Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

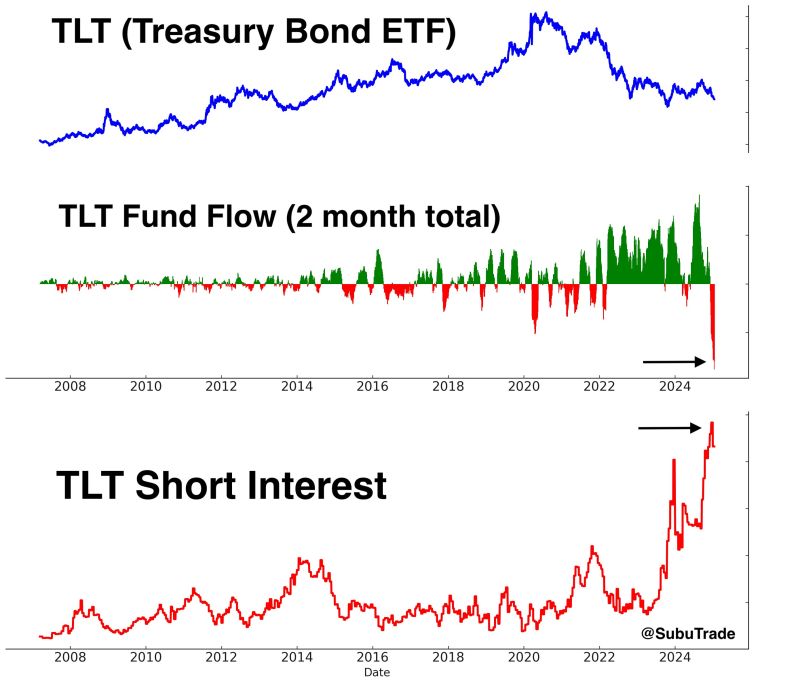

Will we see a short-covering rally in bonds?

In case you missed it: - $TLT short interest is near RECORD highs, while... - TLT has seen massive outflows Bond market shorts are about to get squeezed. A rally in bonds could be bullish for stocks. Source: Subu Trade

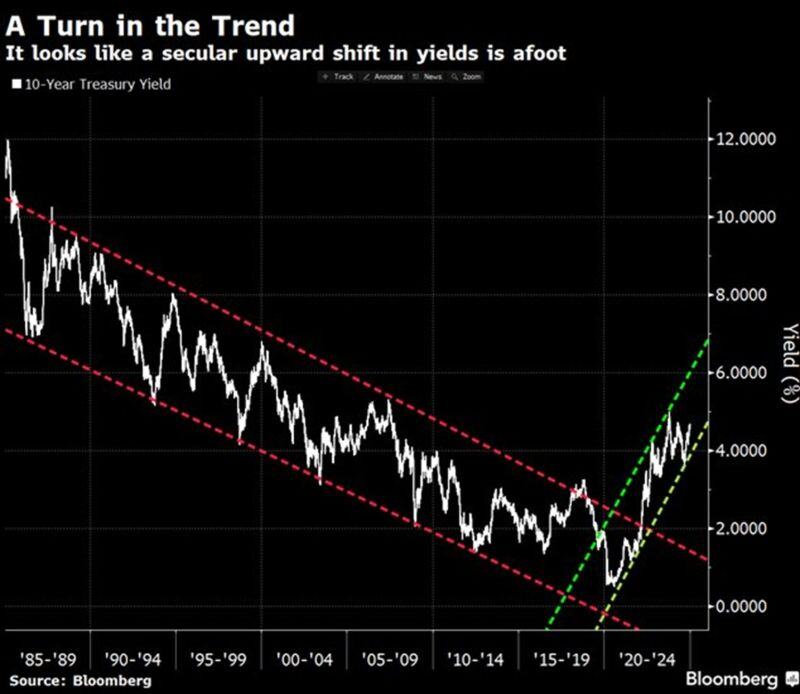

Real yields on 30-year US treasury bonds are now at 2008 levels.

It seems that bond markets are worried about much more than just inflation... Source: Adam Kobeissi, Bloomberg

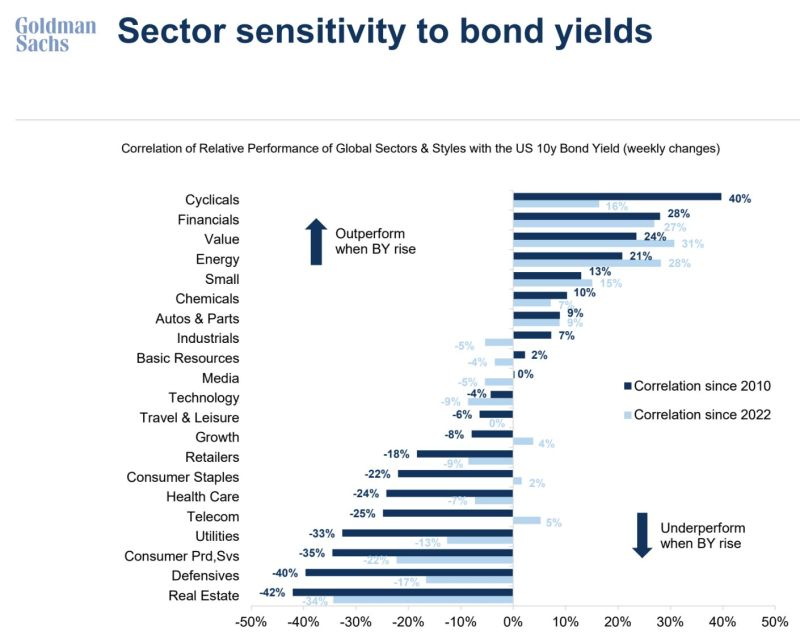

A good chart from GS that shows how sectors & factors may react to change in 10Y bond yields.

Source: Ayesha Tariq, CFA, Goldman Sachs

"....the selloff in US bonds is driving yields higher everywhere, including in economies where the growth outlook hasn’t improved.

Of course, this second point isn't hard to explain. US Treasuries act a generic riskfree asset for the global financial system. When US yields move higher, it creates pressure on bonds everywhere." - TS Lombard, Perkins thru The Market Ear

A turn in the trend? US 10-year Treasury yield has risen ~440 basis points over the last 5 years to 4.76%.

If this trend continues that will materially shift the investing landscape with many investors being caught off guard. Source. Bloomberg, Global Markets Investor

This chart is $IEI iShares 3-7 years Treasury Bond ETF / $HYG iShares iBoxx $ High Yield Corporate Bond ETF

Clearly not indicating any major credit risk! Maybe the market isn’t pricing in a credit crisis because there isn’t one to price in... Source: @cfromhertz on X

The $TLT chart shows a significant 52% decline from its peak, highlighting the harsh effects of increasing rates.

Investing in long-duration US Treasuries is advisable only under specific circumstances: - When a recession is on the horizon. - When inflation is quickly slowing down. Currently, neither of these scenarios is unfolding. Source: Kurt S. Altrichter, CRPS® on X

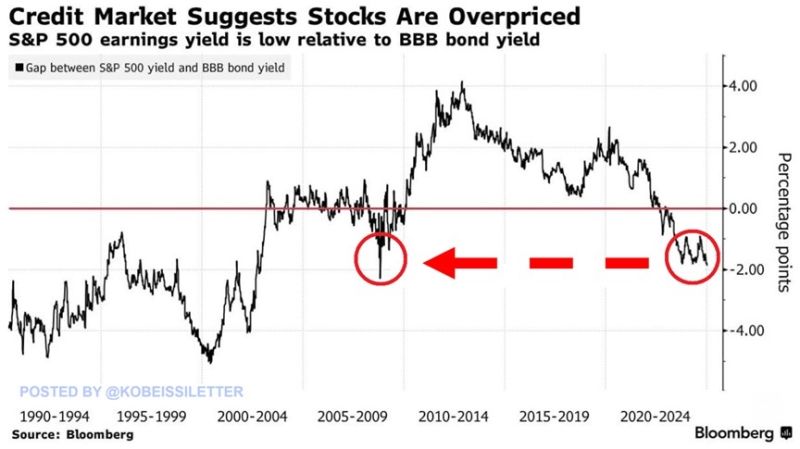

BREAKING: The difference between the S&P 500’s earnings yield and BBB-rated corporate bond yield has dropped to -1.9%, the lowest in 15 years.

Excluding a brief period in 2009, this is the lowest level in 23 years. The gap has fallen by 4 percentage points over the last 5 years as US interest rates have risen sharply. In other words, less risky investment-grade corporate bonds now pay a higher yield than S&P 500 companies' profits relative to their stock prices. This metric suggests the market may be overvalued. Can this gap continue to widen? Source: Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks