Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

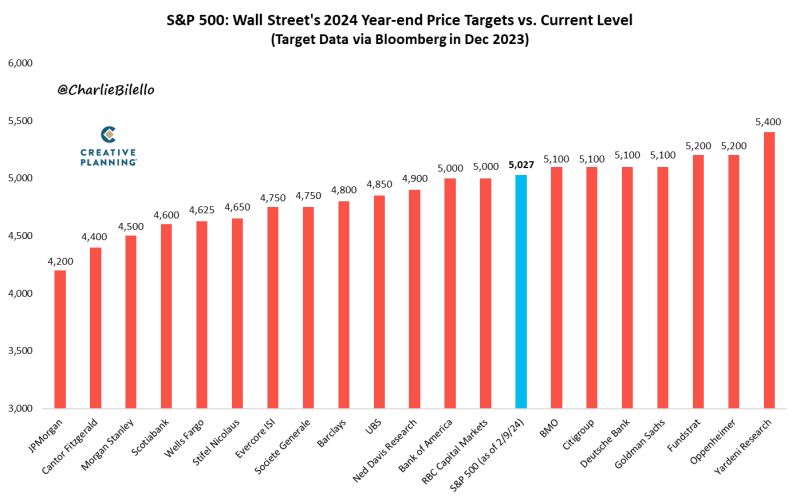

The SP500 is already up 5.4% on the year, well above the 1.9% average gain Wall Street strategists were predicting for all of 2024. $SPX

Source: Charlie Bilello

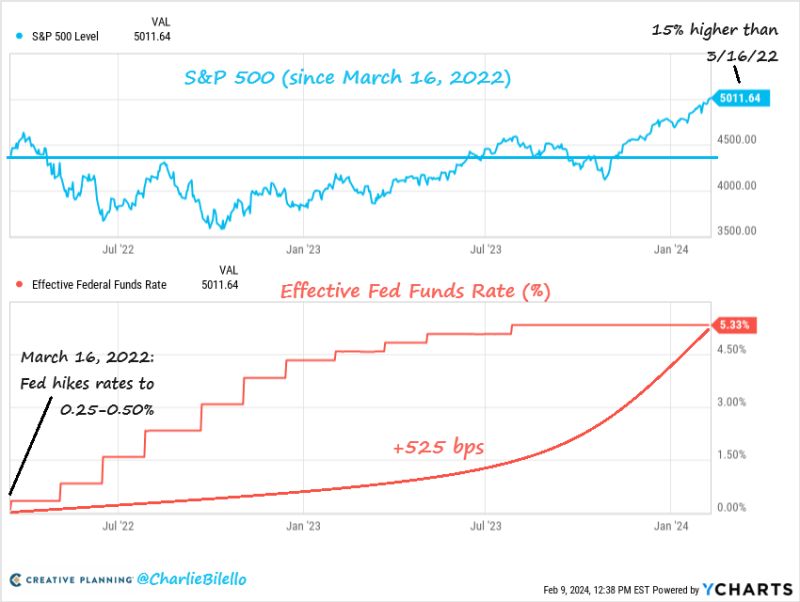

The S&P 500 is now 15% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

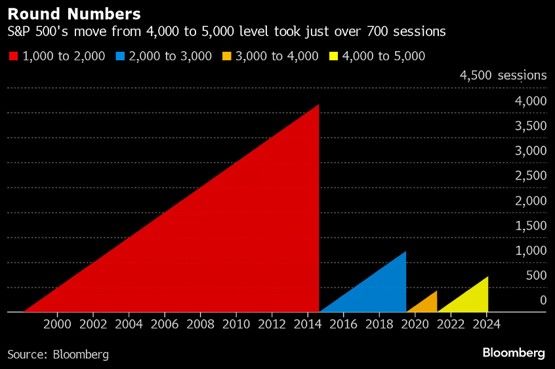

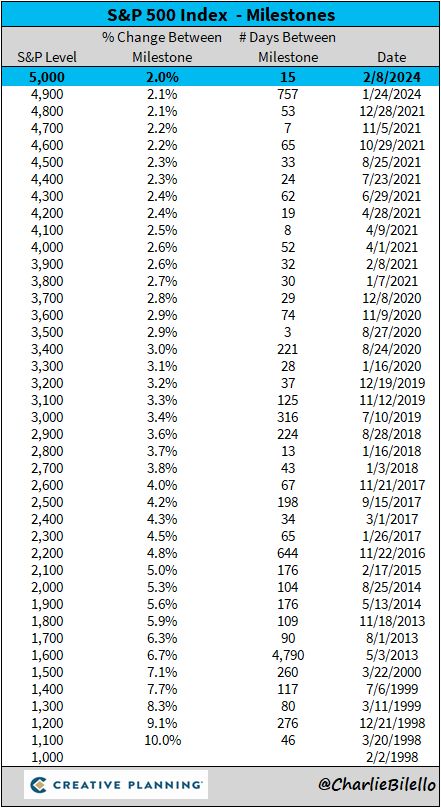

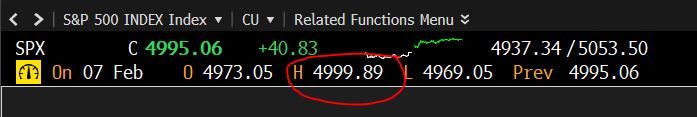

S&P 500 closes above 5,000 for first time ever.

It took 719 sessions for the index to set its latest 1,000-point milestone, a gain of 25%. The 50% advance from 2,000 to 3,000 needed 1,227 trading days, from 2014 to 2019, acc to data compiled by Bloomberg. To double from 1,000 in 1998, it needed 4,168 sessions to get to 2,000 in 2014. Source: HolgerZ, Bloomberg

🍾 S&P 500 closes over 5,000 for the first time in HISTORY

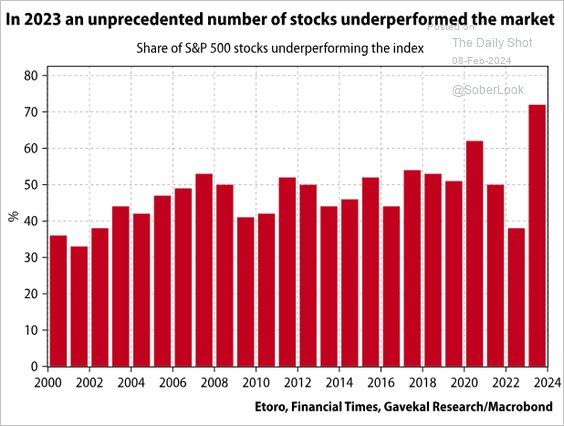

Most of the major US equity indexes moved higher over the week, with the S&P 500 Index reaching new highs and breaching the 5,000 threshold for the first time. The advance remained relatively narrow, however, with an equally weighted version of the index significantly trailing the standard market-weighted version for the fourth time in five weeks... Source hashtag#chart: Genevieve Roch-Decter, CFA

More than 70% of stocks in the index underperformed. That is a record for this century.

Source: Gavekal, The Daily Shot

The S&P 500 crossed above 5,000 today for the first time. It took 757 days to go from 4,800 to 4,900 and just 15 days to go from 4,900 to 5,000.

Source: Charlie Bilello

Coke’s first new permanent flavor in years adds a spicy twist

Coca-Cola announced the new Spiced flavor Wednesday, saying it blends the traditional Coke flavor with raspberry and spiced flavors. It will be available both in full sugar and zero-sugar varieties when it hits store shelves in the US and Canada in the coming weeks. Coke doesn’t often add new permanent flavors to its lineup: Spiced joins just a few other flavors it always sells, including its flagship flavor, cherry and vanilla. Why Coca-Cola doesn’t want to tell you what’s in those weird flavors Spiced was selected because it’s “all about being on category trend and responsive to our consumer preferences,” who are craving bolder and punchier flavors, Coke’s vice president of marketing for North America, told CNN. source : cnn

Investing with intelligence

Our latest research, commentary and market outlooks