Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

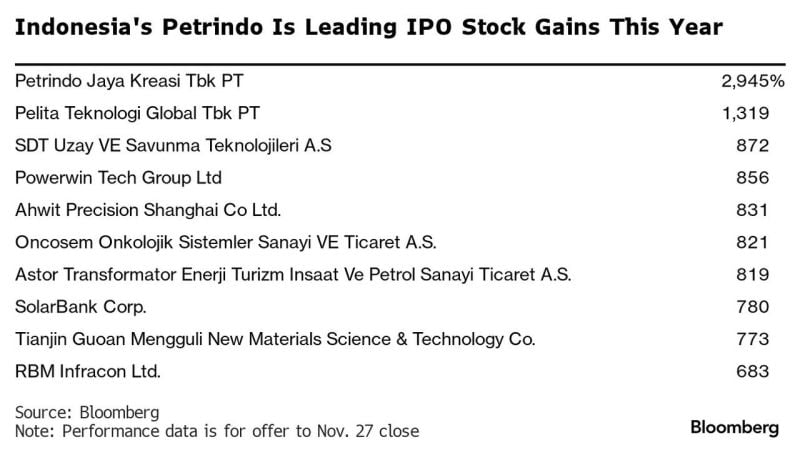

Here's the list of the best performing IPO in the world so far in 2023 YTD

The world’s best-performing IPO stock this year is a little known Indonesian coal mining company that’s backed by one of Southeast Asia’s richest men. PT Petrindo Jaya Kreasi has soared more than 2,900% since it listed in March following a $25 million offering. Yet it still has no analyst coverage, is richly valued and has relatively low trading volumes. Counting Indonesian billionaire Prajogo Pangestu as its main shareholder, the company’s market value has grown by more than 25 times to $5.4 billion in just nine months. Indonesia has been one of the most vibrant markets for initial public offerings globally this year, partially helped by a boom in demand for renewable energy stocks. Petrindo, in particular, is among a cohort of Indonesian stocks that have posted unexplained gains and wild swings this year, reaping fortunes for their backers and leading to regulatory scrutiny. Source: Bloomberg, www.zerohedge.com

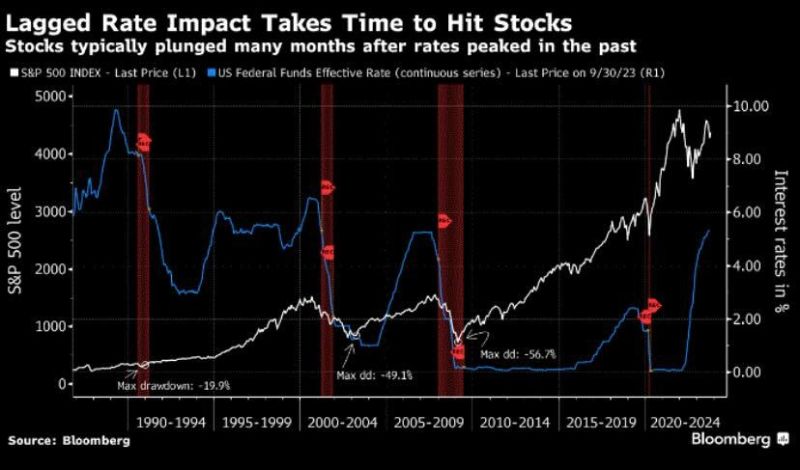

As we moved into 2024, one downside risk needs to be kept in mind:

tightening monetarypolicy cycle often operates with a lag. As shown on the chart below, stocks typically plunged many months after rates peaked in the past. Source. Bloomberg, Cheddar Flow

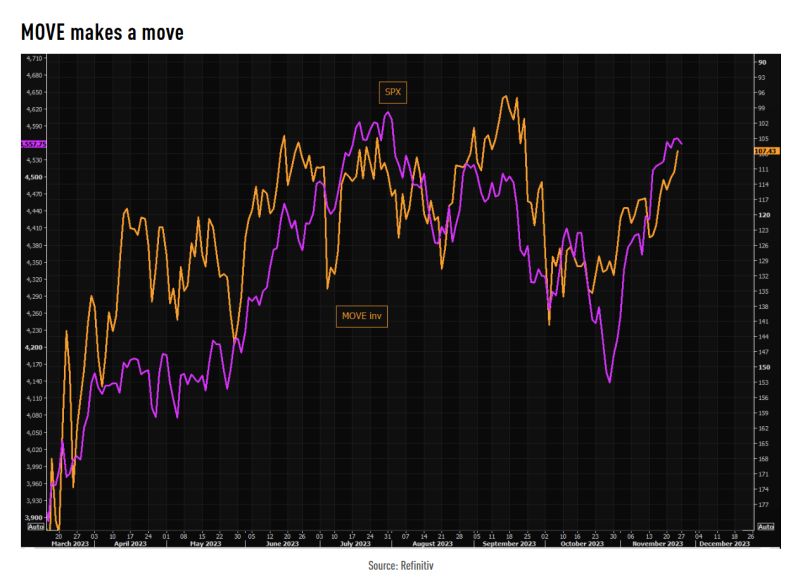

EQUITIES MOVE HIGHER AS BOND VOLALITY DROPS

Rates volatility joined the global volatility puke in November and we actually have the MOVE trading at the lowest levels since around mid September. Perfection vs SPX continues. Chart shows MOVE inverted vs SPX. Source: TME

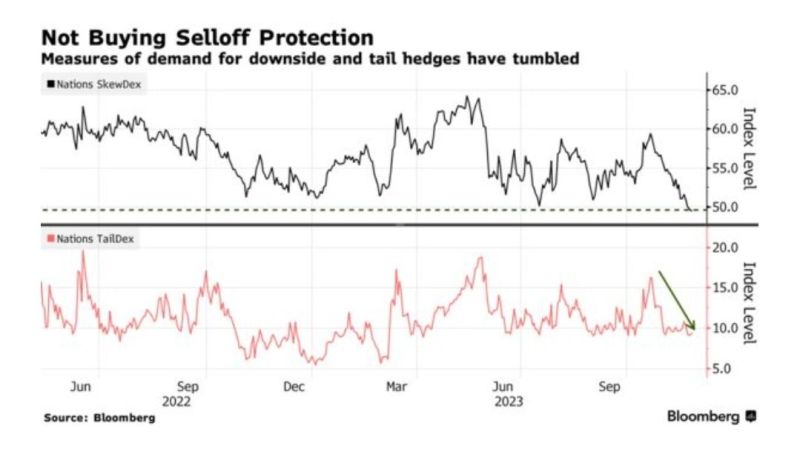

Hedging demand has fallen sharply with the cost to protect against a market selloff down by around 10%, or one-standard deviation, tumbling to the lowest ever in data starting in 2013

Demand for tail-risk hedges that pay out in an equity fall as precipitous as 30% has also dropped and is hovering around the lowest level since March.- Bloomberg

Nasdaq has now listed 0DTE Options (Zero Days to Expiry) for ETFS tracking silver, gold, oil, natural gas, and treasuries. Let the games begin! 🎰

Financial Times >>> "Trading in a controversial type of derivative known as “zero-day” options is spreading to Treasury and commodity markets, as Nasdaq and other exchange groups try to replicate a boom that has transformed trading in US stock indices. Nasdaq this week listed a series of new options contracts tracking some of the most popular exchange traded funds investing in gold, silver, natural gas, oil and long-term Treasuries. Options contracts give investors the right to buy or sell an asset at a fixed price by a given date. Trading a contract on the day it expires is known as zero-day trading and can be used to bet on or hedge against extremely short-term market moves. Zero-day trading in options tied to the S&P 500 index boomed in popularity during the coronavirus pandemic. Initially viewed as a temporary phenomenon driven by speculative retail traders, the surge sparked concern among some analysts and regulators that it could create systemic risk by exacerbating market moves. Source: FT, Barchart

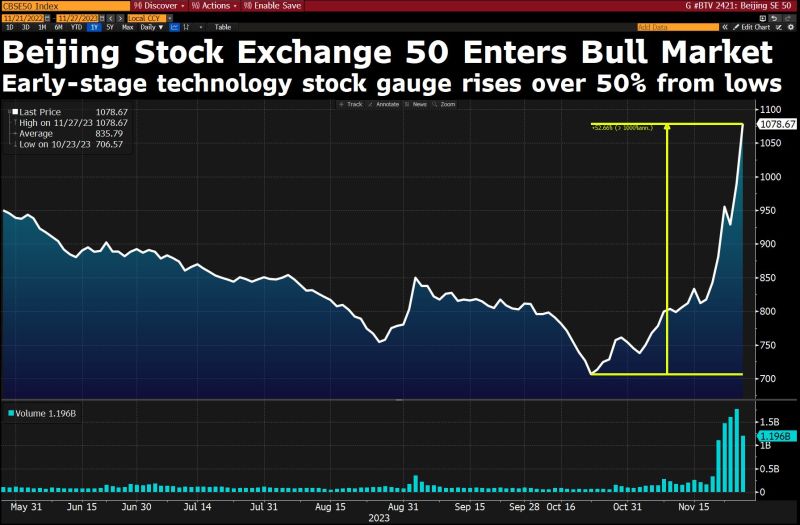

Up again today. Index is up 8%. This group of Chinese stocks is up over 50% in just a few weeks

Source: David Ingles, Bloomberg

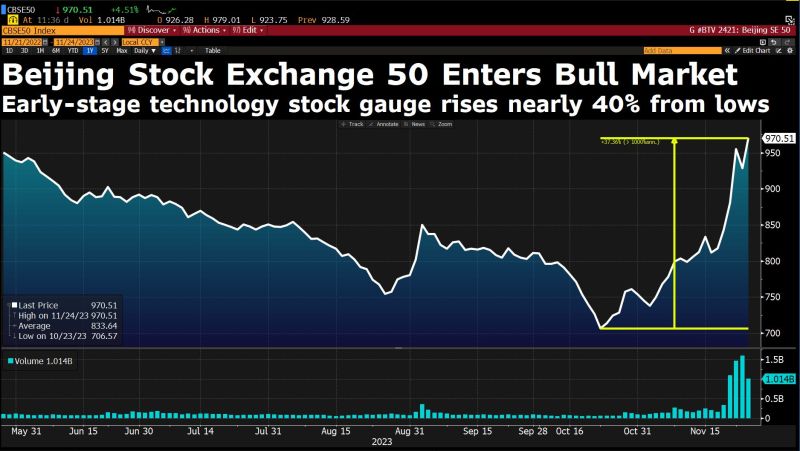

A gauge of early-stage small, mid-cap growth stocks in China has rallied 40% within just a few weeks

Source: David Ingles, Bloomberg

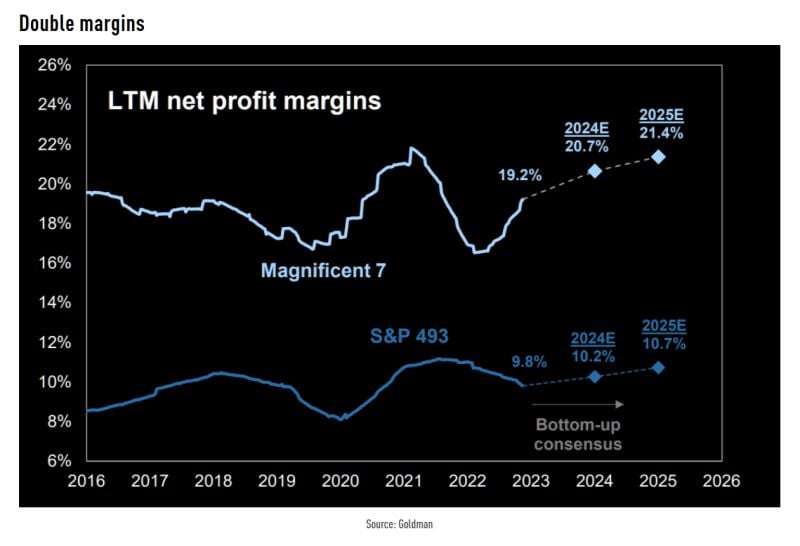

Consensus expects Net margins for the Magnificent 7 to stay significantly higher than the rest of the S&P 500

Source: Goldman Sachs, TME

Investing with intelligence

Our latest research, commentary and market outlooks