Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

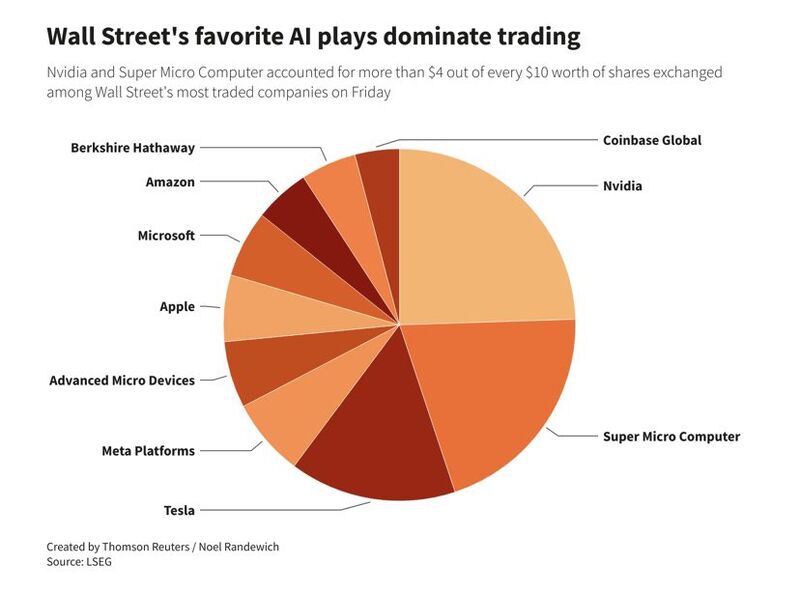

Nvidia $NVDA and Super Micro $SMCI accounted for more than $4 of every $10 traded among the top 10 most traded companies on Friday.

Source: Bloomberg, Beth Kindig

BREAKING: Super Micro Computer, $SMCI, has now lost one third of its value since the February 16th top.

In less than 2 full trading days, $SMCI has lost ~$20 billion in market cap. Still, the stock is trading at levels seen just 5 trading days ago. Even with the decline since Friday, $SMCI is currently up a massive 160% in 2024. Source: The Kobeissi Letter

On this day in 1959 the Dow Jones closed above 600 points for the first time ever

Source :history

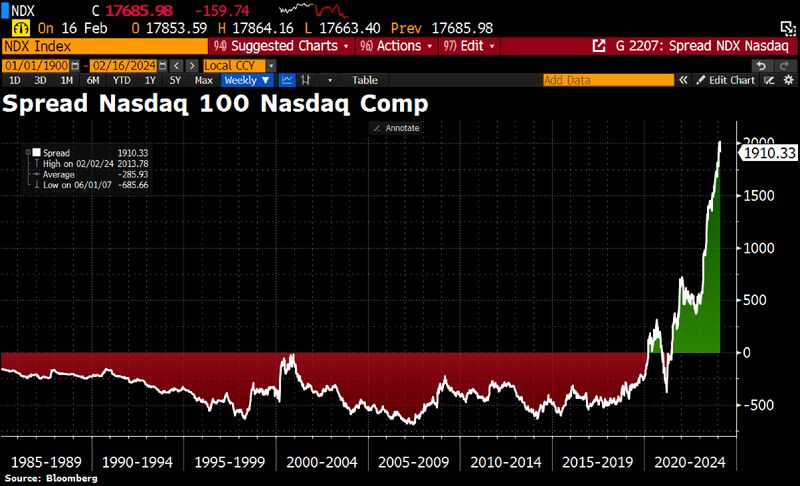

Big Tech Concentration in one chart

The spread of Nasdaq 100 over Nasdaq Composite is near ATH! Source: Bloomberg, HolgerZ

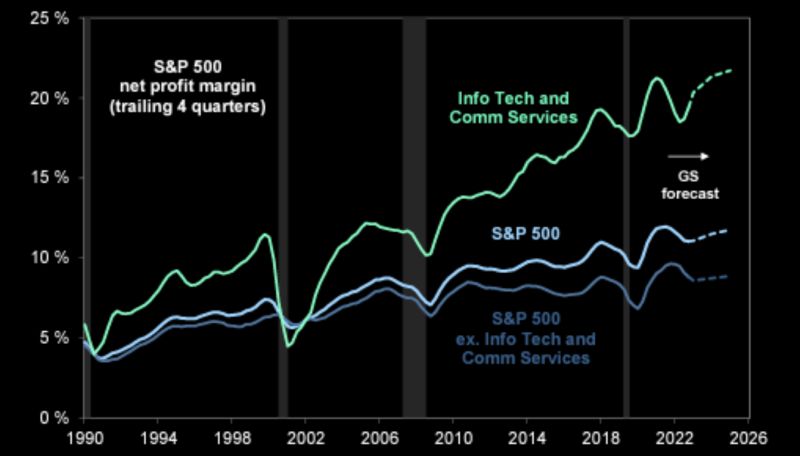

Goldman Lifts S&P 500 Target to 5,200 on Profit Expansion

Goldman now sees the S&P 500 rising to 5,200 by the end of this year, raising his forecast by about 2% from the 5,100 level he predicted in mid-December. The new target implies a 3.9% jump from Friday’s close. Goldman’s 5,200 price target for the S&P 500 in 2024 is now among the highest on Wall Street, joining the ranks of Wall Street bulls. source : gs

Hmmmmm... Observations that provoke thought ?

One of these companies sells chips that power the world and the other sells sweatshirts to teenagers and young adults. source : kofin, tme

According to GS, Index margins excluding “Tech” will only expand modestly in 2024.

source : gs, tme

Investing with intelligence

Our latest research, commentary and market outlooks