Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

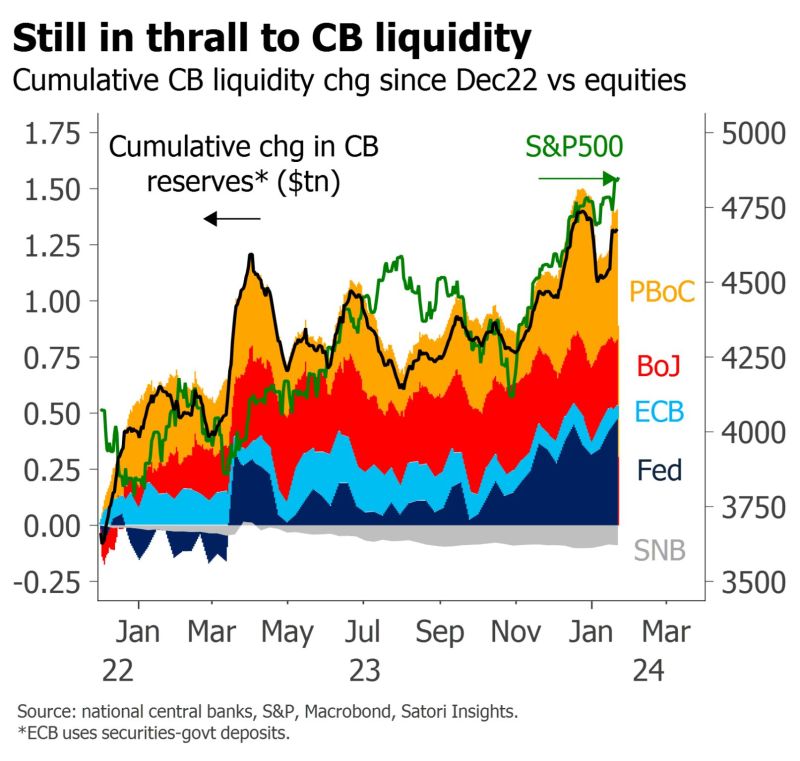

The key role played by central banks liquidity, as highlighted by Matt King

Many seem surprised by the new record highs in the S&P, given an ambiguous outlook and a backdrop of supposedly tight rates. They are a lot less surprising when you consider that central banks' balance sheet policy has been remarkably easy. Over the past 14 months, the Fed alone has added nearly $500bn, and global central banks over $1.25tn, in liquidity. Source: BofA

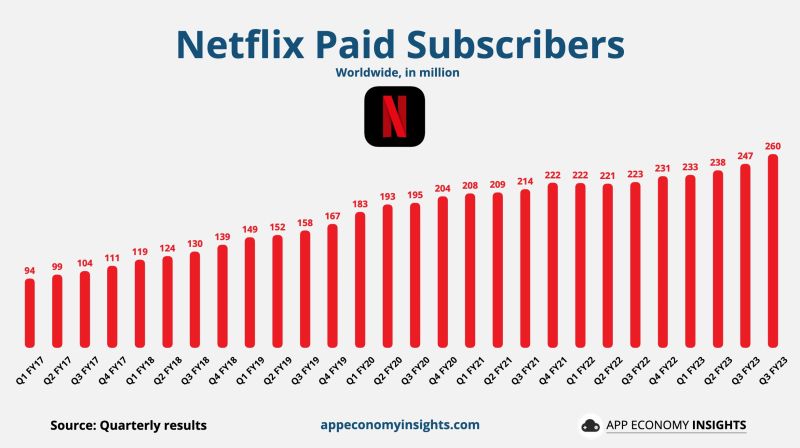

Netflix adds 13.1 million subscribers, tops revenue estimates as membership push gains steam

KEY POINTS -> Netflix added 13.1 million subscribers during the fourth quarter. The company now has 260.8 million paid subscribers. • Subscribers +13M Q/Q to 260M. -> The company also topped Wall Street’s revenue expectations. • Revenue +12.5% Y/Y to $8.8B ($0.1B beat). • Operating margin 17% (+10pp Y/Y). • EPS $2.11 ($0.11 miss). -> Q1 FY24 Guidance: • Revenue +13% Y/Y. • Operating margin 26%. Source: App Economy Insights, CNBC

Tesla is reporting results tonight?

Who wants to play $TSLA earnings call bingo? 😂 Source: Markets & Mayhem

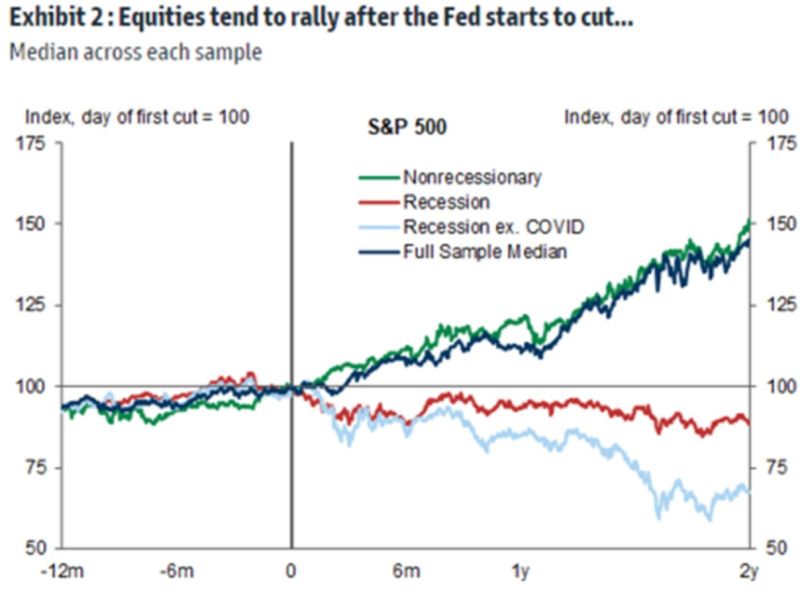

If we do not have a recession, stocks tend to rally after the Fed cuts

If we do, however, they tend to decline They say the economy isn't the market, but in this example it could have a measurable impact on the outcome Source: Markets & Mayhem

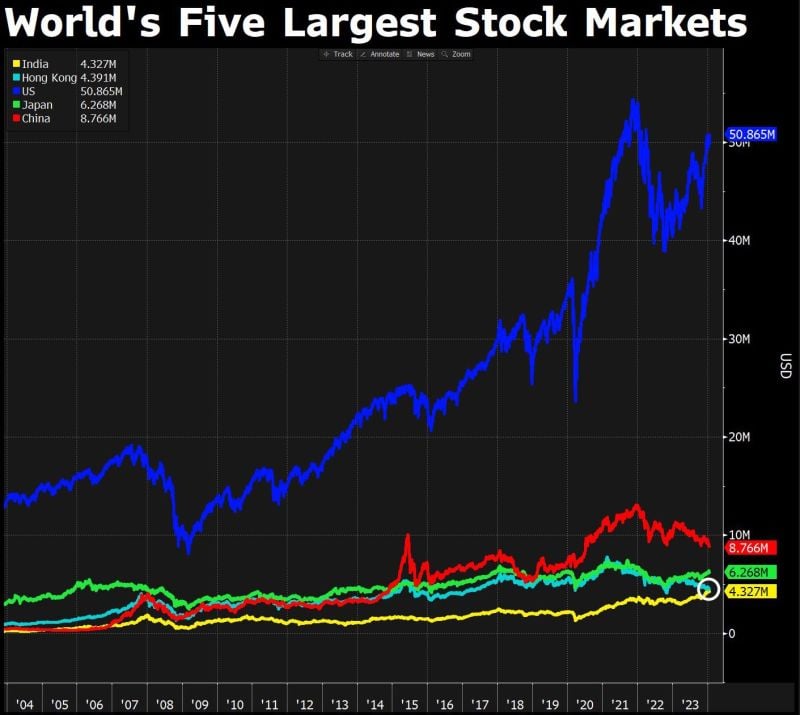

India’s stock market has overtaken Hong Kong’s for the 1st time in another feat for the South Asian nation whose growth prospects & policy reforms have made it an investor darling

Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks