Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

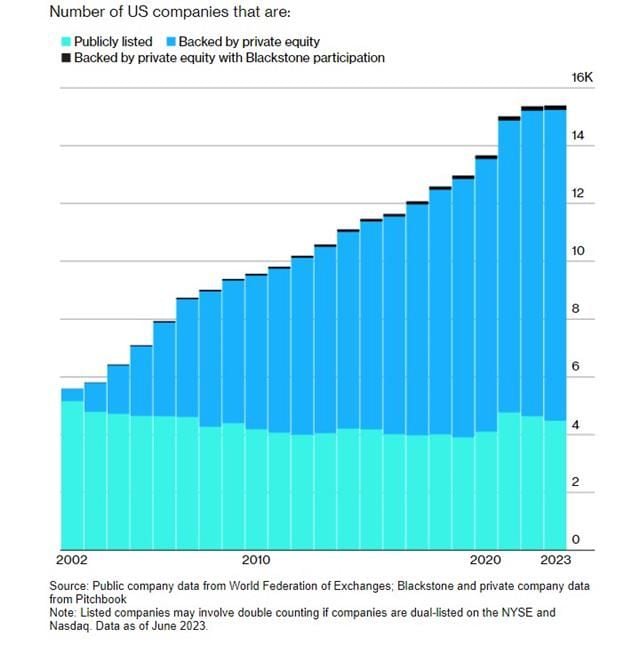

More and more companies are staying private for longer, avoiding IPOs until much later in their growth cycle (if they get there at all).

Source: Markets & Mayhem

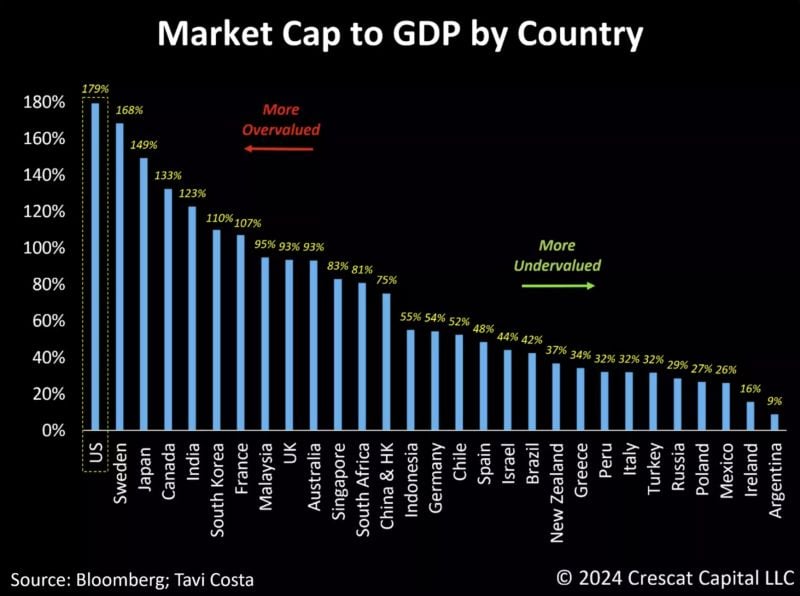

The current macro environment across global equity markets presents a sharply divided investment setup for 2024 and the remainder of the decade.

Source: Tavi Costa

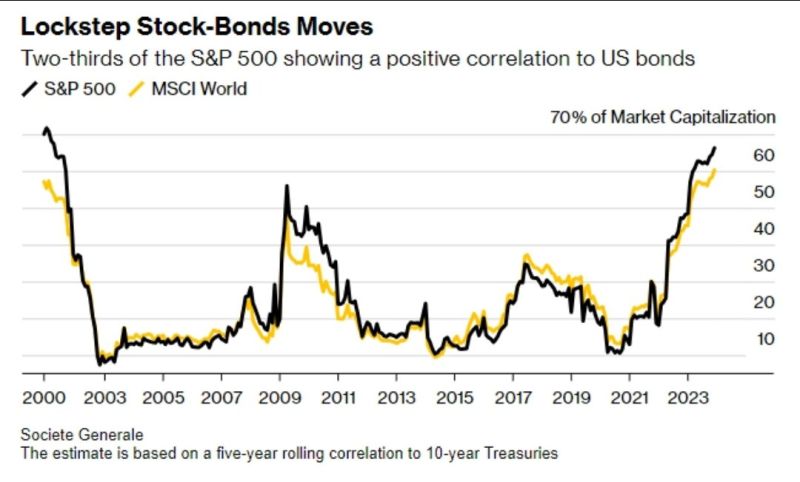

60% of S&P 500 stocks are showing a positive correlation with U.S. Bonds. Most since 2001.

Source: Win Smart, SG, Bloomberg

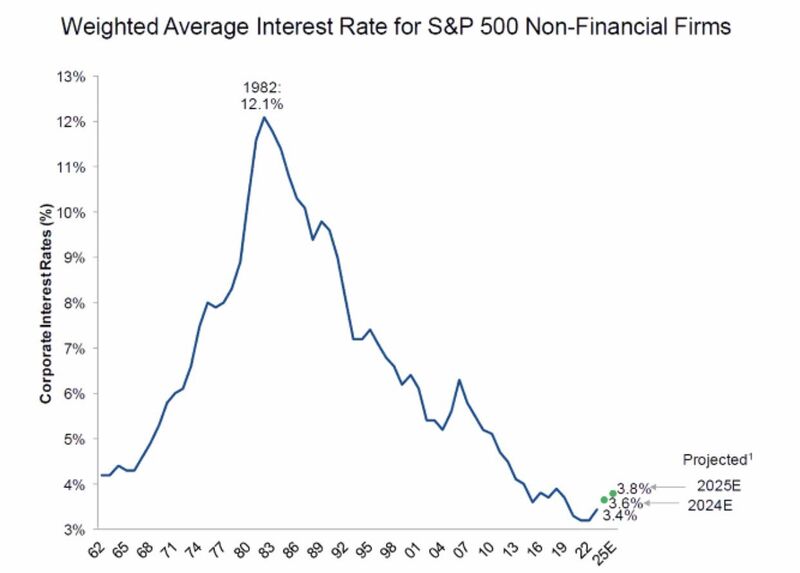

Weighted Average interestrate for sp500 non-financial firms is expected to pick-up in 2024e and 2025e but remains quite low by historical standard.

Source: Michel A.Arouet

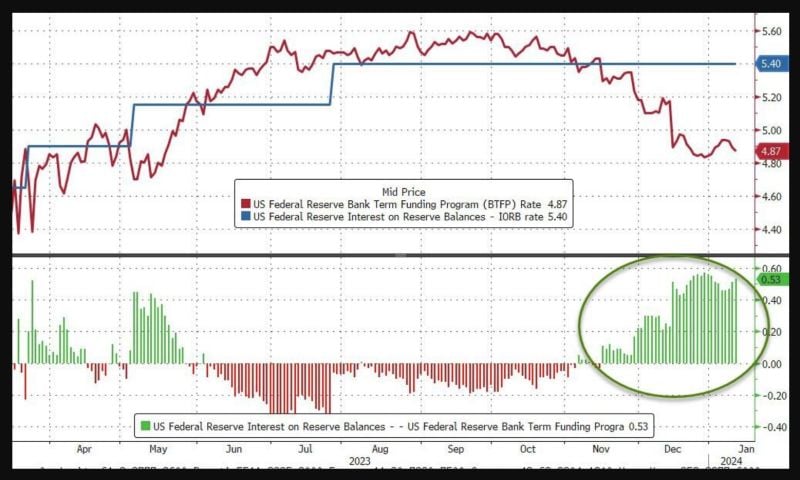

Wondering by us bank stocks are doing well?

Since the introduction of the Bank Term Funding Program (BTFP) in March, there is a nice arbitrage opportunity for banks - watch out on the chart below the gap between the rate on the Federal Reserve’s nascent funding facility and what the central bank pays institutions parking reserves. Since March / SVB crisis, the BTFP-Fed Arb continues to offer 'free-money' to banks - and usage of the BTFP has risen by $38BN since the arb started to exist. Source: Bloomberg. www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks