Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

S&P 500 to 10-year note ratio is going parabolic

Source: barchart, The Daily Shot

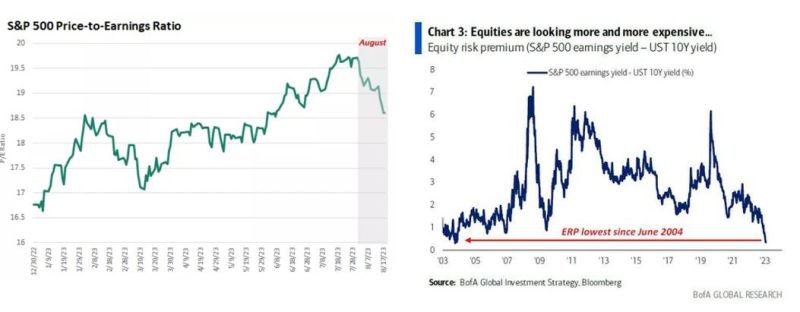

US equities: absolute & relative valuations offer a different perspective

•On the positive side, market (absolute) valuations have improved as stock prices have dipped and earnings have held up •On the negative side, the rise in bond yields imply a lower Equity Risk Premium (ERP), now at 39bps (19-year low), i.e equities are more expensive vs. bonds than at the start of the Summer... Source: Edward Jones, BofA

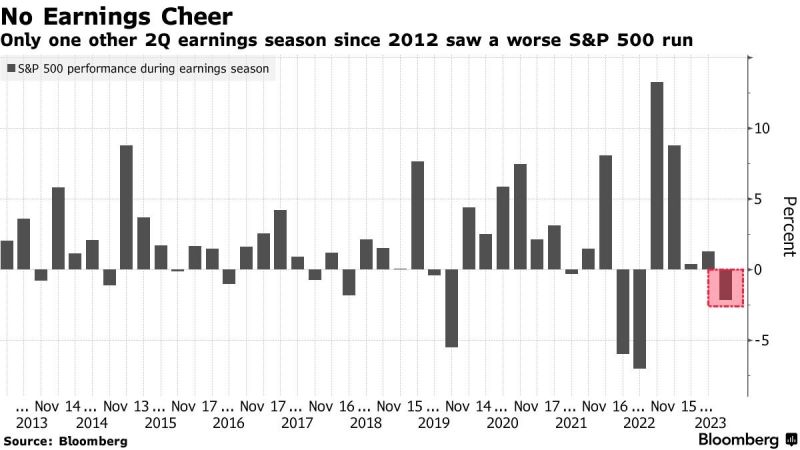

More than 80% of SP500 companies that have reported so far have beaten profit expectations but the returns are setting this up to be one of the worst earnings seasons over the last 11 years

Source: Bloomberg

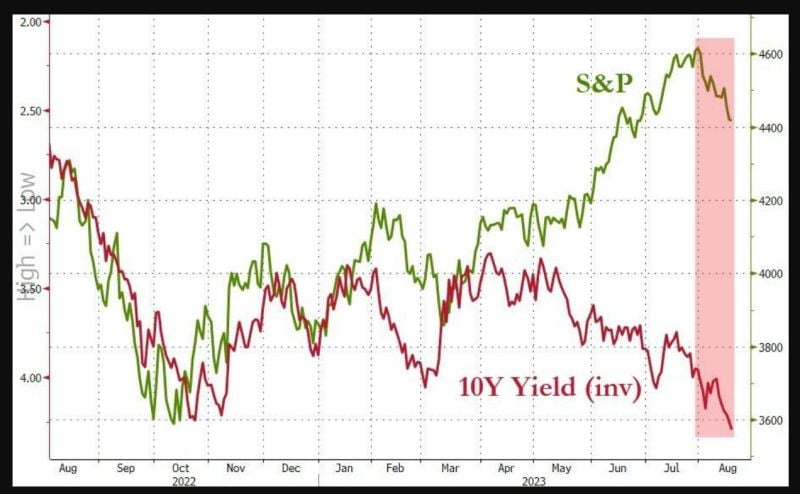

Bonds and stocks are tanking together... Are Chinese banks selling US Treasuries to 'fund' their yuan intervention?

Source: Bloomberg, www.zerohedge.com

There is bearish divergence spotted between the market (SP500) and % of stocks above their 200-day MA

The last occurrence led to significant downside for equities. Source: Game of Trades

China asks some Funds to avoid net equity sales as Markets sink

Chinese authorities asked some investment funds this week to avoid being net sellers of equities, as a rout in the nation’s financial markets deepened. Stock exchanges issued the so-called window guidance to several large mutual fund houses, telling them to refrain for a day from selling more onshore shares.

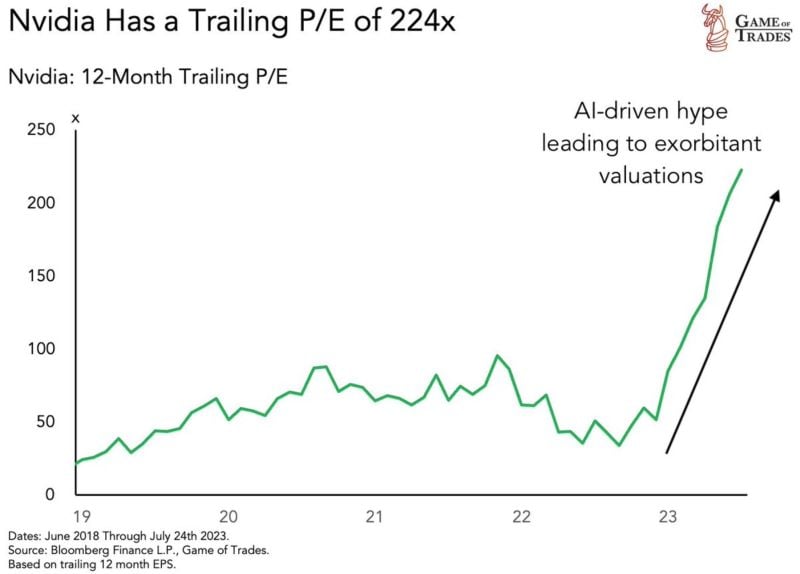

The AI-hype has driven some stocks valuations to extreme levels

The most emblematic one among large-caps is Nvidia with a P/E ratio which went from under 50x to 224x in just 8 months. Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks