Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

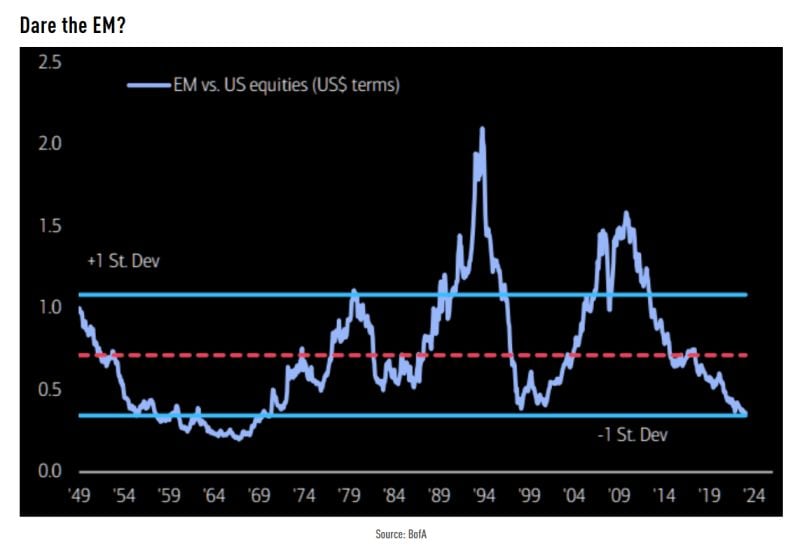

BofA Harnett: "...new 'BRICS 10’= 51% of global CO2 emissions, 46% of population, 45% of energy consumption, 45% of oil production, 37% of GDP (at purchasing power parity)…

yet <25% of global market cap, and EM equities also at 52-year low vs. US" Source: BofA, TME

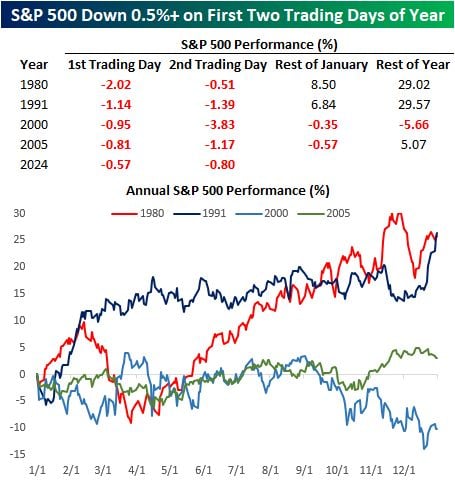

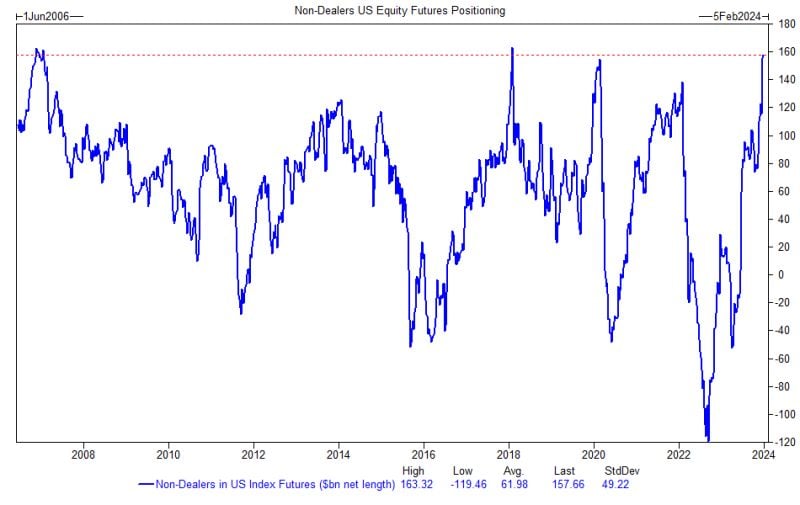

One of the major risk for equity markets in the short-run is Euphoria that prevailed at the start of the year. In other words, positioning is uber-bullish and can only go down from here

As Goldman trader Cullen Morgan writes, after 9 consecutive weeks higher in the S&P (quite a rarity), sentiment and positioning in US equities is very stretched. On the positioning front, US futures length (see chart below) now stands near record highs. In past instances when non-dealer positioning has been greater than $130bn, near term returns have been strong, while returns further out (3-months to 1-year) tend to skew more negative… With the latest data at +$158bn, Goldman traders are very wary of this now being a larger headwind. Similarly, CTA positioning in US Equities is approaching 2023 highs. Bottom-line: any geopolitical or macro news (e.g too hot US jobs print) might lead to higher bond yields might might put some downside pressure on equity markets.

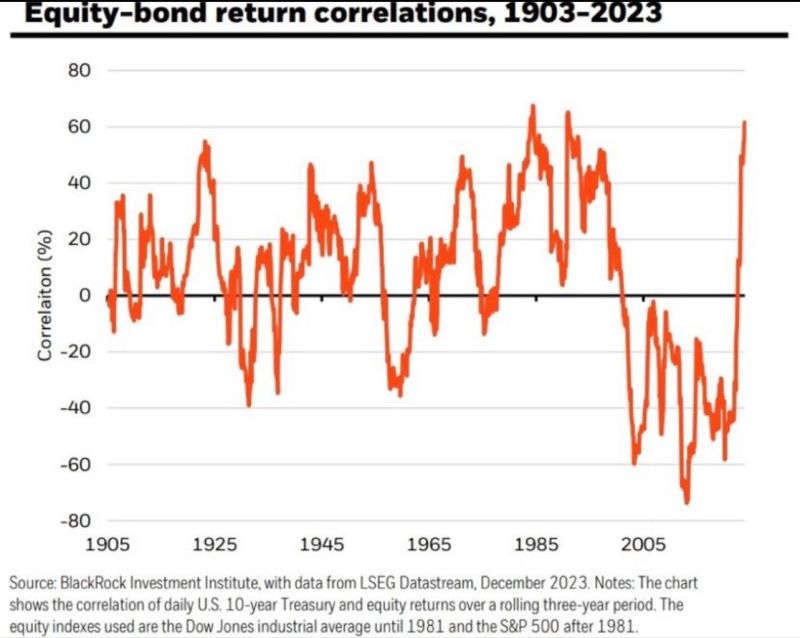

Correlation between Equity and Bond returns

Source: BlackRock, Ayesha Tariq, CFA

Chinese stocks are trading near all-time lows relative to GDP, while US stocks are trading near all-time highs relative to GDP

Perhaps for good reason... but that's a massive spread. Source: Swordfishvegetable

Mark Zuckerberg sold nearly half a billion dollars of Meta shares in the final two months of 2023 after a 2y hiatus in which the company’s stock price hit its lowest in seven years

The Meta CEO sold shares on every trading day between Nov. 1 and the end of the year, unloading nearly 1.28mln shares for ~$428mln. On average, each sale took in $10.4mln. Source: Bloomberg, HolgerZ

Fidelity marks down X valuation by 71.5%

Source: Win Smart, CFA

Investing with intelligence

Our latest research, commentary and market outlooks