Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

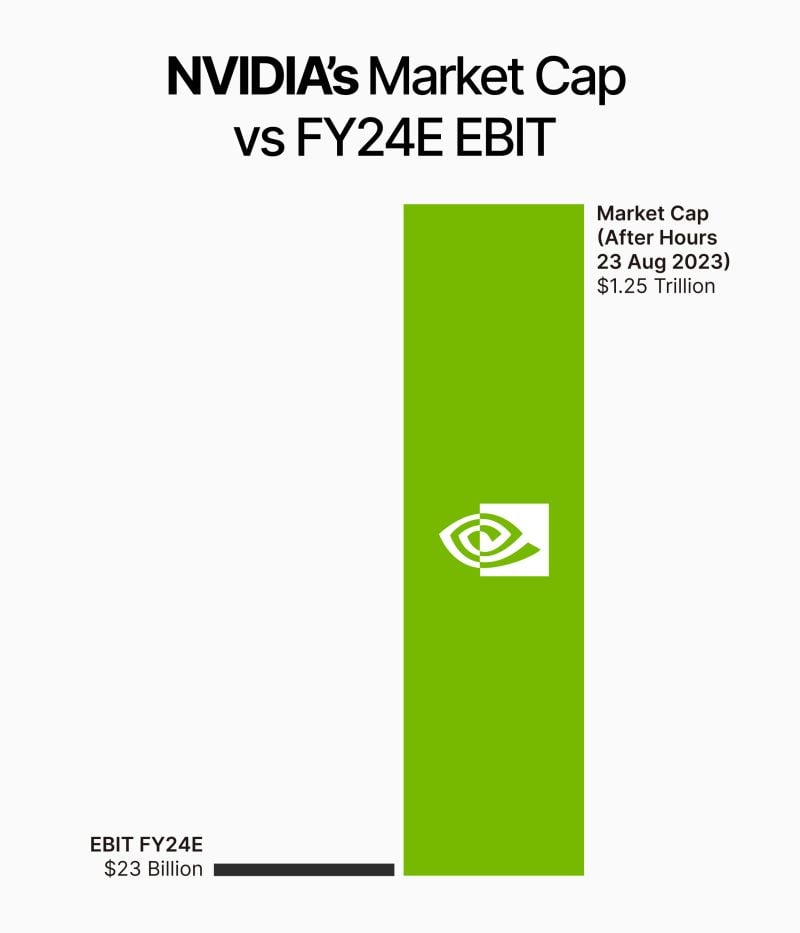

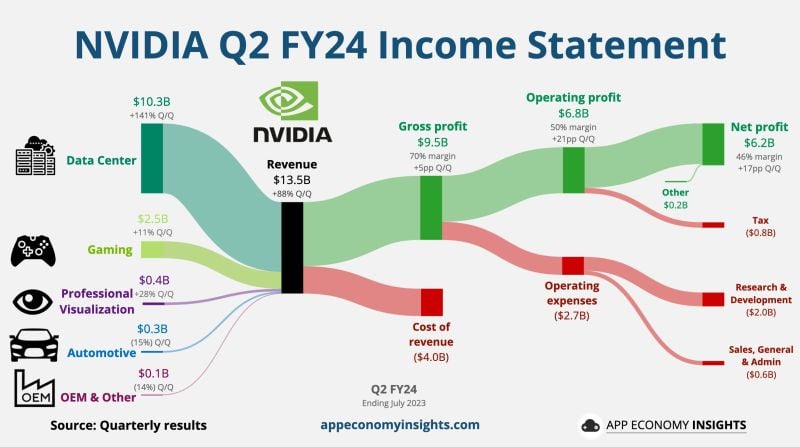

$NVDA NVIDIA Q2 FY24 in one chart by App Economy Insight

Nvidia shares climbed 8% in extended trading on Wednesday after the chipmaker beat estimates for the second quarter and issued optimistic guidance for the current period. Nvidia said it expects third-quarter revenue of about $16 billion, higher than $12.61 billion forecast by Refinitiv. Nvidia’s guidance suggests sales will grow 170% on an annual basis in the current quarter. Source: CNBC, App Economy Insight

The Nvidia share shows very well that analysts usually lag behind the share price with their price targets

Source: HolgerZ, Bloomberg

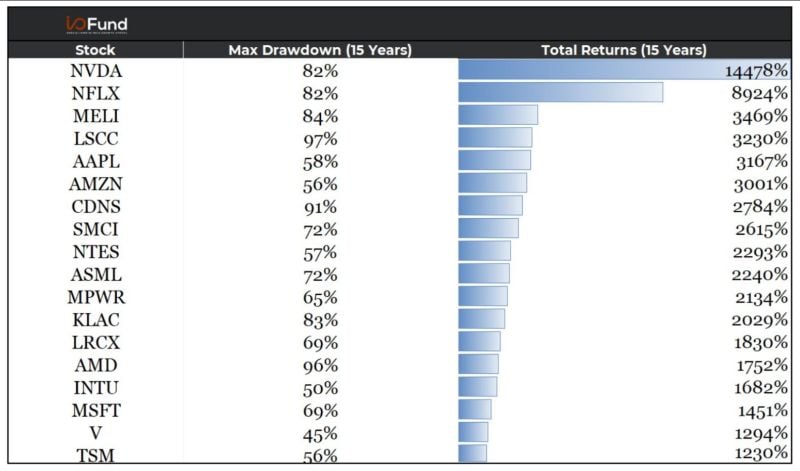

Investing requires patience. Over the past 15 years, investors in these stocks navigated significant drawdowns before reaping substantial gains

The same principle might apply to bitcoin and some cryptocurrencies as well. Source: ycharts, Beth Kindig

Eli Lilly stock hit a new record high yesterday as the company continues to record a surge in sales for its buzzy diabetes drug Mounjaro

Sales of Mounjaro, which has also gained popularity for weight loss, came in at $979.7 million for the second quarter, up from $16 million a year earlier when it was introduced (2Q results were publichsed 2 weeks ago). That helped the drug company post higher-than-expected sales for the second quarter. Novo Nordisk is also surfing on the strong demand for a similar weight loss blockbuster

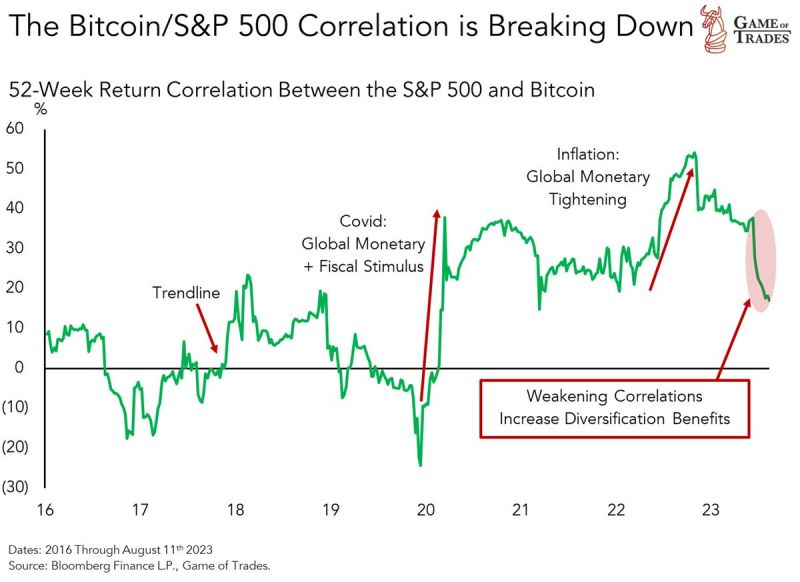

Bitcoin's correlation to the sp500 has shown signs of breaking down Lower correlation boosts BTC's diversification potential

Source: Game of trades

Bespokeinvest posted: "Here's one way to think about investing in equities and "buy and hold."

Casinos make money by making sure bettors eventually lose more often than they win. The stock market is the opposite. The longer you play, the better your odds. Historically, the odds of the S&P 500 being up over any one-month time frame have been 62.6%. Over a year, the odds of being up jump to 74.6%, and over eight years, they jump to 97%. Since 1928, all 16+ year time frames have seen positive returns. Check out this chart Bespokeinvest created to help people visualize this data a couple of years ago (updated through July 2023):

Investing with intelligence

Our latest research, commentary and market outlooks