Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

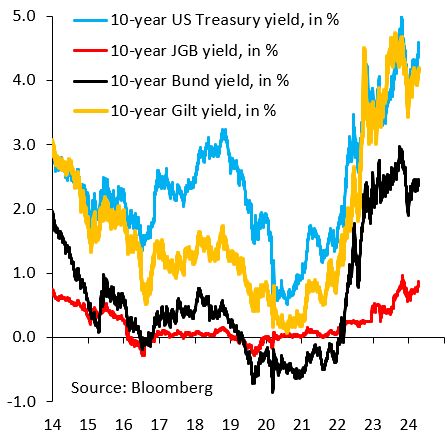

The 10-year US Treasury yield (blue) is marching back towards its high last October.

Recall that - at the time - US Treasury announced that it would issue less longer-term paper, which is what stopped that rise. That card has now been played and yields are rising again... Source: Robin Brooks

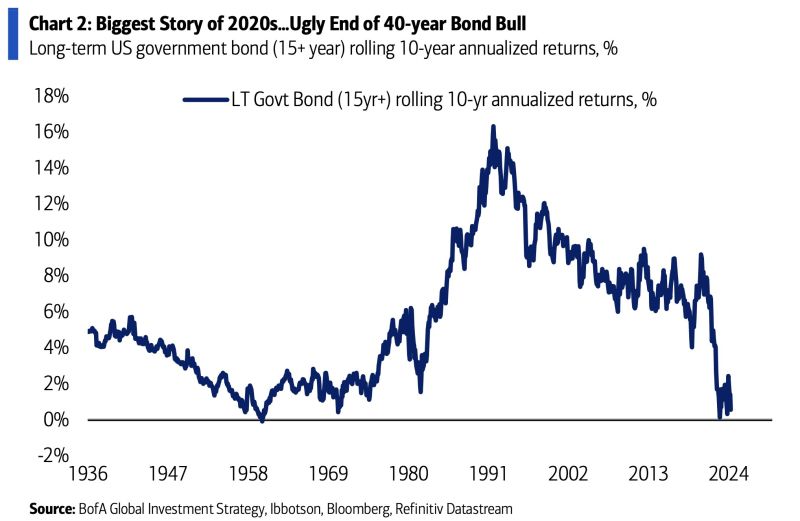

The 10y annualized return of US Treasuries has dropped to a 65-year low of 0.6%.

The 2020s era of war, protectionism, fiscal excess, scarce energy/housing/labor killed the 4 decades-long bond bull market. Source: BofA; HolgerZ

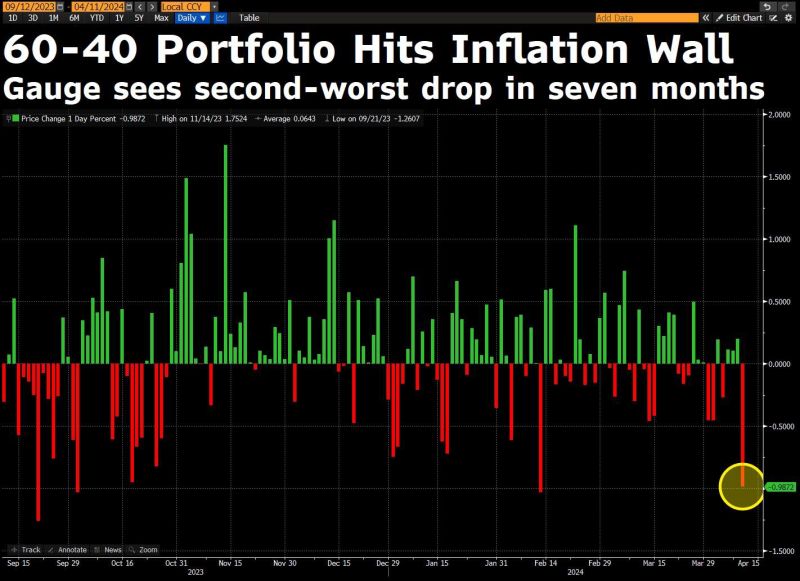

Yesterday was very painful for diversified 60-40 (equities / bonds) portfolios

Source: Bloomberg

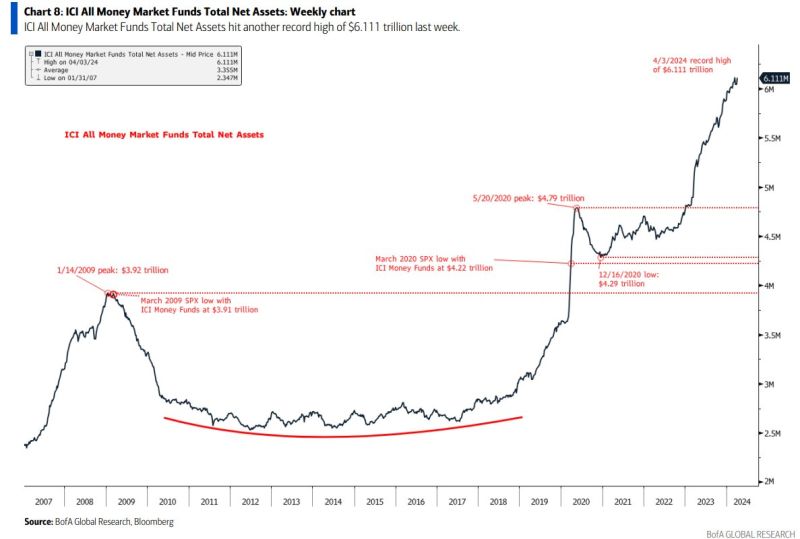

Money market fund levels to record high of $6.111 trillion

Source: WinfieldSmart

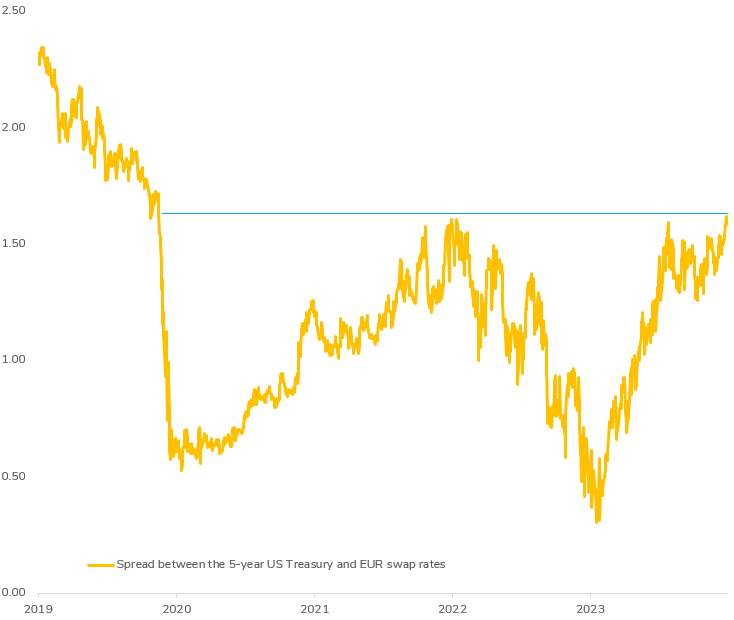

A Pivotal Moment Between the ECB and the Fed?

This week unfolds as a critical juncture for the interest rate disparity between the US and Europe. As the spread between the 5-year US Treasury and EUR swap yields hits its highest level since the pandemic, the upcoming release of US CPI data and the ECB meeting carry the potential to reshape this landscape once again. All eyes are on ECB President Lagarde as she navigates the challenge of maintaining ECB independence from the Fed, especially amidst differing inflation dynamics across the Atlantic. The implications for currency exchange rates, interest rates, and monetary policy are captivating areas to watch closely in the coming days.

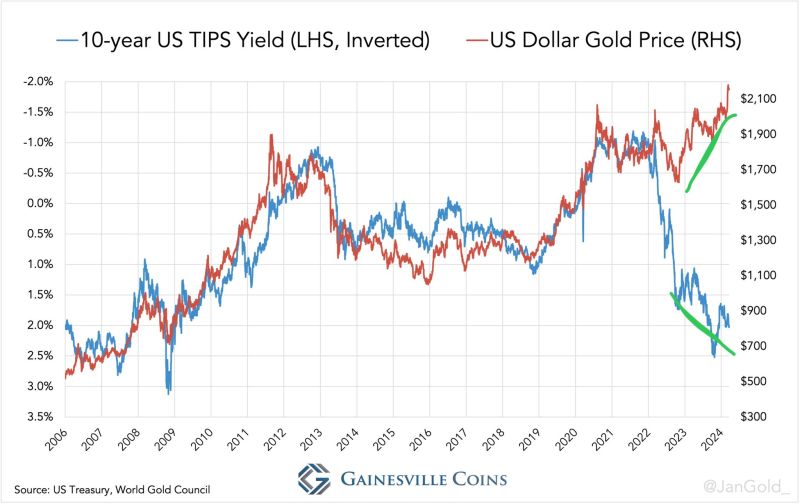

Gold is going up together with real yields (inverted axis in the chart).

Who would have thought?!! Source: Jan Nieuwenhuijs

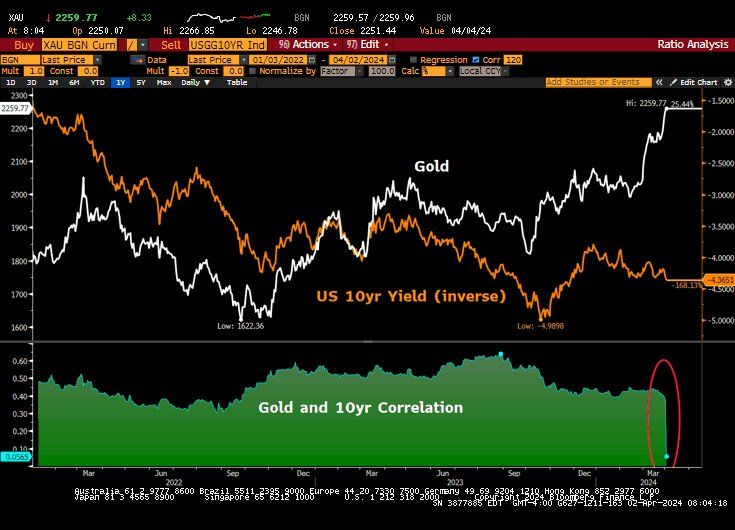

Bond yields up and gold up?

This looks like a classic 1970s action, with the inverse relationship between gold and 10-year Treasury yields starting to decouple. Gold is at all-time highs in the face of bond market weakness. This, coupled with the rise in commodity prices (especially oil / gasoline), could mean troubles for the Fed and the banks. Source: Bloomberg, Lawrence McDonald

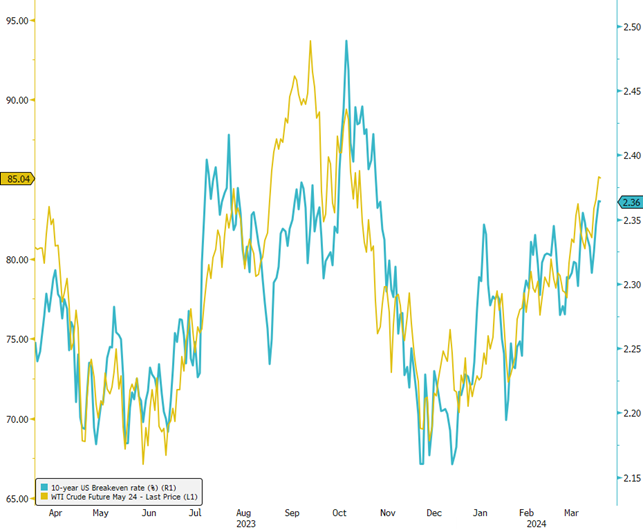

Impact of Higher Oil Prices on US Breakeven Rates 🛢️

📈 In recent months, the surge in oil prices has played a pivotal role in the noticeable increase in US Long Term breakeven rates, with a significant rise of 20 bps since the end of December. This trend underscores the nuanced dynamics that influence US Treasury nominal rates, which are comprised of the sum of real yields and inflation expectations (as captured by breakeven rates), alongside the impact of the term premium on longer maturities. Traditionally, long-term US breakeven rates have closely mirrored the Federal Reserve's inflation target of 2%, maintaining a 25-year average of 2.05%. This long-term alignment has served as a benchmark for inflation expectations and a guide for monetary policy. However, the aftermath of the pandemic has ushered in an era of elevated breakeven rates, with the 10-year US Breakeven rate averaging 2.33% since September 2020. This elevation signals market anticipations of persistently higher inflation over the next decade, influenced by factors such as deglobalization trends, sustained supply chain challenges, and increased commodity prices, notably oil. The correlation between rising oil prices and the uptick in US Long Term breakeven rates is stark, highlighting how energy costs can act as a bellwether for inflation expectations. The accompanying chart illustrates this relationship, with oil prices' sharp rebound since December propelling breakeven rates upwards, suggesting a potential for continued increases. This resurgence in oil prices coincides with a broader recovery in global economic activity, posing significant considerations for the Federal Reserve's approach to monetary policy. The crucial question now is whether the Fed will adjust its easing policy plan in response to these inflationary signals. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks