Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

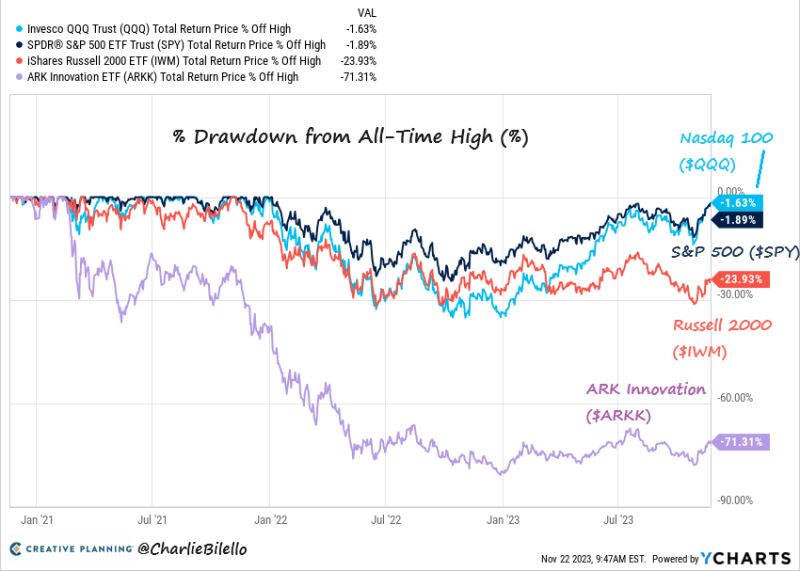

The Nasdaq 100 and S&P 500 ETFs are now less than 2% below their all-time high while the Russell 2000 ETF (small caps) is 24% below its high and the ARK Innovation ETF is 71% below its high

Source: Charlie Bilello

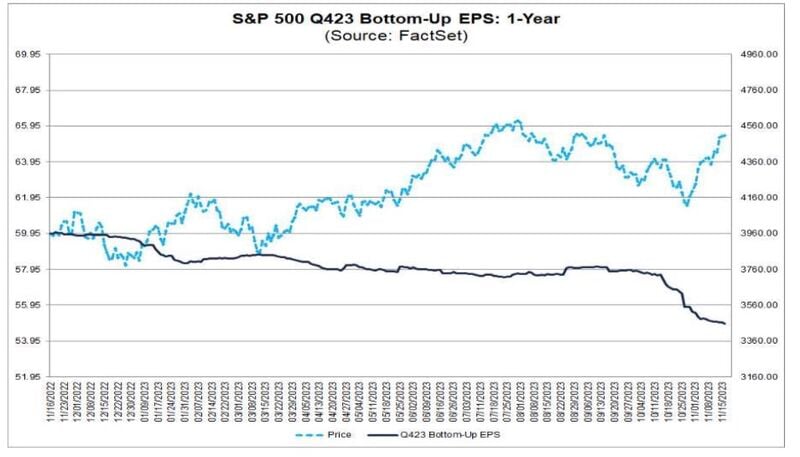

The rally in US stocks in recent weeks has taken attention away from what looks like a pretty concerning forward picture from earnings releases

Q4 earnings expectations have come down considerably in recent weeks, in contrast with equity market strength. Source: Bob Elliott, Factset

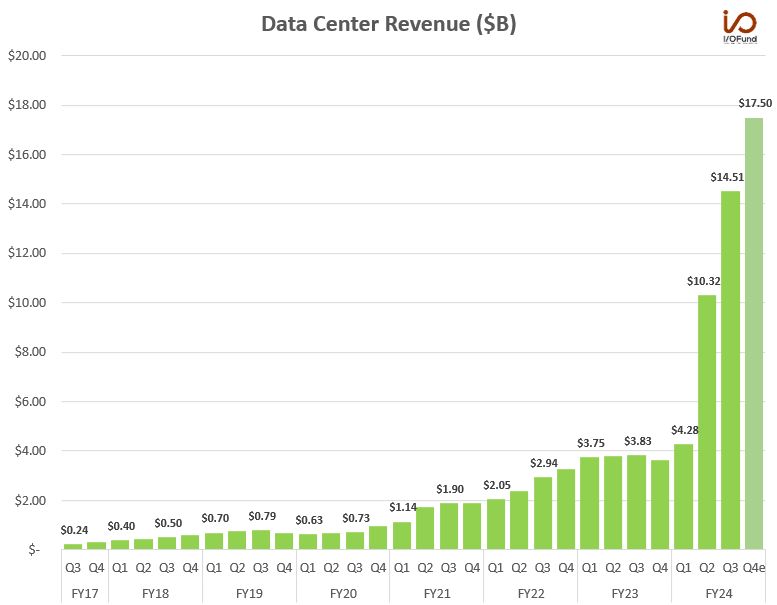

A look back on just how rapid Nvidia's $NVDA data center growth has been

· +79.7% CAGR since Q3 FY17's $240M revenue. · Reached record levels at $1.9B in Q3 FY21. · Grown 664% since then to $14.51B in Q3 FY24. · Projected to reach $46.6B in FY24, 56x more than FY17's $830M. Source: Beth Kindig

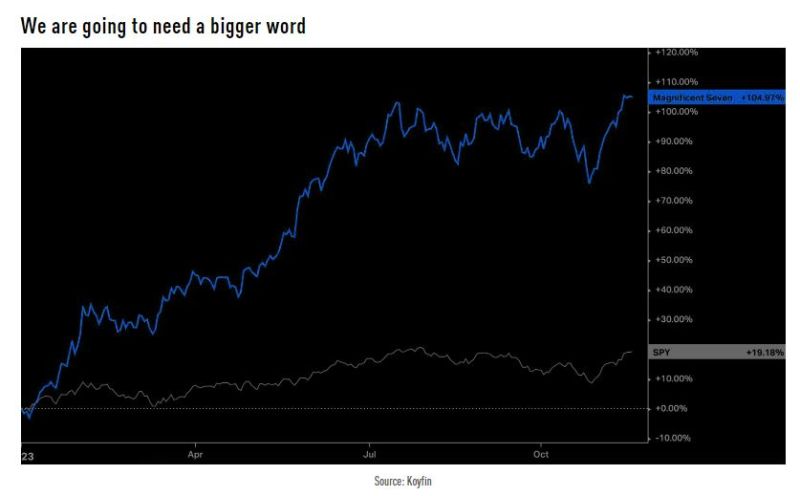

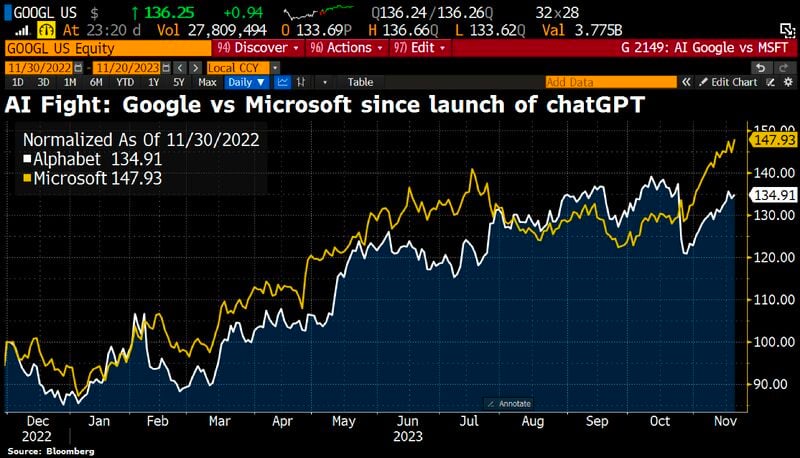

Microsoft is now clearly ahead of Alphabet again in the AI race on the stock market

Source: HolgerZ, Bloomberg

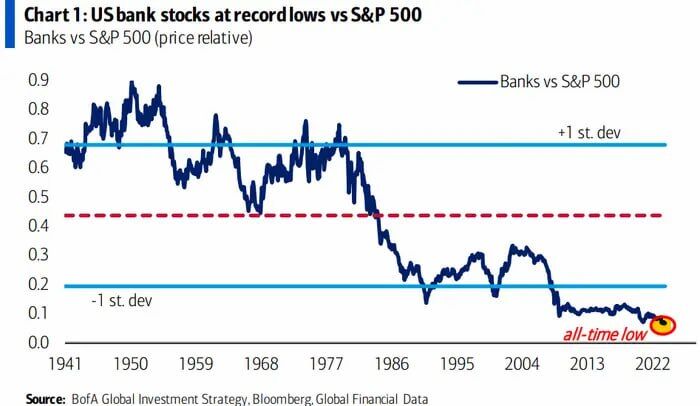

US bank stocks never recovered from the regional banking crisis. Currently, US bank stocks are at record lows relative to the S&P 500

According to Moodys, major US banks are sitting on $650 billion in unrealized losses. Meanwhile, the looming commercial real estate (CRE) crisis has small banks in question. Small banks currently hold ~70% of all CRE loans in the US, $1.5 trillion of which need to be refinanced by 2025. Source: BofA, The Kobeissi Letter

Nvidia stock hits All-Time High ahead of earnings:

The stock has gained 24% in November, on pace for its best month since a blowout earnings report in May. Nvidia has gained 245% in 2023, pushing its market value above $1.2tn. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks