Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

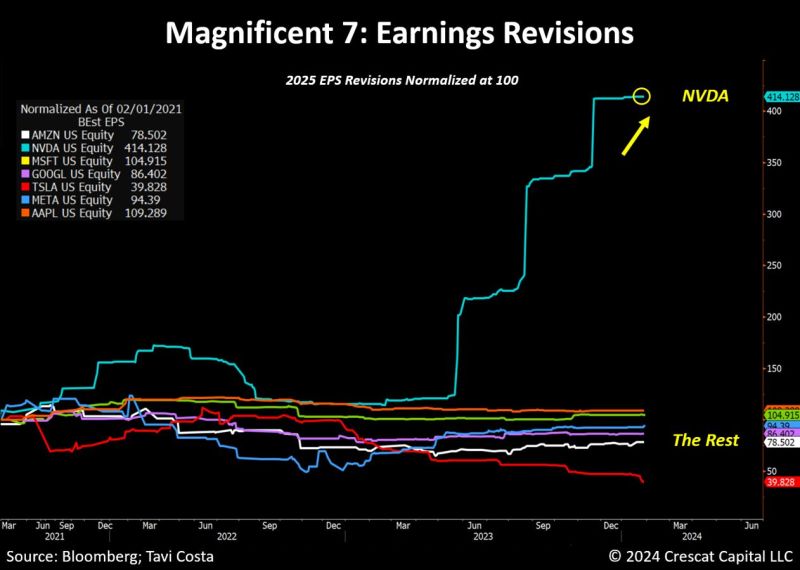

The week is THE week of BIG TECH earnings and it is time for a reality check: NVDA is the only Magnificent 7 stock seeing an increase in earnings revisions.

The company is almost the sole beneficiary of the recent AI advancements, contrasting sharply with others that have only experienced hype without any fundamental improvement. Is the Mag7 acronym already blowing out? Source: Bloomberg, Tavi Costa

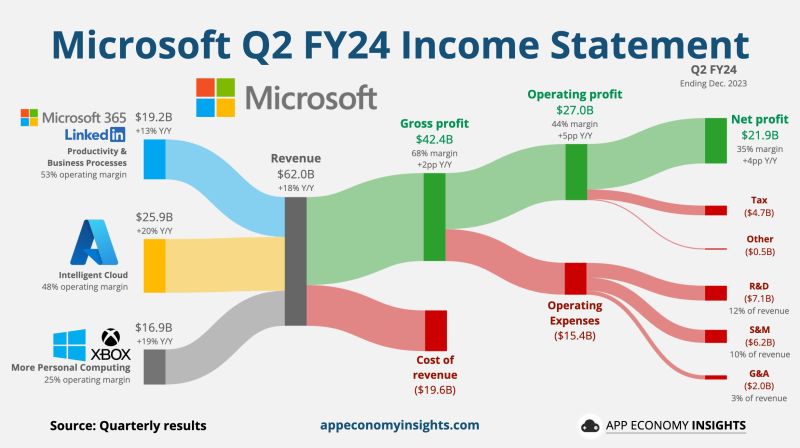

Microsoft $MSFT hitting all-time highs in extended hours trading after blowing out EPS and Revenue expectations

• Revenue +18% Y/Y to $62.0B ($0.9B beat). • Gross margin 68% (+2pp Y/Y) • Operating margin 44% (+5pp Y/Y). • EPS $2.93 ($0.16 beat). Source: App Economy Insights

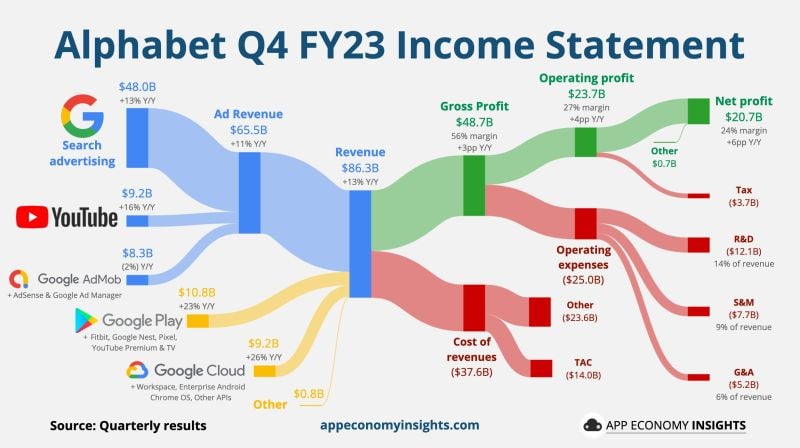

⚠️ Alphabet $GOOGL is down between -3% and -5% in extended hours trading after beating EPS and Revenue expectations

SUMMARY OF ALPHABET $GOOGL EARNINGS: 1. Revenue +13% Y/Y to $86.3B ($1.0B beat). 2. EPS $1.64 ($0.04 beat). 3. The search giant underperformed in its core ad search segment. -> Google’s advertising revenue totalled $65.52 billion, below expectations for sales of $65.80 billion. 4. Operating income also came in below expectations at $23.7 billion, compared to $23.82 billion. 5. On the bright side, Google cloud revenue topped estimates as the company spends heavily to compete with Microsoft’s Azure and Amazon’s AWS. ☁️ Google Cloud: • Revenue +26% Y/Y to $9.2B. • Operating margin 9% (+12pp Y/Y). 6. ▶️ YouTube ads +16% to $9.2B.

Market Breadth looking bullish!

Almost 84% of S&P 500 $SPX Stocks are now trading above their 100D moving average. Source: Barchart

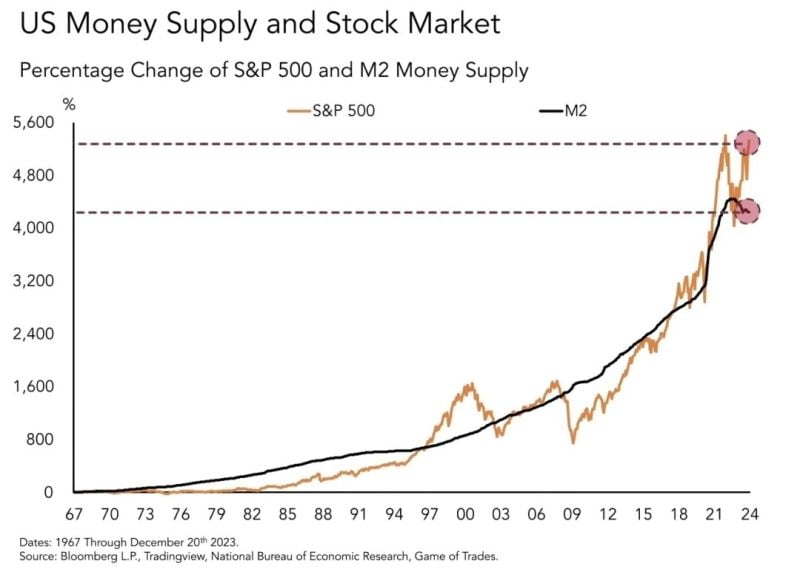

- The stock market's rise mirrors the money supply's growth. Both have risen over 4,500% since 1967&summary=Source: Win Smart, CFA, Game of Trades&source=https://blog.syzgroup.com/syz-the-moment/sgs-under-pressure-on-long-term-swing-support-0-0-0-0-0-0-1-0-0-0-0-0-0-0-0-0-0-0-0-0-0-1-0-0-0-0-0-0-0-0-0-0-1-0-0-0-0-0-0-0-0-0-0-0-0-0-0-0-0-0-1705-90b7fb5c' target="_blank">

Liquidity as a key market's driver in one chart -> The stock market's rise mirrors the money supply's growth. Both have risen over 4,500% since 1967

Source: Win Smart, CFA, Game of Trades

JUST IN: Fidelity has marked up the value of its shares in X by 11% during the month of December, according to a new disclosure

Usage of X is currently at an all time high of 384 billion user seconds per day. It is also believed that the launch of Elon Musk's AI company, Grok, has helped increase valuation. X is currently the #2 news app on the App Store. Source: The Kobeissi Letter

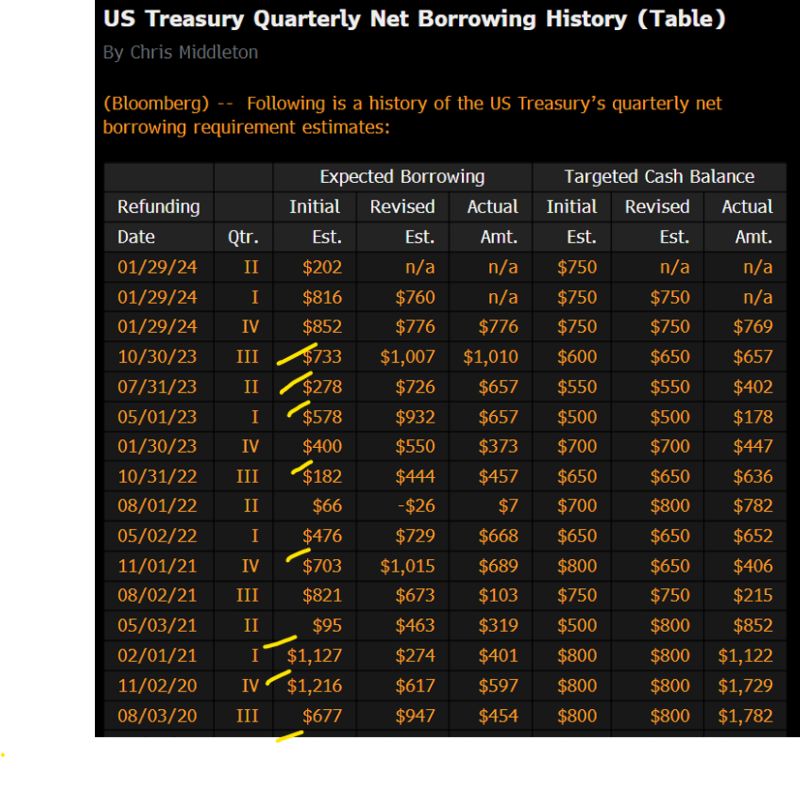

Equity futures spiked while bond yields dropped yesterday after the close after US Treasury unexpectedly slashed borrowing estimates:

- For Q1, US Treasury now expects to borrow "only" $760 billion in debt, which is $55 billion lower than what it expected in October 2023, and is about $30BN below wall street estimates. The difference the Treasury explained is "largely due to projections of higher net fiscal flows and a higher beginning of quarter cash balance." In other words, Treasury expects higher taxes to more than make up the $55BN difference from the previous estimate. - For Q2, the Treasury now expects to borrow only $202 billion in debt. While there was no previous Treasury forecast for this period, Wall Street expected a number somewhere in the $500BN vicinity, so clearly this is far lower than preciously expected. Source: Bloomberg, Chris Middleton, Lawrence McDonald, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks