Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Another day, another loss for chinese stocks.

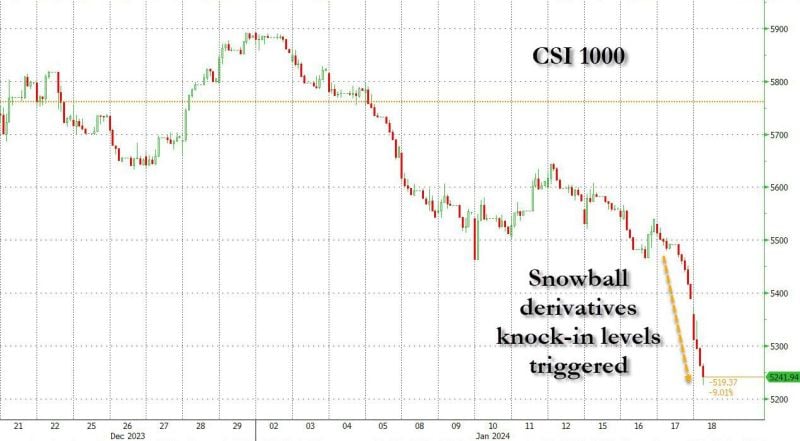

According to Guotai Junan Futures, there are about 30 billion yuan ($4.2 billion) of snowball derivatives products tied to the CSI 1000 Index are near levels that trigger losses at maturity, according to Guotai Junan Futures Co, as the stock rout in China's stock market pushes the derivatives to near knock-in levels. Another 60 billion yuan of the derivatives are 5%-10% away from their knock-in thresholds! Source: www.zerohedge.com

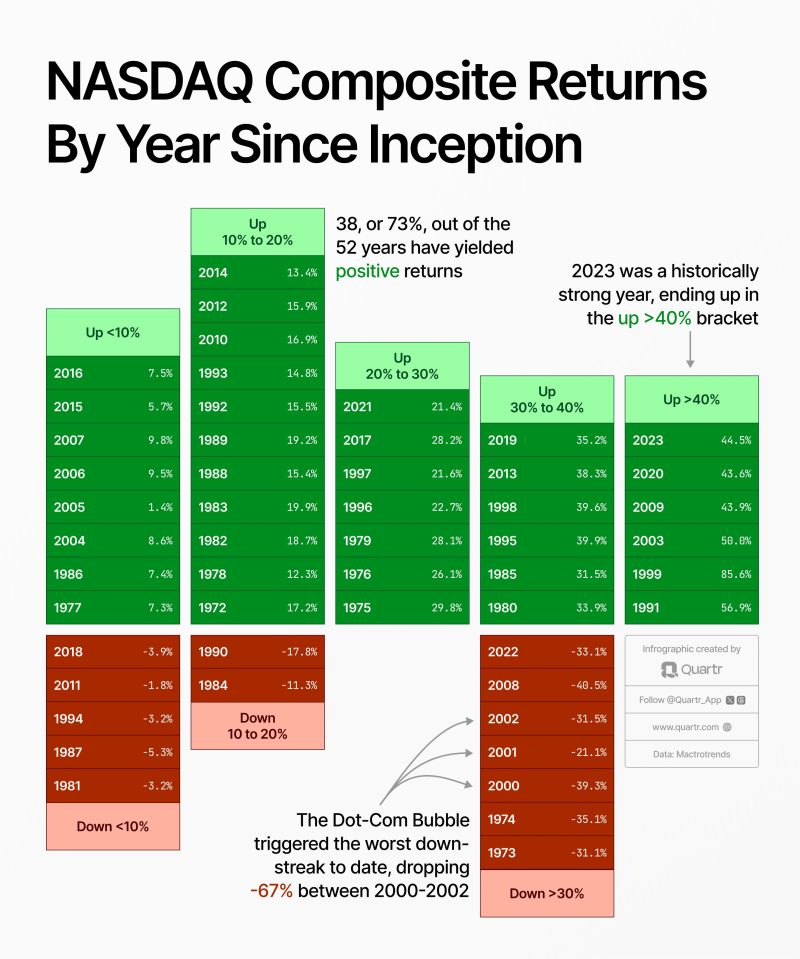

Fortune favors the patient investor. NASDAQ Returns By Year Since Inception

by Quartr

China’s economy spooks markets, and stocks sink.

The CSI 300 has underperformed the S&P 500 by >40ppts over the year. Source: Bloomberg, HolgerZ

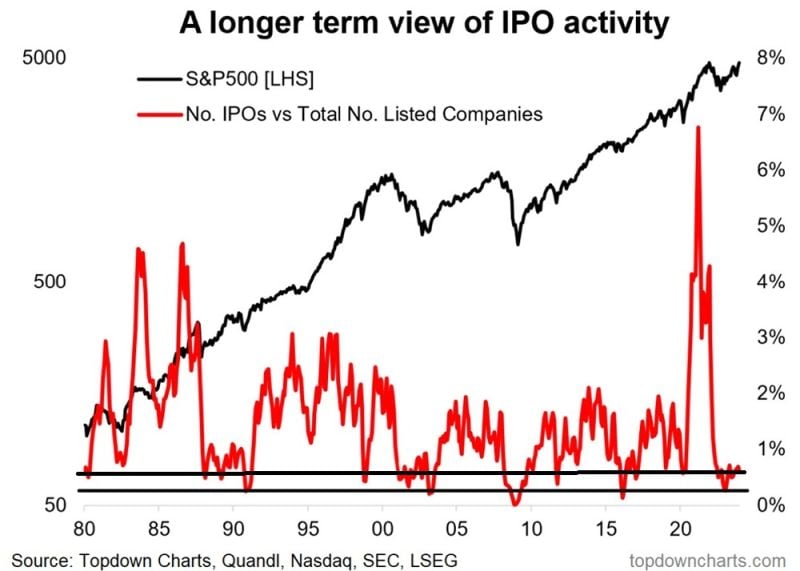

You’d think there would be more IPOs considering how well stocks have been doing the past year+ all around the world...

Supply is clearly not an issue for tech stock market. Basically we have huge supply coming on the G7 bonds side (to finance growing budget deficits) and shrinking supply on the equity side. make your choice... Source: Topdown charts

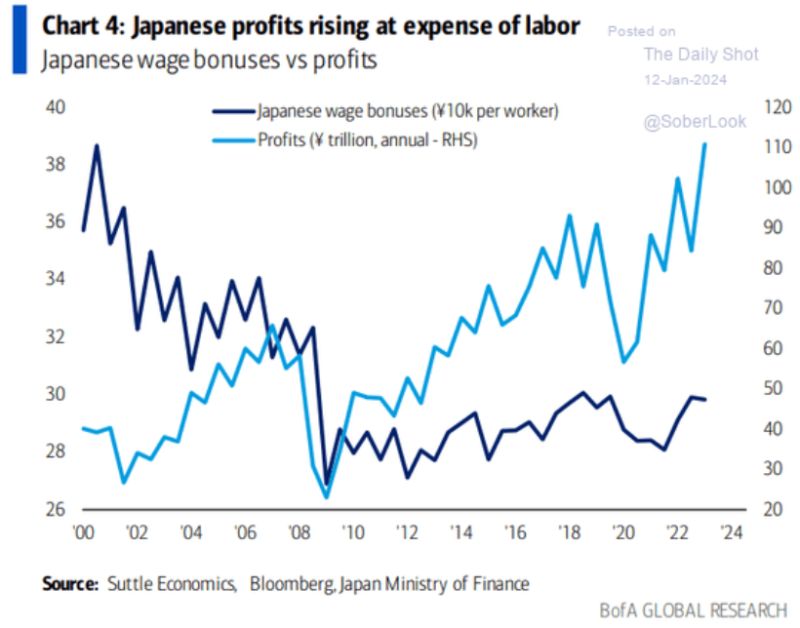

Japanese companies profits are surging

but that's not translating into rising domestic wages, keeping a lid on domestic inflationary pressures, and allowing easy monetary & FX policy to persist. The main winners are japan equity investors. Source: DB, Bob Elliott, The Daily Shot

The valuation gap between the S&P 500 $SPX and the rest of the world continues to widen

Source: FT, Barchart

China stocks cbear market continues unabated

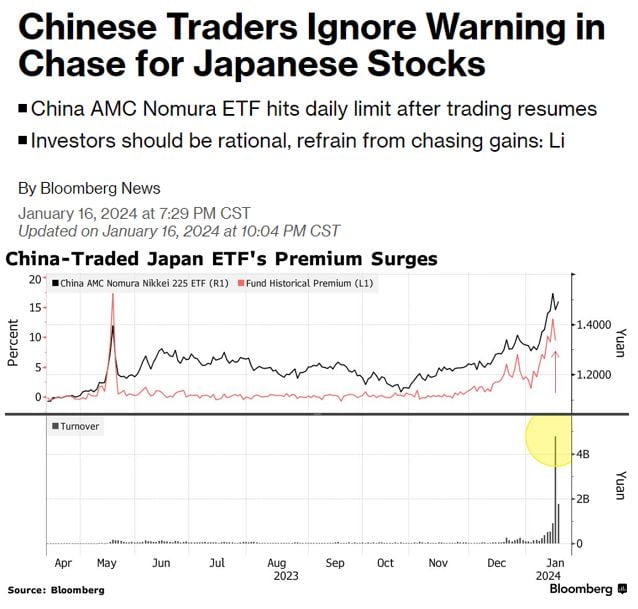

As Hong Kong’s Hang Seng index tumbled 3.06% afterweaker than expected GDP numbers were released, while China’s CSI 300 index shed 0.73%. Meanwhile, AMC Nomura Nikkei 225 ETF went limit up today after Chinese traders ignored warnings to avoid chasing gains in Japanese Stocks. This ETF trades with a 9.5% premium over its net asset value... Source: Bloomberg, Barchart

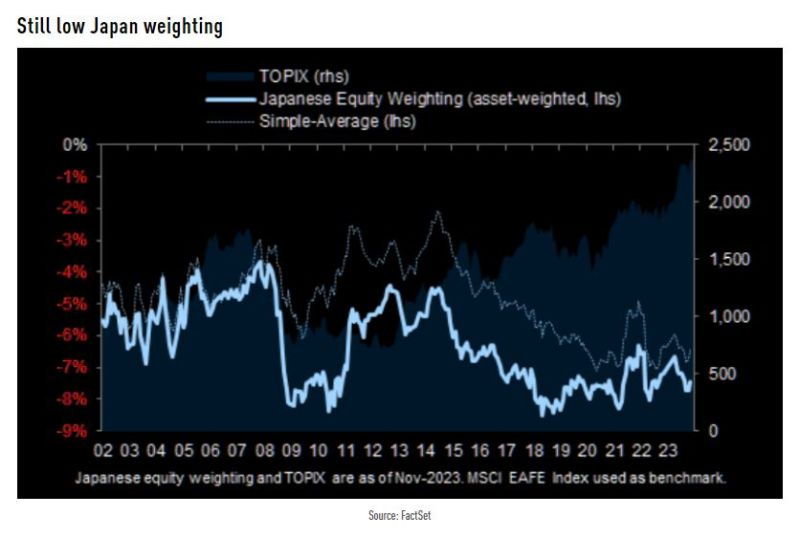

The silent bullmarket...

Global mutual funds' active weighting of Japanese stocks has not risen in the past six months. Source: TME, Factse

Investing with intelligence

Our latest research, commentary and market outlooks