Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

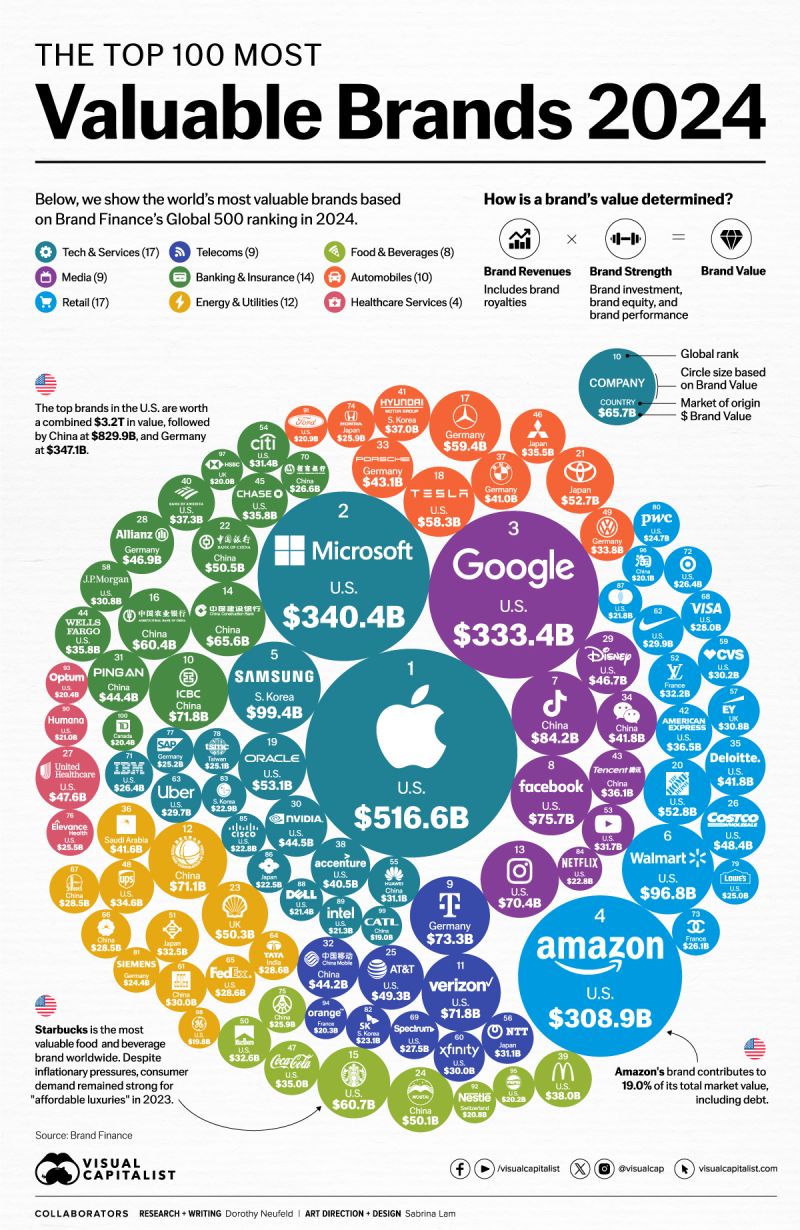

The 100 Most Valuable Brands in the World are Worth more than $5 Trillion

source : visualcapitalist

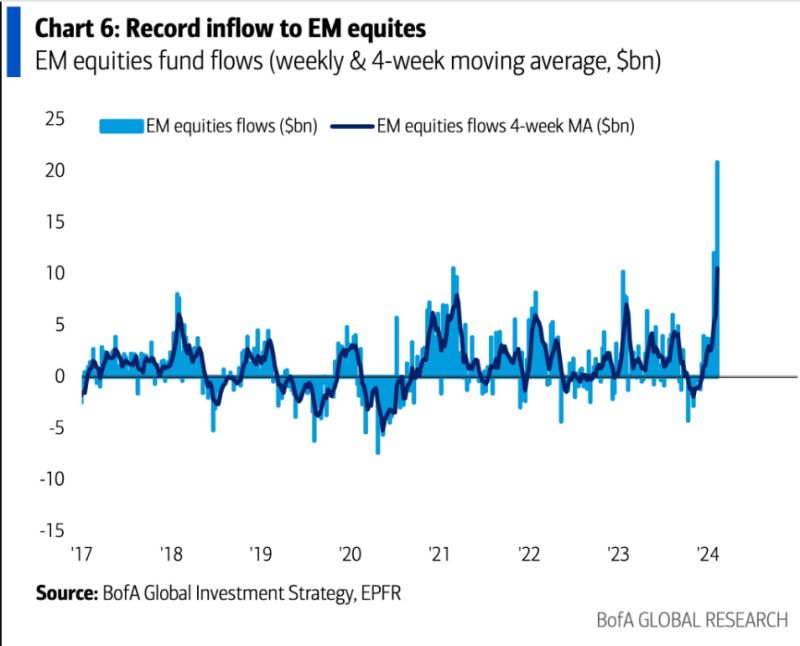

Record inflow to EM equities

Emerging Market Stocks see a weekly inflow of $20.8 billion, the most in history source : BofA, barchart

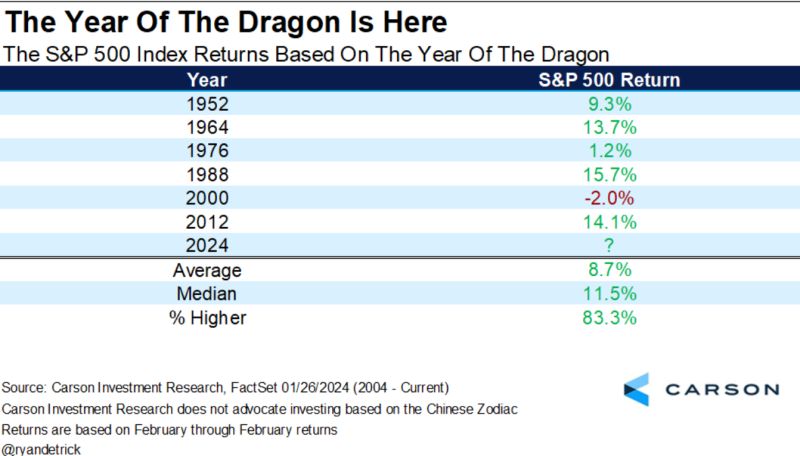

The S&P500 Index Returns Based on the Year of the Dragon

source : carson

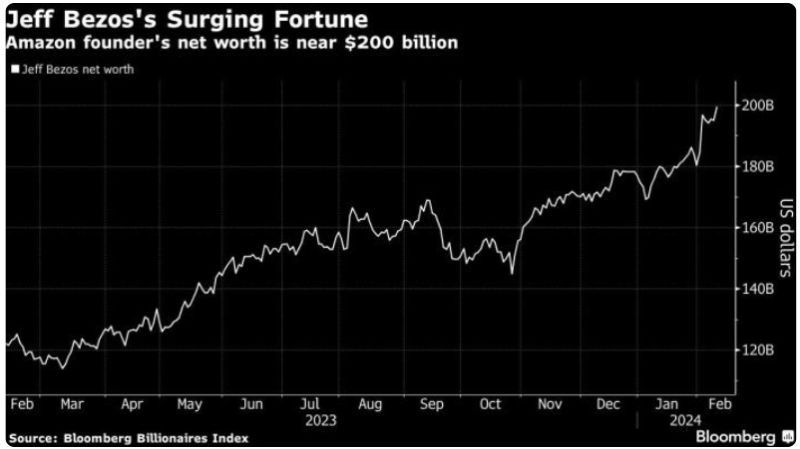

Bezos Sells $2 Billion of Amazon Shares in First Major Stock Sale Since 2021

Jeff Bezos unloaded 12 million shares of Amazon.com Inc. this week, the first time the billionaire has sold the company’s stock since 2021. The Amazon founder has sold over $30 billion in shares since records going back to 2002, including about $20 billion combined in 2020 and 2021. He has primarily been gifting stock, including shares worth roughly $230 million that were given to nonprofit organizations in November. source : yahoo!finance, bloomberg

The rally on Wall Street has meant that US equities now have a weighting of ~70% in the popular MSCI World index.

That is a record. The risk is correspondingly high if US equities go out of fashion. Source: Bloomberg, HolgerZ

Only 6 weeks into 2024, and the S&P 500 and other indexes have already reached new ATH's.

With the S&P up 5.38% YTD and the Nasdaq showing a 6.75% increase, let's see which stocks are the outperformers so far 1. $SMCI - Super Micro Comp - 160.4% 2. $ARM - ARM - 53.3% 3. $NVDA - Nvidia - 45.7% 4. $PLTR - Palantir - 42.0% 5. $CLFT - Confluent - 35.6% 6. $APPF - AppFolio - 34.9% 7. $META - Meta - 32.2% Source: KoyfinCharts Note: only companies with Mcap >$5B and an Altman Z-Score >3. No biotech companies.

The negative correlation between the us dollar with stocks (and other risk assets) has been strong for quite some time.

Meanwhile, US Dollar Index Futures are up every single week this year. Has this relationship now changed, or is the unwind about to come? Source: JC Parets

Investing with intelligence

Our latest research, commentary and market outlooks