Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

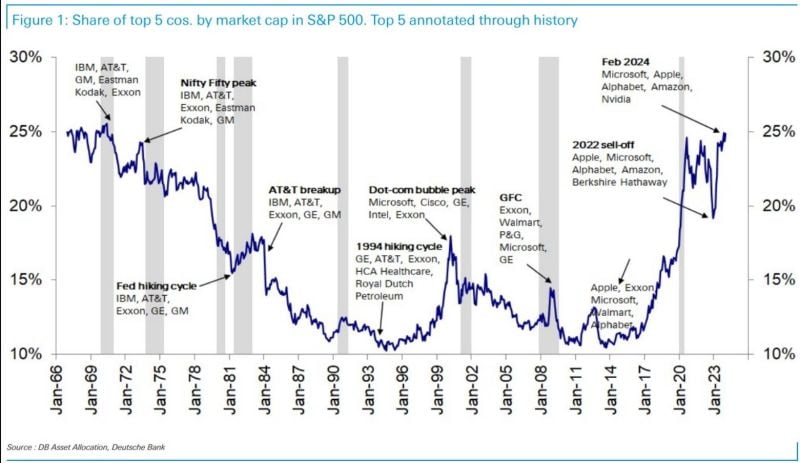

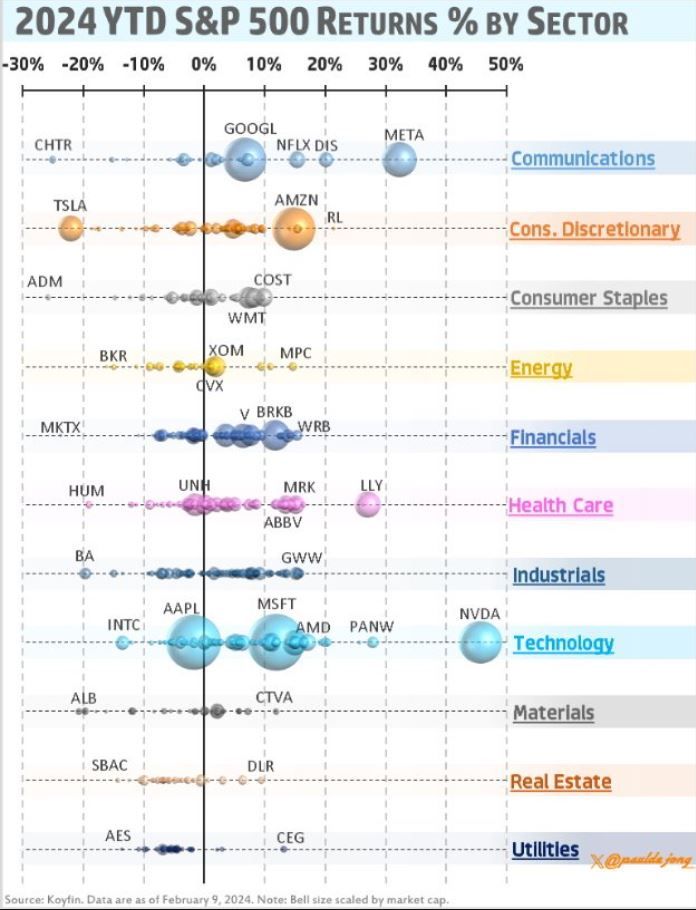

The US equity market is rivalling 2000 and 1929 in terms of being its most concentrated in history, DB has calculated.

The top 5 stocks Microsoft, Apple, Nvidia, Alphabet & Amazon account for 25% of mkt cap of the S&P 500. source : holgerz

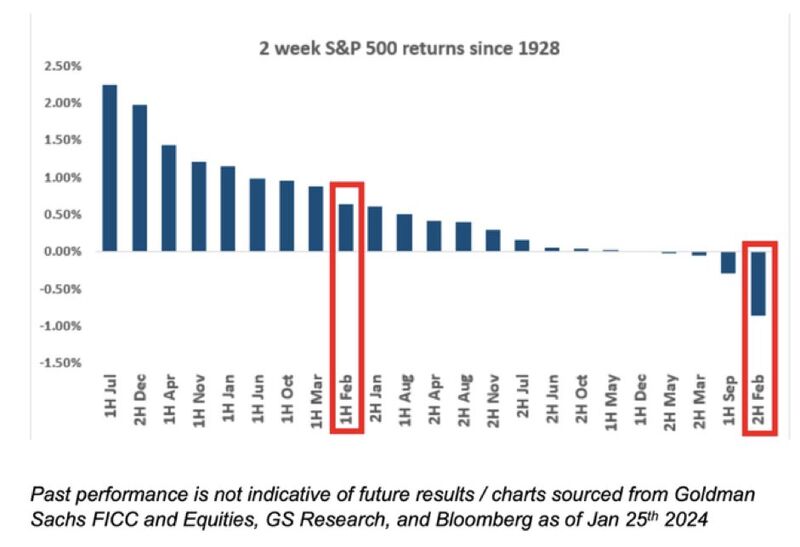

S&P 500 $SPX is now entering the worst 2-week period of the year based on data going back almost 100 years.

Source: Bloomberg

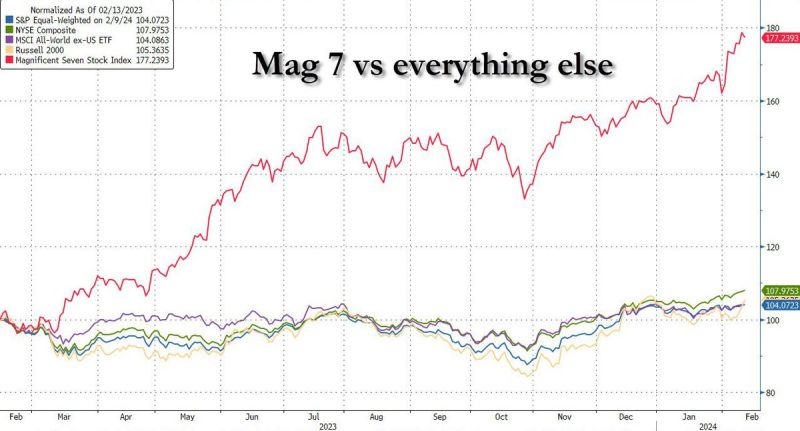

Since February 2023:

1. Magnificent 7: +77% 2. S&P 500: +20% 3. Russel 2000: +5% 4. S&P 500 Equal Weight: +4% If you remove the Magnificent 7 from the S&P 500, the index is barely up 5% over the last year. Source: The Kobeissi Letter

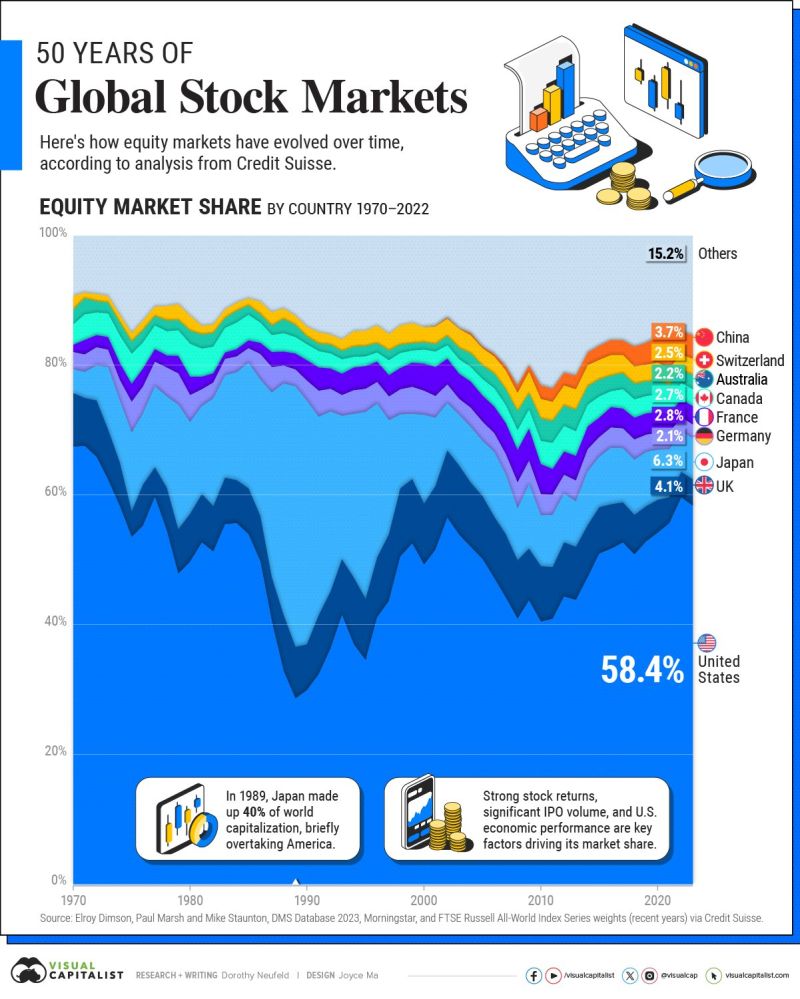

Ranked: The Largest Stock Markets Over Time, by Country (1970-Today)

Source: Visual Capitalist

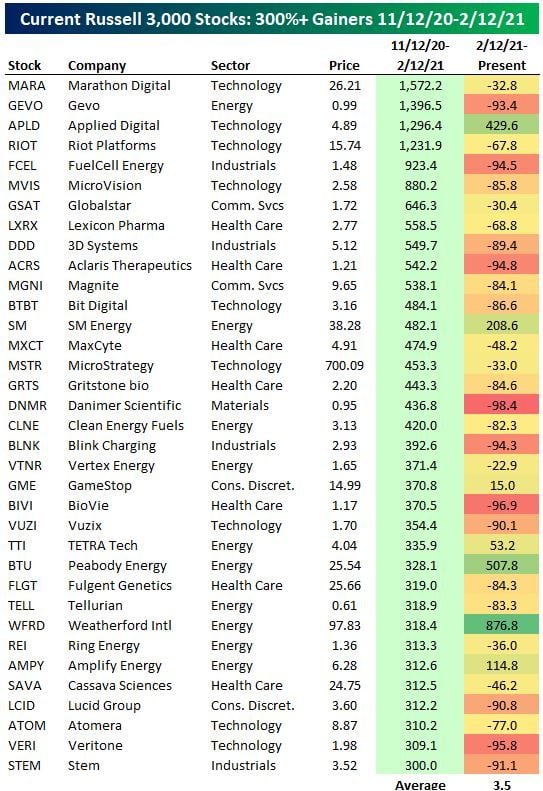

Meme Stock Anniversary

Three years ago today, the "meme-stock mania" that saw hundreds of profitless stocks surge hundreds of percent in a matter of months hit its ultimate peak. In the three months leading up to February 12th, 2021, the average stock in the Russell 3,000 (current members) rallied 40%, but there were 178 stocks that saw three-month rallies of more than 100%, 35 stocks that rallied 300%+, and four stocks that rallied over 1,000%. Below is a table of the 35 stocks currently in the Russell 3,000 that rallied 300%+ in the three months leading up to 2/12/21( include also how each of these stocks has performed since 2/12/21) source : bespoke

THE SILENT BULL MARKET...

Japanese stocks index Nikkei 225 closes up 1066.55 points and within striking distance of all time high 38957! It briefly crossed the 38,000 mark for the first time since the asset bubble burst in 1990 as it rallied about 3% and pushed 34-year highs. In times of financial repression aka negative real rates, real assets go up. January PPI came weaker than expected (+0.0% m/m vs. 0.1% expected) Futures going higher still: Nikkei 38110 Source chart: IG

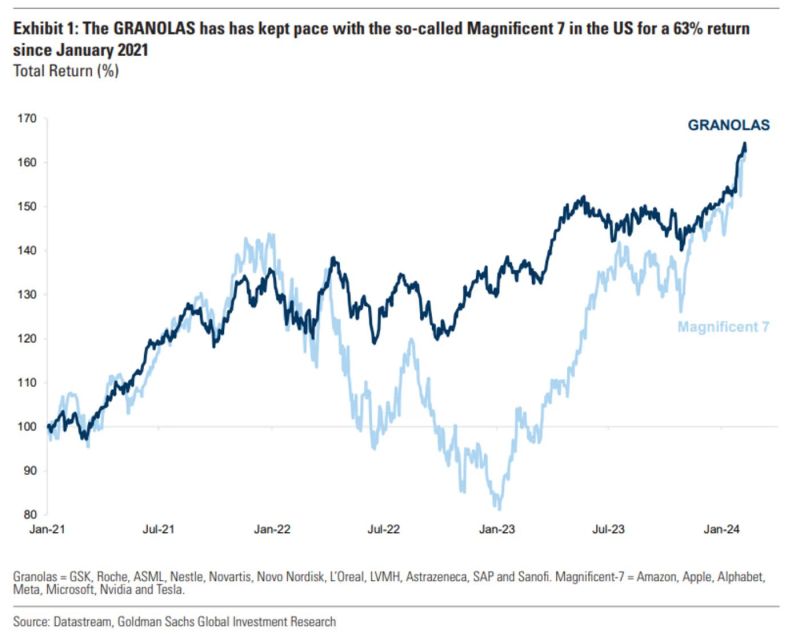

Did you know that there's another group of stocks that has kept pace with the Mag 7?

The largest companies in Europe have staged a rather impressive rally over the last three years as well! Source: Markets & Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks