Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

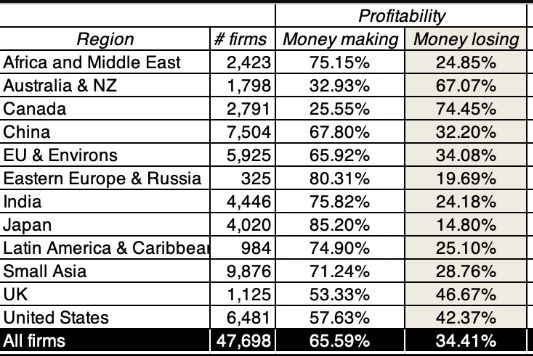

"Australia (67%) and Canada (74%) have the highest percentage of money losing companies in the world and Japan (15%) has the lowest" - via @AswathDamodaran

Source: Charlie Munger Fans

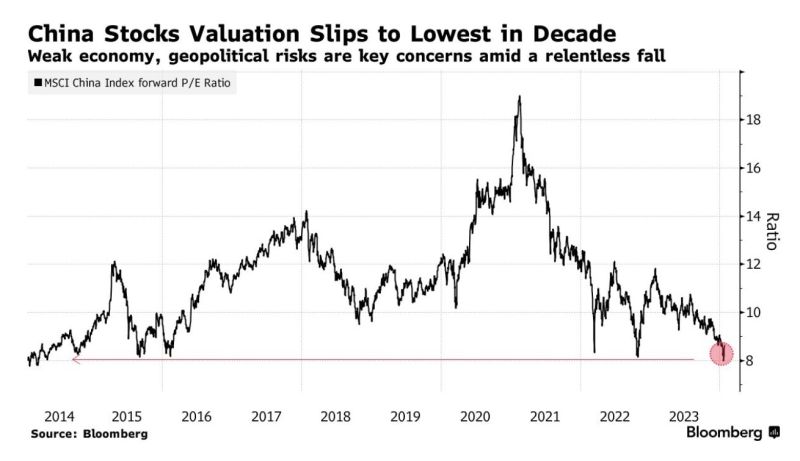

Chinese Stocks have fallen to a P/E Ratio of just 8, their lowest valuation in a decade 👀

Source: Barchart, Bloomberg

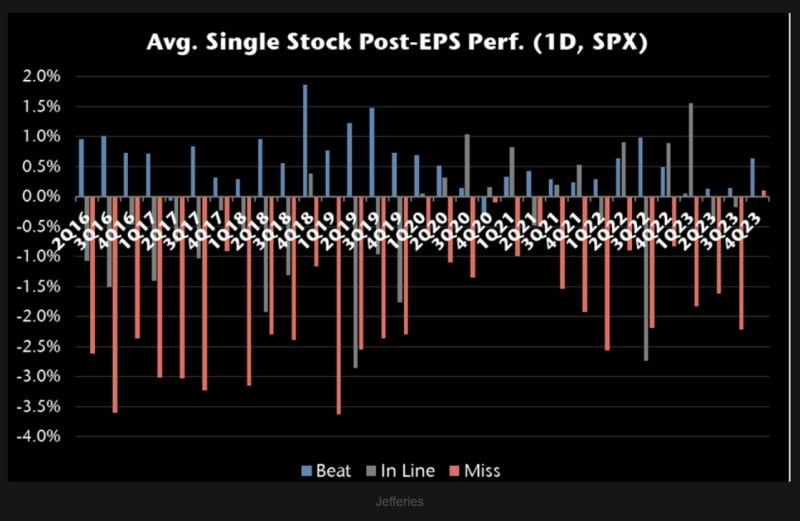

This US equity bull market doesn't care about earnings misses...

Despite the fact that >20% of SPX companies have missed, on average, they are still getting rewarded for it. Source: TME, Jefferies

The "Deutsche Mag 5" -> Germany has its version of Magnificent 7 stocks

An index consisting of SAP, Siemens, Allianz, Munich Re, and Deutsche Telekom has outperformed the Dax Price Index by almost 90ppts over a 10y period. Source: HolgerZ, Bloomberg, TME

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

Germany has its version of Magnificent 7 stocks">

How are the 'Magnificent 7' Tech Stocks doing so far this year?

Nvidia Is Up +23.2% $NVDA. Meta Is Up +11.3% $META. Alphabet Is Up +9.1% $GOOGL. Microsoft Is Up +7.4% $MSFT. Amazon Is Up +4.7% $AMZN. 🔴 Apple Is Down -0.1% $AAPL 🔴 Tesla Is Down -26.2% $TSLA Source: Jesse Cohen, Bloomberg

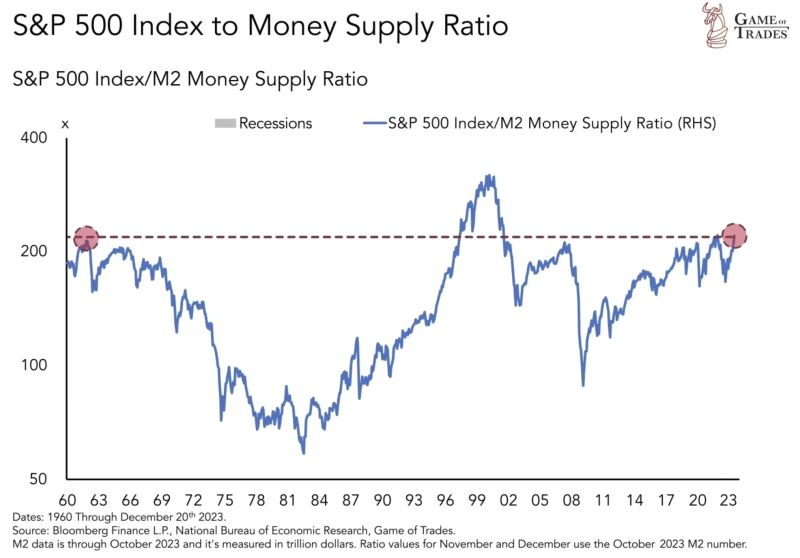

The market is at the same level as 1960 when adjusted for M2 money supply

Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks