Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

German exports to Kyrgyzstan are up 2000% in the past 3 years

Value of these exports is small, but this is just one of many examples showing how hard it is to police export controls on western goods to Russia. Source: Robin Brooks

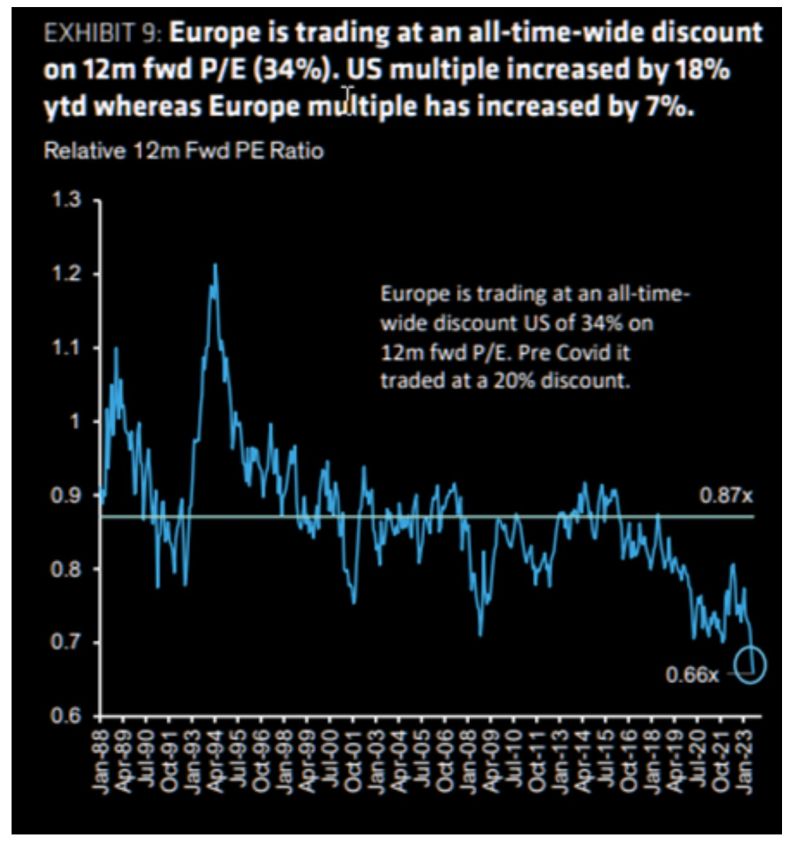

The gap in valuation discount between US and European equities has never been wider

Source: TME, Sanford Bernstein

Hungary still has an inflation rate of >20%, highest inflation rate in entire EU.

Inflation is driven by food prices (Food CPI +29% YoY) as Hungary has been hit by a drought and this has caused prices to rise. In addition, there is a shortage on the labor market, low labor productivity & very expansionary macroeconomic policies. Source: Bloomberg, HolgerZ

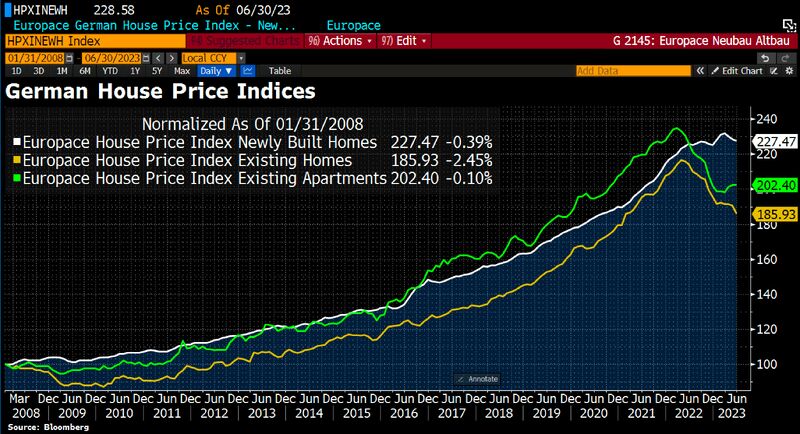

The housing bubble continues to lose more air in Germany

The housing bubble continues to lose more air in Germany. In June, real estate prices slumped sharply, w/existing homes in particular falling by 2.4% MoM. Even new buildings became somewhat cheaper, namely 0.4%. Source: Bloomberg, HolgerZ

Disinflation is on the way in Germany

Disinflation is on the way in Germany. Wholesale prices dropped 2.9% YoY in June, an acceleration from the 2.6% decline from May & the biggest annual decrease since June 2020. Lower wholesale prices could translate to falling #inflation in Germany. Source: HolgerZ, Bloomberg

German ZEW survey highlights concerns over shaky recovery.

ZEW investor expectations fell to -14.7 in Jul (estimate -10.6) from -8.5 in June a bad omen for econ growth. Source: Bloomberg, HolgerZ

Germany is being hit by a heat wave and another drought.

Economically important waterway Rhine has lower & lower water levels. The depth of the Rhine at the gauge tower at Kaub has sunk to 1.06. Source: HolgerZ, Bloomberg

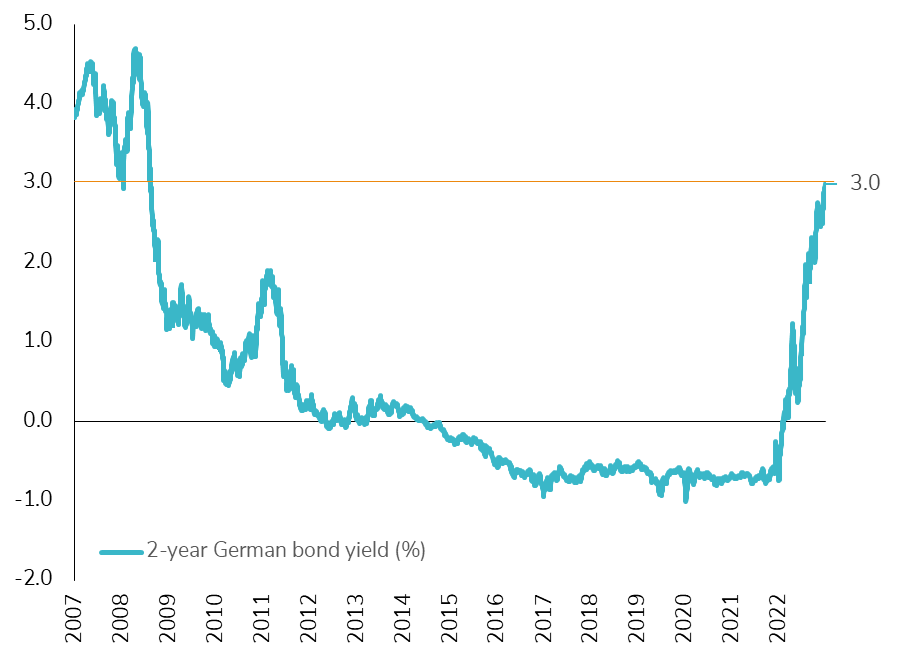

The yield on German 2-year bonds reached 3% for the first time since 2008!

While yesterday the Eurozone core CPI reached a new record of 5.3%, the German 2-year bond yield reached 3% for the first time since 2008! The ECB still has a lot of work (more than currently expected?) to do in tightening monetary policy to curb inflation, especially considering the minor impact (for now) of the Fed's monetary policy tightening on US inflation and the economy. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks