Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

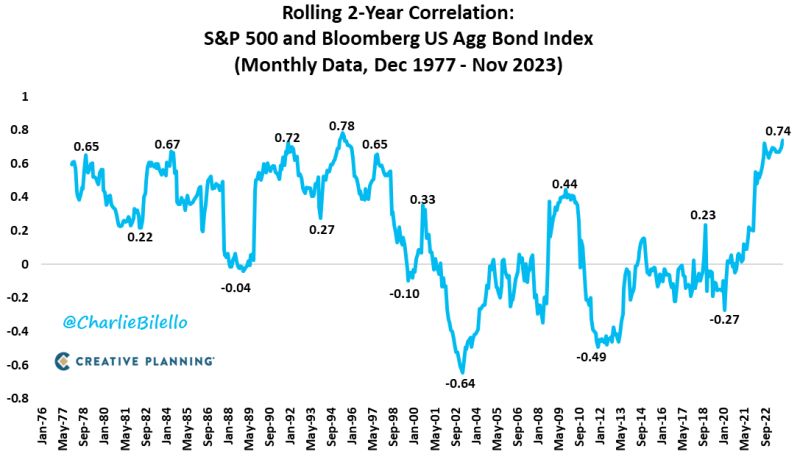

The correlation between US stocks and bonds over the last 2 years is the highest we've seen since 1993-95

Source: Charlie Bilello

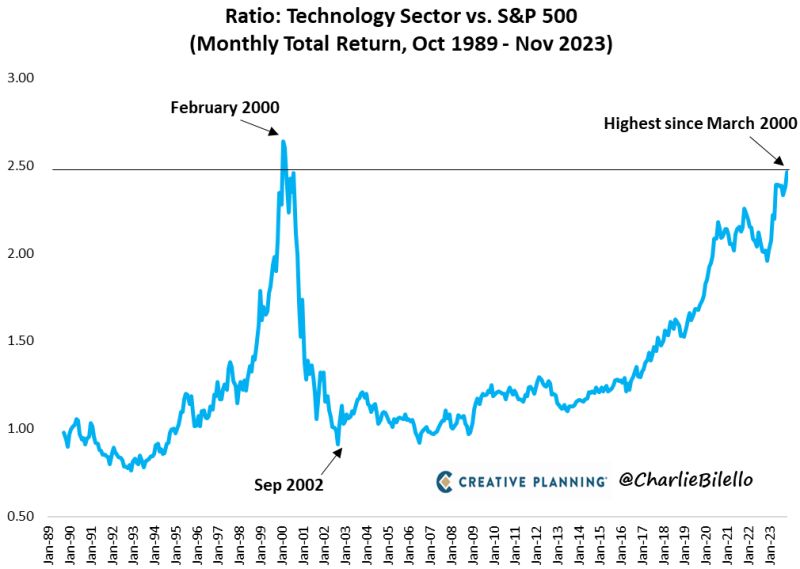

The S&P 500 technology sector's relative strength versus the broad market is at its highest level since March 2000

Source: Charlie Bilello

How much of the bonds outperforming stocks market action we've seen in the last couple weeks is a function of strong rebalancing flows given bond underperformance this year?

As highlighted by Bob Elliott, even part of this years 1.5tln pension fund stock/bond imbalance happening now could have quite an impact.

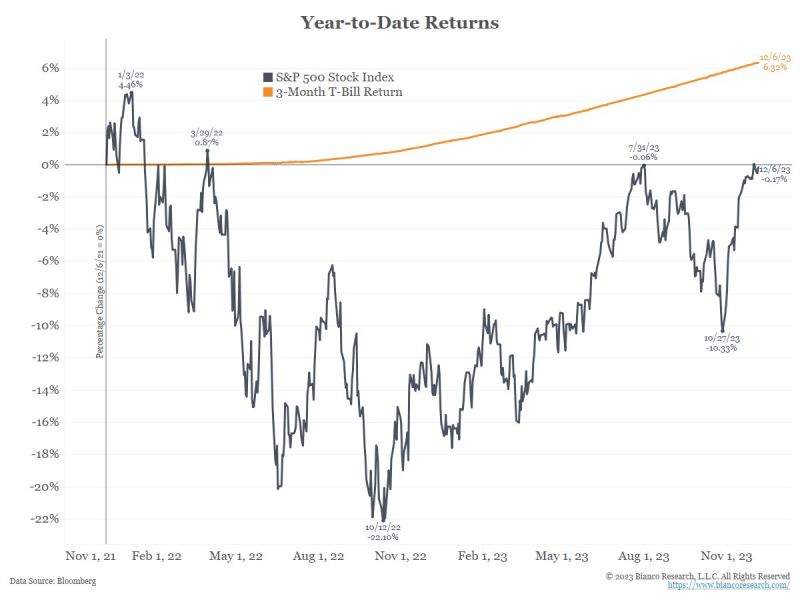

Regarding the stock market, the sp500 is exactly at the same level it was two years ago today, December 6, 2021. As the black line shows, the change in the index is up just 0.17%

Meanwhile, the 3-month T-Bill (orange line) is up 6.3% over the same period. Source: Bianco Research

JUST IN: SpaceX has initiated discussions about selling insider shares at a valuation of $175 billion or more

The shares are expected to be sold at $95 each. The $175 billion valuation is a premium to the $150 billion valuation obtained this summer. If SpaceX went public, it would be one of the largest IPOs of all time. Source: The Kobeissi Letter

Most of this year's Dax rally is driven by higher EPS expectations, not P/E expansion. Dax has gained 18% year-to-date while Dax P/E has expanded only 6% from 11.5 to 12.2

Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks