Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Headline CPI Hotter Than Expected In December, Food Costs Hit Record High

>>> Headline Consumer Price Inflation printed hotter than expected in December, +0.3% MoM vs +0.2% exp and +0.1% prior, pushing the YoY headline CPI up to +3.4% (from +3.1% prior and hotter than the +3.2% exp)... >>> US Core CPI (ex-Food/Energy) rose 0.3% MoM as expected, dropping the YoY change below 4.00% (3.93%) for the first time since May 2021. This was also above estimates of 3.8% yoy. >>> Goods deflation has stalled as the used cars and trucks index rose 0.5 percent over the month, after rising 1.6 percent in November. Food costs stand at record highs. Fuel costs are on the rise again. >>> More problematically for The Fed is the fact that Core CPI Services Ex-Shelter (SuperCore) rose 0.4% MoM, upticking the YoY rise to +4.09%...(see chart below). All the subsectors of SuperCore rose MoM with the shelter index increased 6.2 percent over the last year, accounting for over two thirds of the total increase in the all items less food and energy index. >>> Market reaction: 10Y hit 4.06% and sp500 futures are sligthly down. Prediction markets are severely discounting a March rate cut. We started 2024 with a 70%+ chance that interest rate cuts begin by March. After the strong jobs report and a hot inflation reading, odds have nearly HALVED. Still, markets are pricing in 6 rate cuts in 2024, DOUBLE what the Fed is guiding. Source: Bloomberg, The Kobeissi Letter, www.zerohedge.com

BREAKING: Japan's Nikkei 225 stock index rises above 34,000 for the first time since March 1990. Breakout from a 30-year base!

- Breakout + test from 30-year base (blue circle) - Successful test of 2nd base (purple circle) - $NIKKEI now trading at 34-year high - Still below ATH recorded in 1989 - Yen is undervalued by ~40% on PPP-basis (source: ) Along with hitting a fresh 33-year high, Japan's stock market is now up 120% from its low in 2020. Both technology and health care stocks have been the main drivers. Recently, Warren Buffett began betting on a recovery of Japan's economy. Japan is back in a bull market.

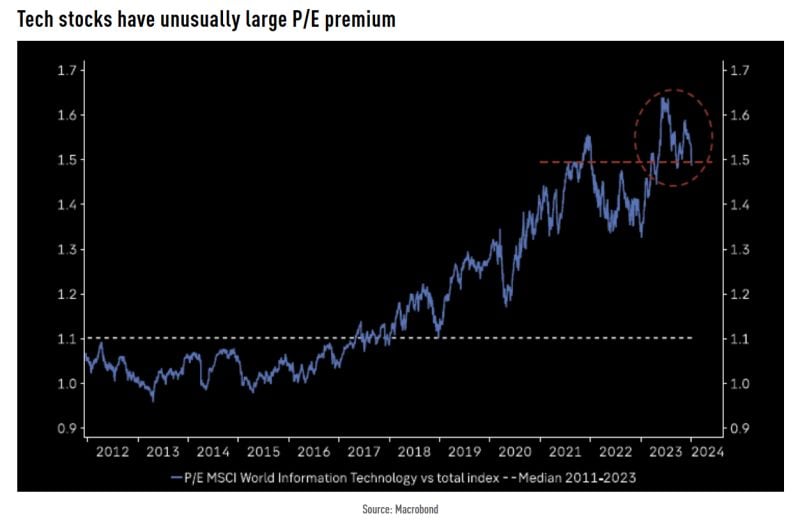

P/E MSCI World IT vs MSCI World

Tech stocks have unusually large P/E premium Source: Macrobond, TME

New Year, New Low!

After a shallow rally, Chinese hashtag#equities just made a new low. Down 15% from their peak in May last year, down 22% from their 2021 peak. Sources: Jeroen Blokland, Bloomberg

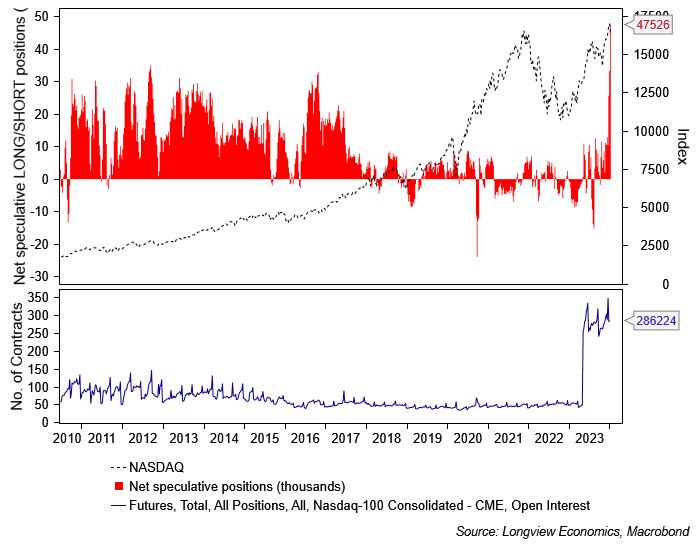

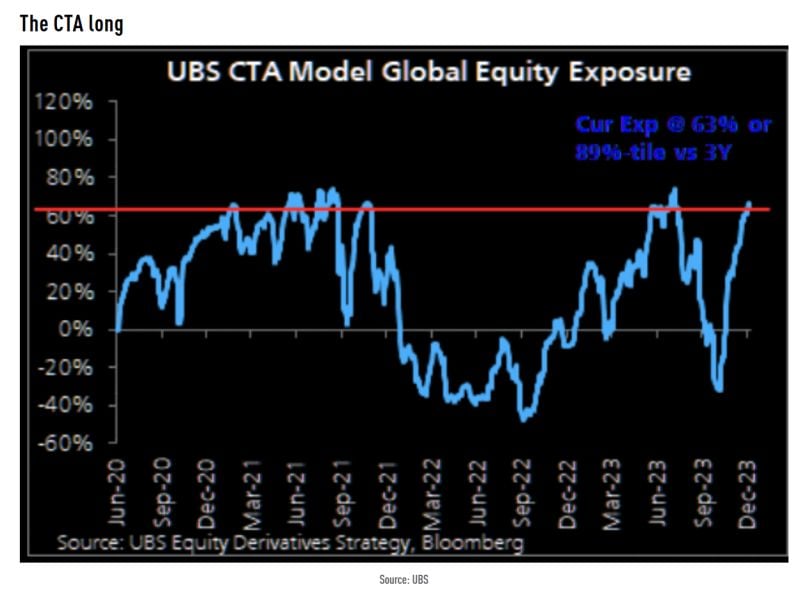

Long positioning by CTAs is extreme and creates some downside risk for the market.

According to UBS: "ES1 (sp500 futures) is already 100% long with first meaningful sell triggers @ -4% to -6%. NQ1 (nasdaq) is 92% long with first meaningful sell triggers @ - 4% to 6%". Source: TME, UBS

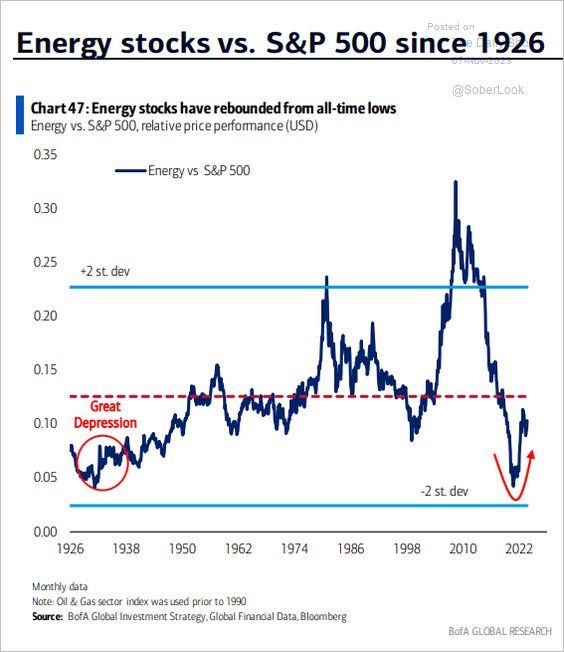

ENERGY STOCKS SINCE 1926 (relative to S&P)

Source: BofA, The Daily Shot

Goldman believes that the 5% EPS forecast for sp500 is too low as a strong economy and falling interest rates should lead to positive surprises

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks