Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

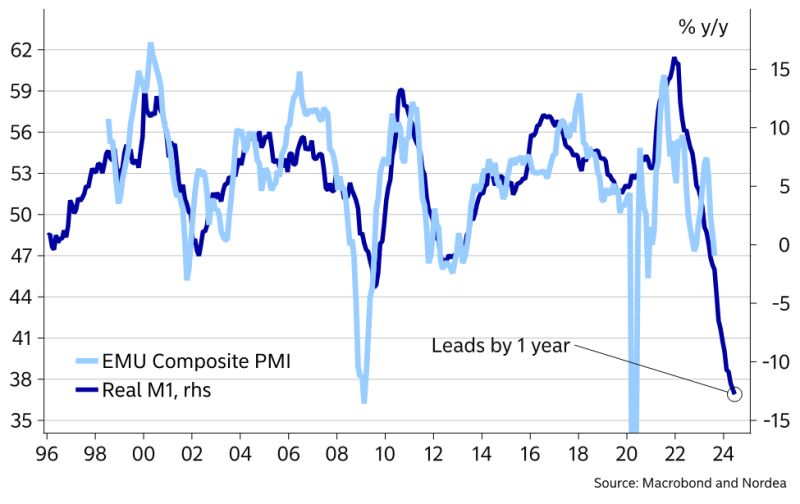

EU Composite PMI... monetary policy works with a long and variable lag...

Source: Macrobond, Nordea

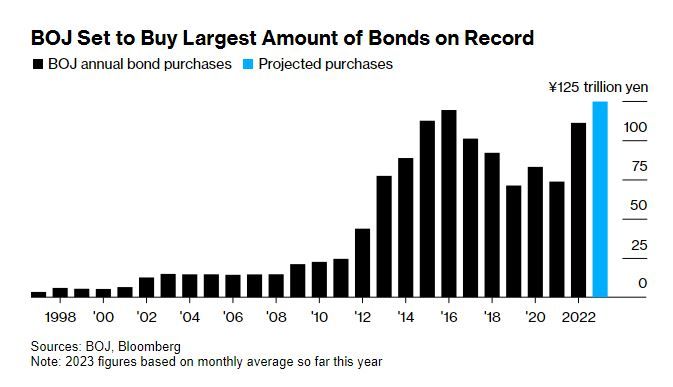

The Bank of Japan is purchasing government bonds at a record pace this year

A factor that likely prompted its recent move to allow larger yield movements to reduce the strain on its control of longer-term #interestrates. Source: Bloomberg

Disinflationary forces are intensifying in Germany

Producer Prices drop for 1st time since 2020, a good leading indicator for Consumer Prices. In July, producer prices (PPI) fell by 6.0% YoY, the biggest decline since October 2009, when the financial crisis has caused prices to collapse. Last year, the prices received by manufacturers for their goods had at times risen at a record rate of 45.8%. Source: HolgerZ, Bloomberg

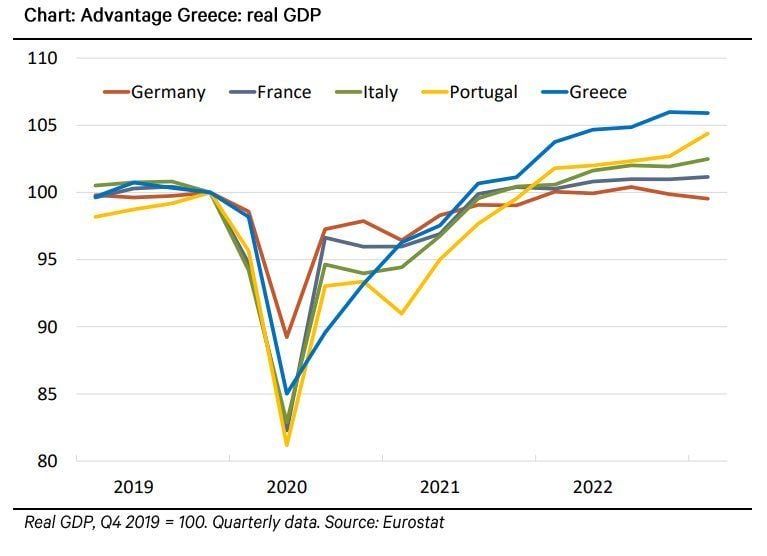

Advantage greece... A decade ago, Germany was giving lessons to Greece how to run its economy. Things can quickly change.

Source: Michael A.Arouet

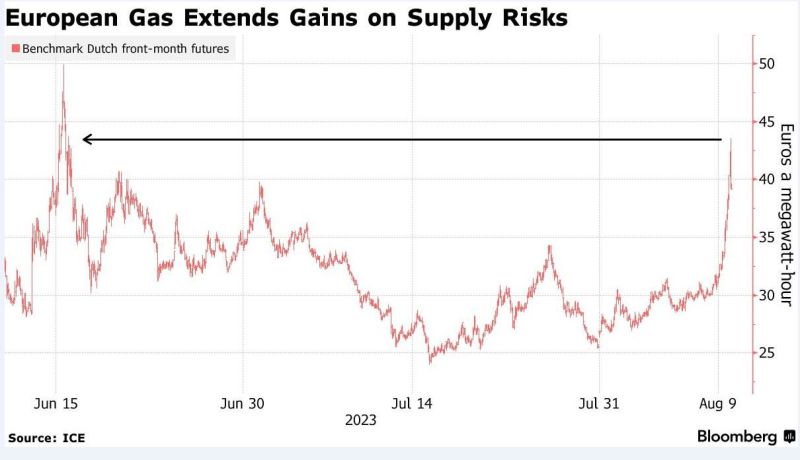

In a stunning move, reminiscent of the first few months of Putin's invasion of Ukraine, European NatGas prices exploded a stunning 40% higher YESTERDAY ALONE

This comes as the possibility of worker strikes at some LNG plants in Australia threatens global supply..... This is the biggest daily increase since March 2022. Citigroup estimates EU natural gas prices could double. Meanwhile, oil hit 9 months high and coal is rising as well. The surge of energy prices will make the job of central-bankers more difficult. Source: The Kobeissi Letter, ICE, Bloomberg

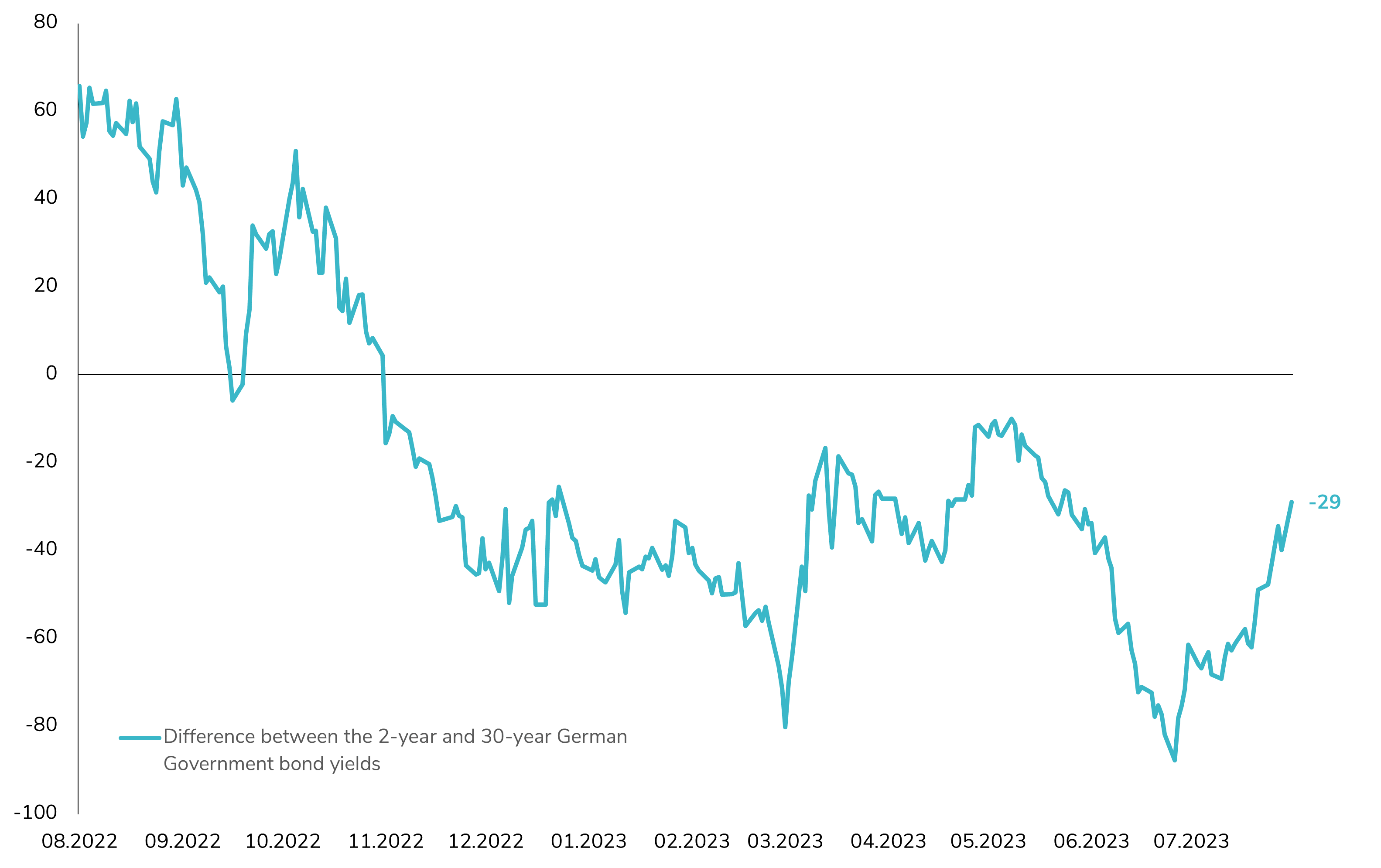

Why is the German Yield Curve Sharply Steepening?

The German yield curve has experienced an impressive steepening of almost 60bps in just one month! This significant movement can be attributed to several key factors that are driving the shift: Fundamentals and Economic Outlook: One of the primary drivers behind this steepening is the market's reassessment of the potential avoidance of a recession. There's a positive repricing of economic fundamentals, suggesting improved prospects for growth and stability. Additionally, there's growing concern about structural inflation running higher than initially expected. Notably, the German 5-year breakeven rate has surged to 2.63%, reaching its highest level since 2009, which has translated into higher long-term yields. Front-End Yield Curve Repricing: The recent decisions made by the European Central Bank (ECB) have also played a role in the steepening. Firstly, the ECB chose to no longer remunerate the bank's minimum reserve held at the central bank. Additionally, today's surprise decision by the Bundesbank's Executive Board further impacted the market. The decision was to remunerate domestic government deposits held with the Bundesbank at 0%, starting from 1 October 2023. Both of these developments could potentially increase demand for German short-term papers. Source: Bloomberg.

Investing with intelligence

Our latest research, commentary and market outlooks