Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

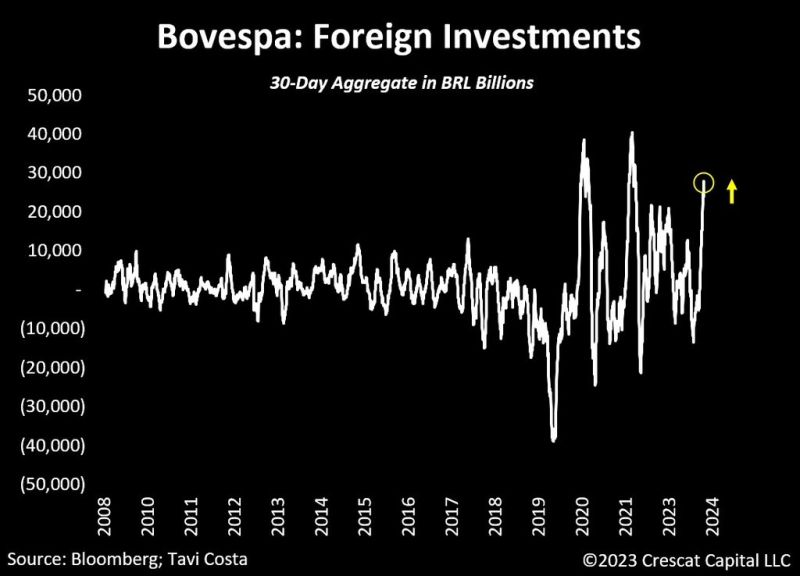

Tavi Costa -> Brazilian equity markets have experienced near-record foreign investments in the last month

Despite all the skepticism about $EWZ is outperforming the S&P 500 by 23 percentage points in the last 2 years. The aggregate market cap of Brazilian stocks relative to its overall money supply remains near historical lows. Source: Crescat Capital, Bloomberg

Between 2:00 and 4:00 PM ET today, the S&P 500 erased ~$600 billion of market cap

To put this in perspective, the S&P 500 added ~$600 billion of market cap over the last week. The index was up for 10 straight days but erased 5 of those daily gains in 2 hours. The volatility index, $VIX, spiked ~10% in a matter of minutes. Source: The Kobeissi Letter

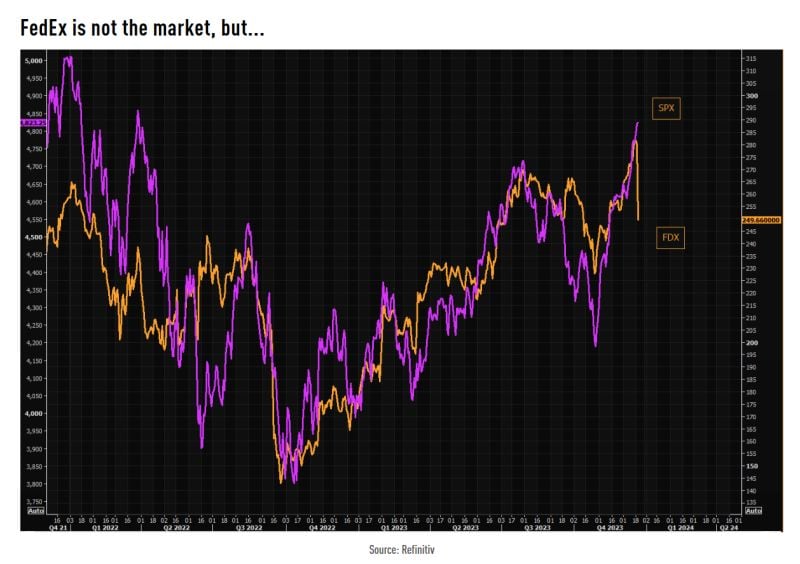

FedEx is not the market, but...

...has moved in perfect tandem with thee SPX for some time. Source: The Market Ear, Refinitiv

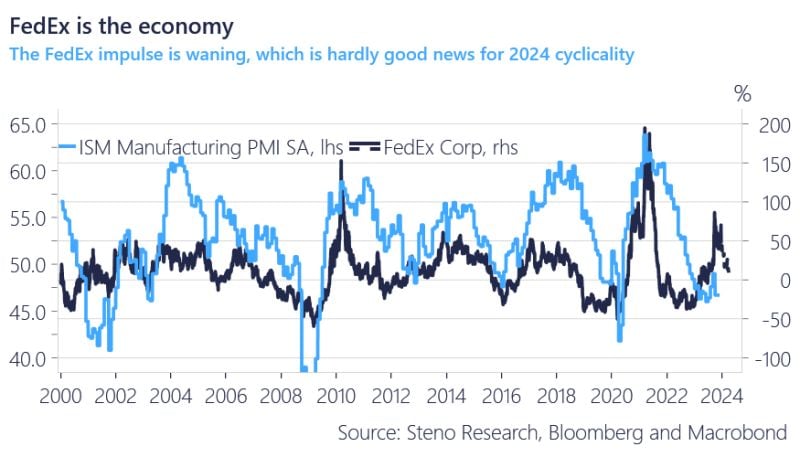

Steno Research -> Big miss from FedEx leading to a >10% nosedive in the stock price

FedEx is the economy and air freight was particularly disappointing here Given the strong correlation between FedEx and the cyclical economy, this speaks against expecting a strong comeback in 2024 Source: Steno Research, Macrobond, Bloomberg

BREAKING : Short Sellers

U.S. Stock Short Sellers have lost a reported $145 billion this year. Complete wipeout Source: Barchart

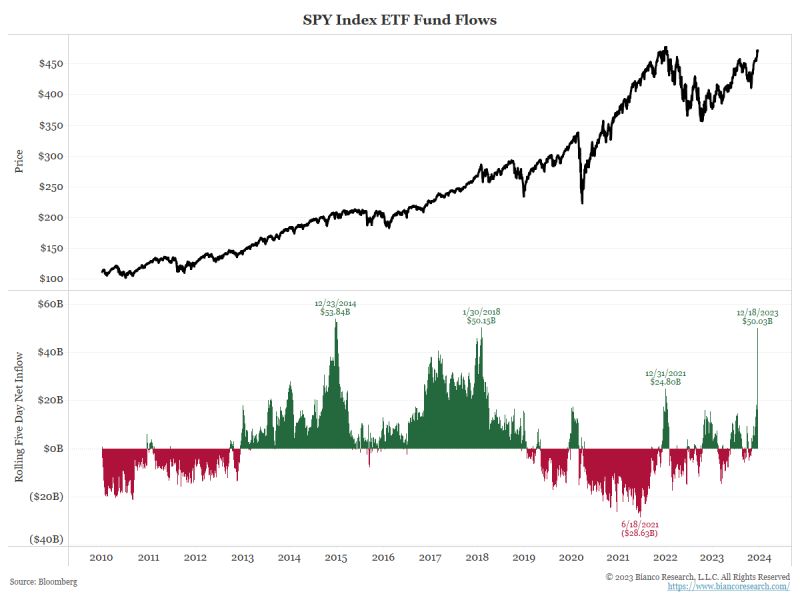

In just 5 days, $SPY has taken in $50B+, more than any other ETF YTD! This is the biggest 5-day take for $SPY since January 2018

This is the biggest 5-day take for $SPY since January 2018. FYI - the following week Jan 30, 2018, was vol-maggeon, (the $VIX went from 12 to 50 in 3 days and the $SPX plunged 10+% in 9 days) Source: Jim Bianco

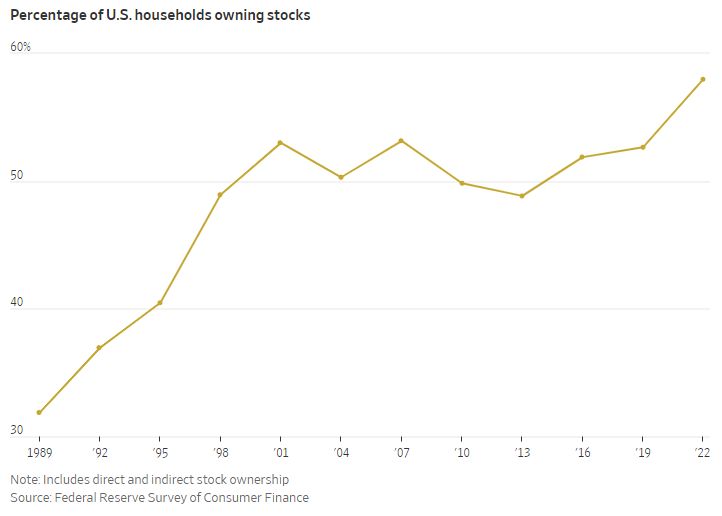

58% of US households own stocks, the highest percentage on record

Source: Charlie Bilello

The gap between the Magnificent 7 and the S&P 493 (remaining 493 companies) is now 63%

This year, the Magnificent7 is up a massive 75% while the remaining 493 companies are up just 12%. Combined, the S&P 500 is up ~25%, more than doubling the S&P 493's total return. In other words, the Magnificent 7 is up 3 TIMES as much as the S&P 500 and ~6 TIMES as much as the S&P 493. Just 7 weeks ago, the S&P 493 was DOWN 2% this year. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks