Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

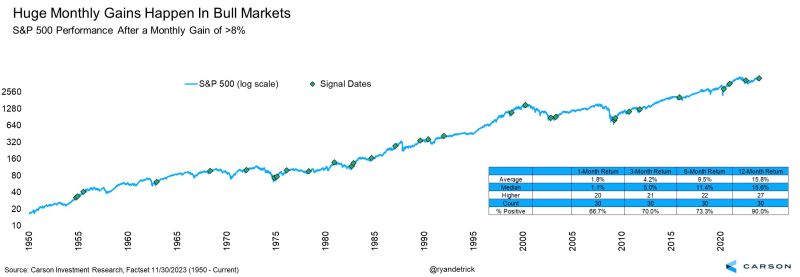

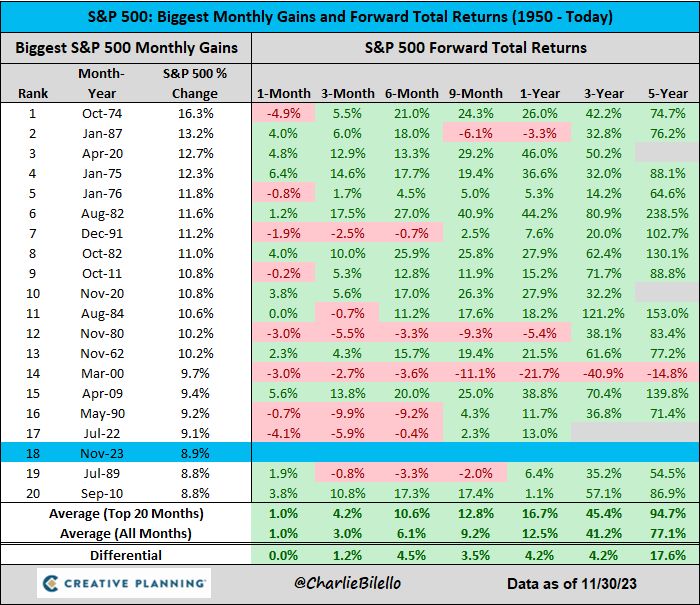

The S&P 500 gained 8.9% in November, the 18th biggest monthly advance since 1950. $SPX

Source: Charlie Bilello

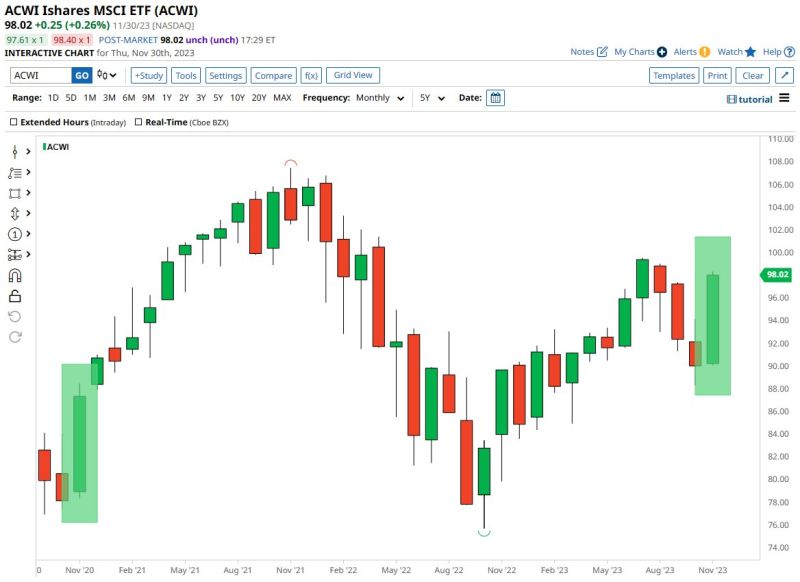

This chart shows that correlation between stocks and long duration bonds remain quite high

This is a regime change from previous decade and has implications for portfolio construction. Source: J-C Parets

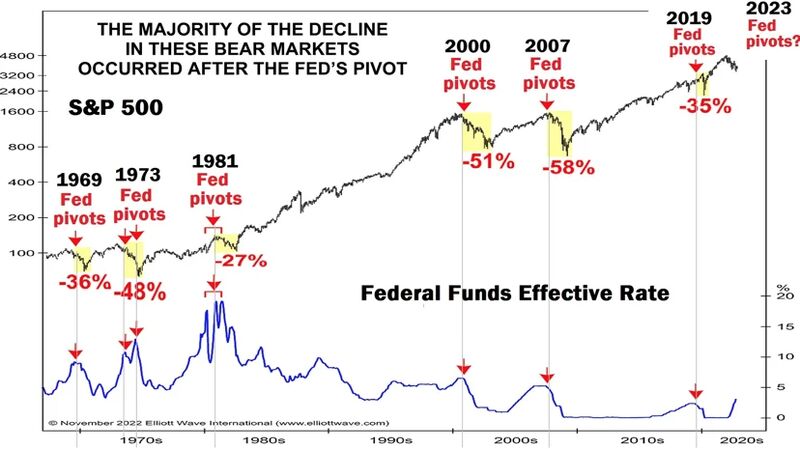

So the FED is expected to pivot next year, maybe as soon as March

Is a pivot good for equity markets? Well, history shows that the months that follow the pivot are not the best ones for stocks... maybe this time will be different... Source: Phoenix Capital

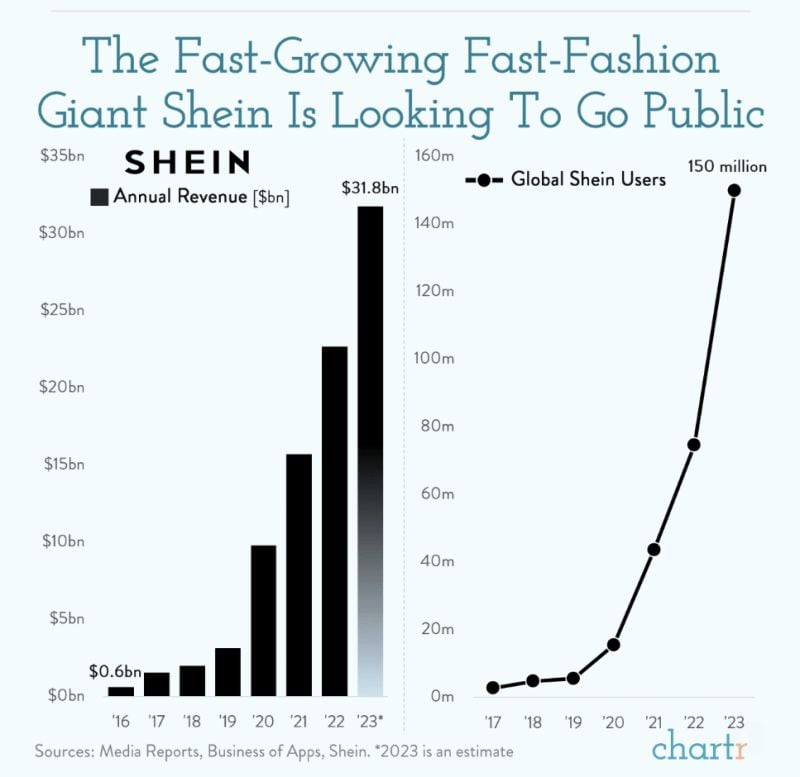

Fast-fashion giant Shein has filed confidential paperwork for a potential public listing in early 2024

seeking a valuation of up to $90 billion (per Bloomberg), which would make the 15-year-old company more valuable than Lululemon and H&M combined. Established in China in 2008 as ZZKKO, Shein puts the fast in fast fashion: dropping as many as 10,000 new items on its website every day, producing items in small batches (50-100), and only ramping supply reactively for any products getting a lot of demand. Its wallet-friendly offerings — like earrings for less than 50¢ — have won over young consumers across the world, with its US customer base helping to catapult the company’s sales up 45% year-over-year, to $23 billion in 2022. Source: Chartr

Investing with intelligence

Our latest research, commentary and market outlooks