Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

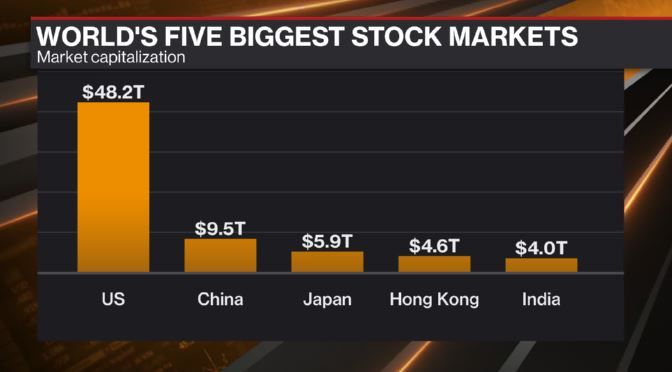

INDIA IN THE TOP 5!

India's stock market hit a milestone this week. It's now a $4 trillion market. Here's how that looks alongside the world's biggest. Source: David Ingles, Bloomberg

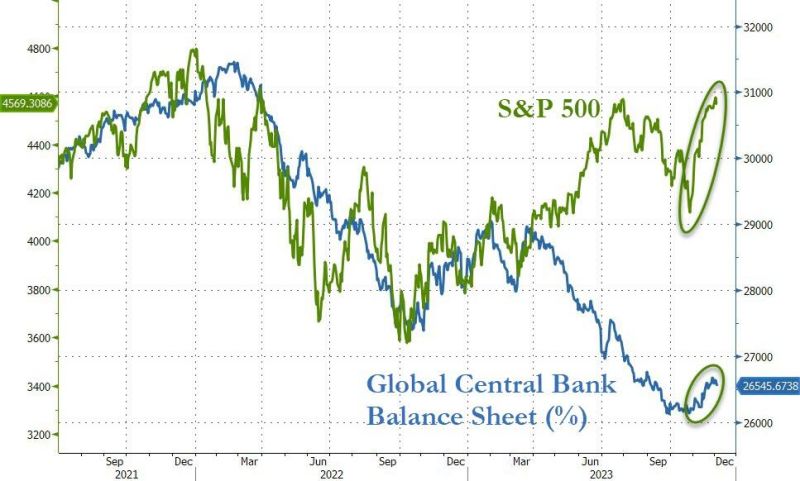

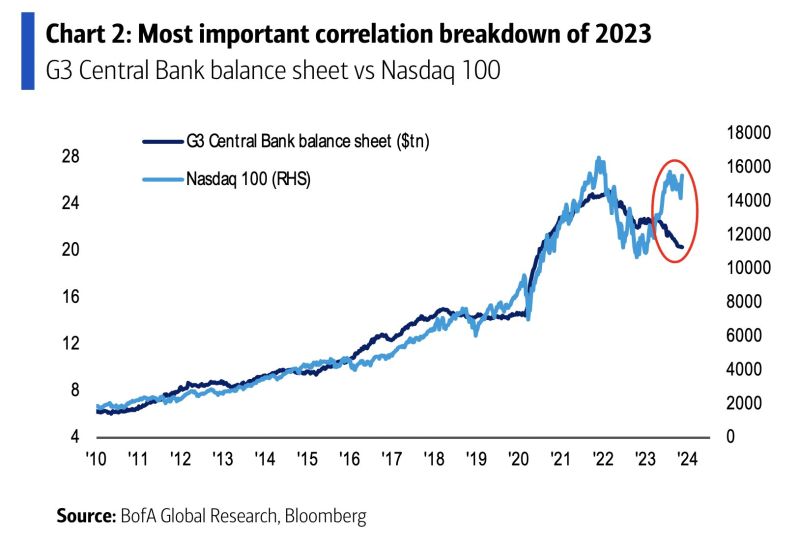

Liquidity continue to matters for stocks

Source: www.zerohedge.com, Bloomberg

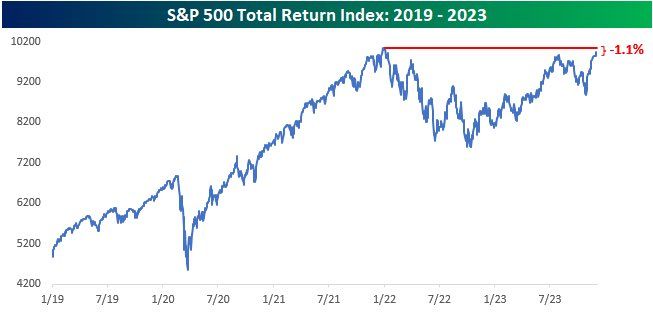

(Source: Bespoke) As shown in the chart below, the S&P 500 total return is within 1.1% of its prior all-time high from 1/3/22

In addition to nearing its prior highs, the pattern of the S&P 500 looks a lot like a cup and handle which technicians consider to be a bullish formation. Source: J-C Gand

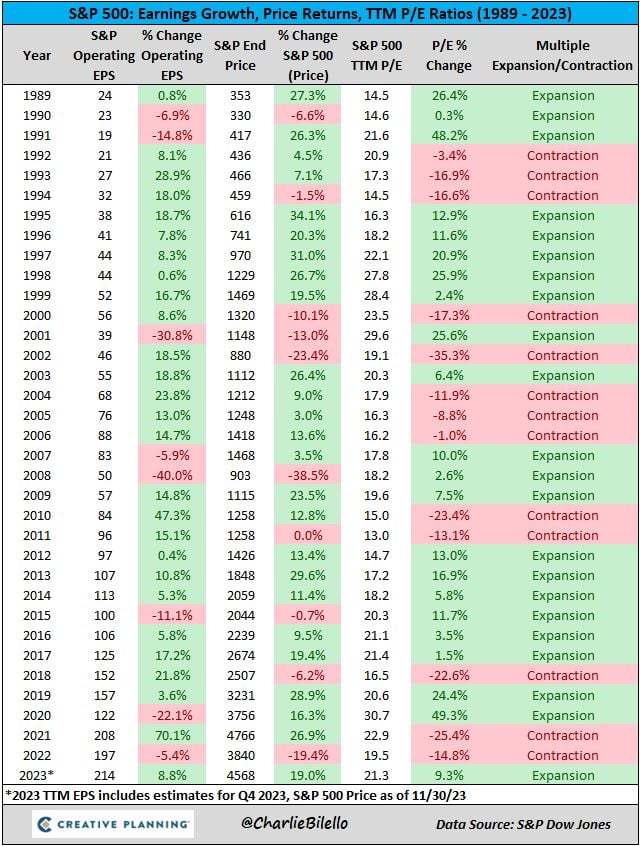

The P/E ratio on the S&P 500 is currently 21.3, with a multiple expansion of 9% in 2023

The average P/E ratio for the S&P 500 since 1989 is 19.2. Source: Charlie Bilello

BREAKING 🚨: Chinese Stocks have fallen to their lowest prices in 5 years

Source: barchart

Unprofitable Tech stocks continue to outperform the Magnificent 7, with the latter now back at support levels seen in the early summer relative to the unprofitable names...

Source: www.zerohedge.com, Bloomberg

Peak Big Tech? Nvidia insiders unload shares after 220% AI rally:

Insiders sold or filed to sell about 370,000 shares last month worth ~$180mln. Zuckerberg sells 1st Meta shares in 2 years after 172% surge. Meta co-founder unloaded $185mln of stock in November. Meanwhile, Nvidia Corp. executives and directors last month sold or filed paperwork showing they intend to sell roughly 370,000 shares worth about $180 million, according to data compiled by the Washington Service. If all of the shares were sold, it would be the biggest monthly disposal by dollar value in at least six years. Source: Bloomberg, Holger Zschaepitz

Most important correlation breakdown of 2023, according to BofA:

The S&P 500 soared >19% YTD led by "Magnificent Seven" (now 30% of market cap). Tech stocks hit 100-year relative high (despite global liquidity (G3 Central Bank Balance sheet) -$1.8tn.

Investing with intelligence

Our latest research, commentary and market outlooks