Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The stock market spent 2022 steadily declining and 2023 steadily gaining, to generally wind up about where it started

Source: Peter Mallouk

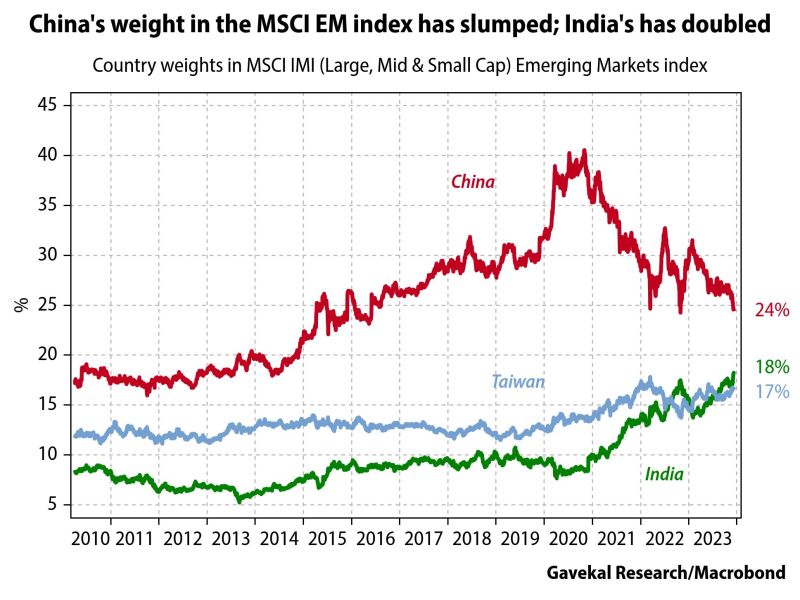

Chinese stocks made up 24.7% of the MSCI Emerging Markets index by capitalization, down from 40% three years ago

Meanwhile, India's weight has doubled... Source: Gavekal

BREAKING: Chinese Equities

Chinese Stocks continue to nosedive and have fallen to their lowest prices in 5 years. Source: Barchart

Markets are full risk-on since November 9th

The Nasdaq 100 and the S&P 500 have underperformed the equal weighted indices. They got beat up pretty badly by the Russell 2000 and have been left in the dust by Regional Banks and $ARKK (Ark Invest Innovation ETF). Source: Peter Tchir of Academy Securities

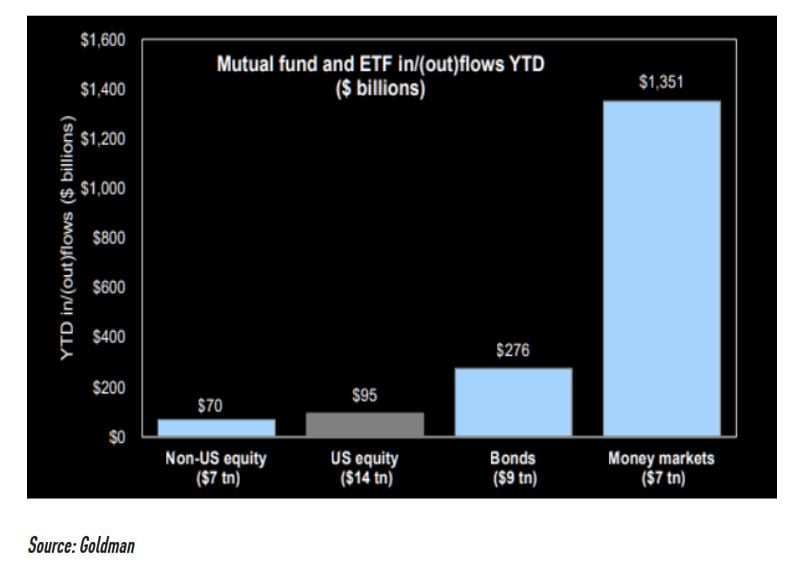

There is significant dry powder on the side line...

In 2023, we saw very limited US equity inflows vs. $1.4 trillion in money market inflows. If the gap starts to close for real now and gains momentum in 2024 it is needless to say a very good support for equities. Source: Goldman

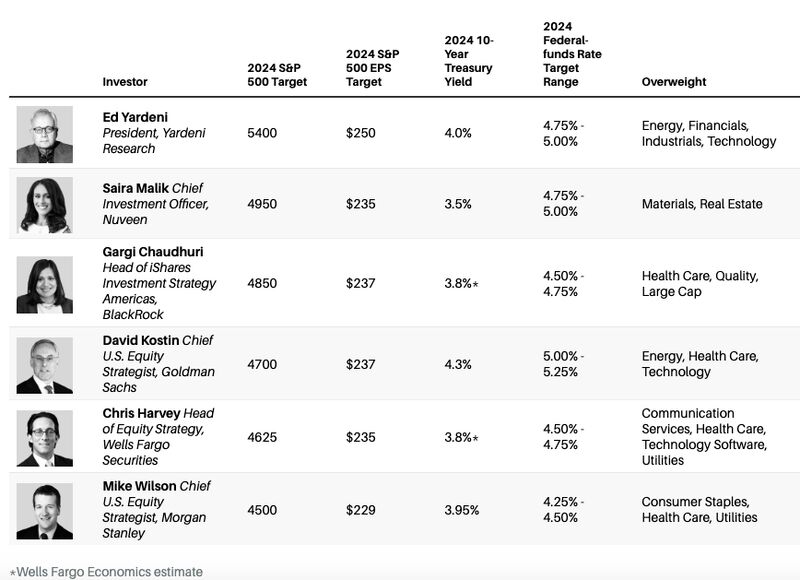

The average market strategist's 2024E S&P 500 target is 4837 with EPS of $237 for a return of 2.5% (excluding dividends) and a P/E of 20.4

Source: Julian Klymochko

Investing with intelligence

Our latest research, commentary and market outlooks