth of its advertising business. Walmart is acquiring the company for $2.3 billion, or $11.50 per share. - CFO said customers have still shown discretion with purchases. They are putting fewer items in their baskets but shopping more frequently, he said. Electronics, TVs, computers and some other expensive items have been a tougher sell, Rainey added. - Earnings per share: $1.80 adjusted vs. $1.65 expected / Revenue: $173.39 billion vs. $170.71 billion expected - Walmart said it expects consolidated net sales to rise 4% to 5% in its fiscal first quarter. It also anticipates adjusted earnings of $1.48 to $1.56 per share on a pre-stock split basis. - For its fiscal 2025, the retailer expects consolidated net sales will climb 3% to 4%. Walmart anticipates adjusted earnings will be $6.70 to $7.12 per share on a pre-stock split basis. Source: CNBC, Bloomberg

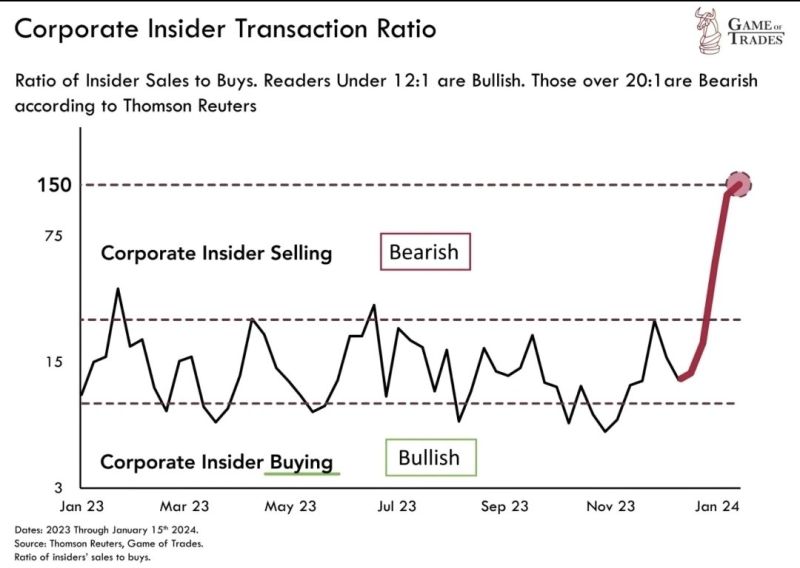

Smart money has been selling like NEVER before...

The insider transaction ratio spiked to levels unseen since 2023 When this ratio hits is at 20 or above, it's bearish as insiders sell Source. Win Smart

Investing with intelligence

Our latest research, commentary and market outlooks