Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A Significant Decrease in High-Yield Bonds' Maturation Life: An Impending Threat?

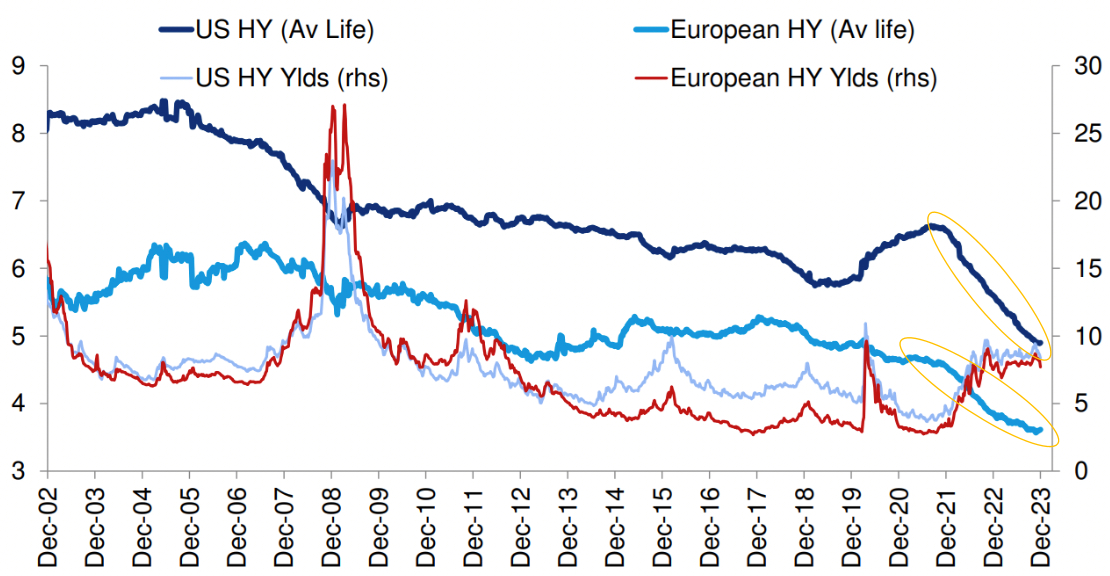

Deutsche Bank's analysis of #highyield corporate bonds' maturity offers intriguing insights. In the last two years, the average maturity of high-yield bonds has significantly decreased, signaling companies' hesitancy to issue new debt amidst rising interest rates. This trend underscores the pressing challenges faced by high-yield borrowers on both sides of the Atlantic, with refinancing costs reaching levels seen only in severe crises over the past two decades. Not to mention that HY credit spreads are low, so what if they were to start widening sharply? #HighYieldBonds #FinancialInsights #MarketTrends #DeutscheBank #BankOfAmerica #Finance Source: Bloomberg, Deutsche Bank.

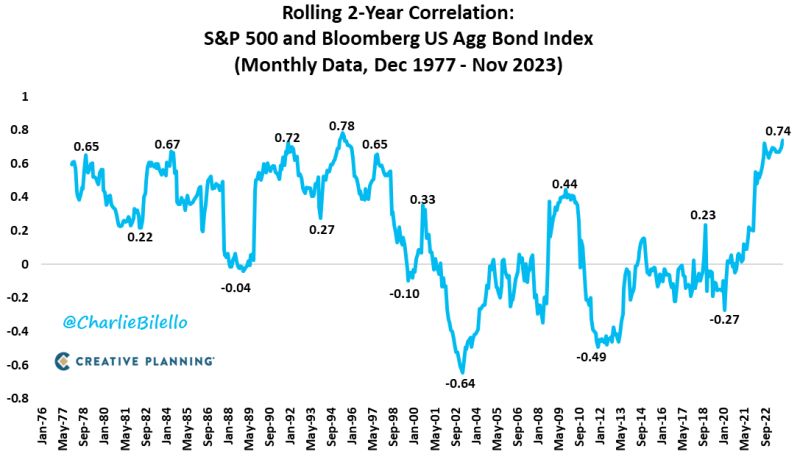

The correlation between US stocks and bonds over the last 2 years is the highest we've seen since 1993-95

Source: Charlie Bilello

How much of the bonds outperforming stocks market action we've seen in the last couple weeks is a function of strong rebalancing flows given bond underperformance this year?

As highlighted by Bob Elliott, even part of this years 1.5tln pension fund stock/bond imbalance happening now could have quite an impact.

Looming Threat to Japanese Bonds: A Setback for the Global Fixed-Income Rally?

Amidst the impressive year-end rally in the global fixed-income market, a significant development last night casts a shadow over this upward momentum. The yield on the Japanese 10-year bond surged by 12 basis points, driven by comments from BOJ Governor Kazuo Ueda and Deputy Governor Ryozo Himino, instigating a belief that change might unfold sooner than anticipated. The probability of the BOJ ending its negative rates policy this month skyrocketed to nearly 45%, as Himino's speech was perceived as relatively hawkish, amplifying the significance of the BOJ's December meeting to a live event. Adding to the market tension, the Japan 30-Year Bond Sale recorded its lowest bid-cover since 2015. Notably, the sharp steepening of the Japanese curve, from 20 bps in March to 80 bps at the end of October, coincided with a significant increase in US Treasury yields over the same period... Source: Bloomberg

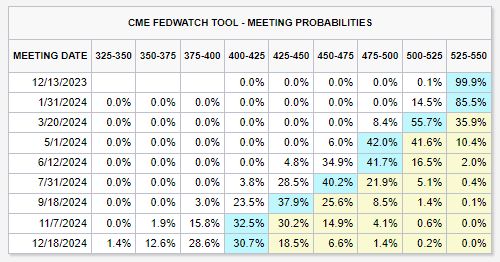

Odds of rate cuts beginning as soon as January 2024 are rising quickly

There is now a ~15% chance of rate cuts beginning next month. The base case shows a ~56% chance of rate cuts beginning in March 2024. Markets are currently expecting a total of FIVE 25 basis point rate cuts in 2024. Still, the Fed has yet to discuss the possibility of any rate cuts at all. Markets are fully bought in to the "Fed pivot." We believe that the economy will continue to slow down and that rate cuts will take place next year. However, a lot pof these cuts are already priced in. This could generate some volatility for bonds and stocks in case of disappoinment (aka macro data surprising on the upside). Source: The Kobeissi Letter

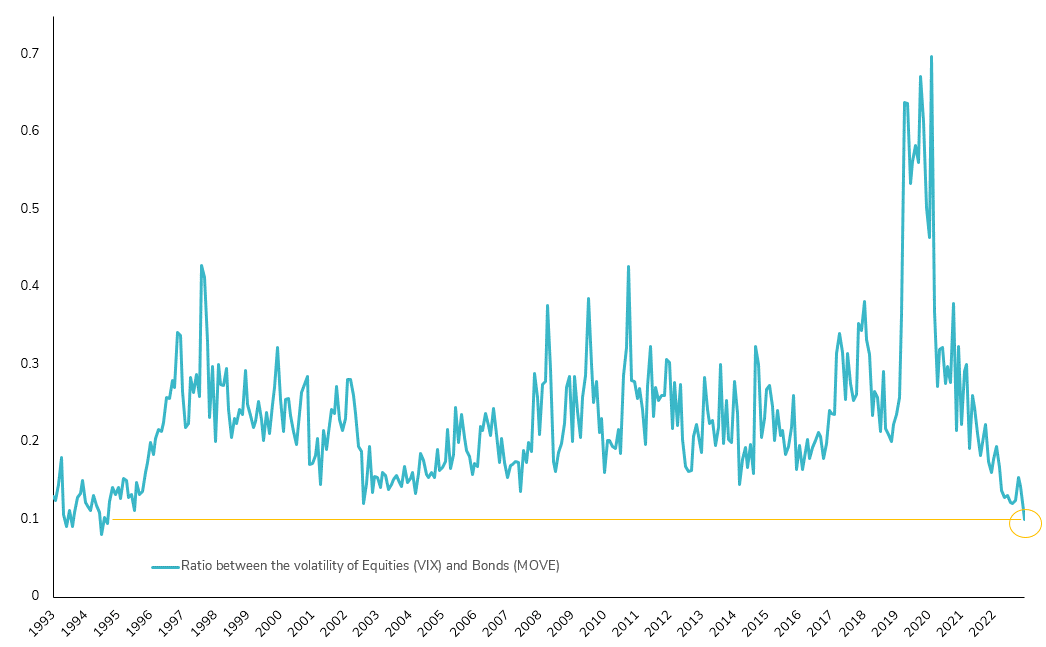

Record Low: Equity/Bonds Volatility Ratio Hits Unprecedented Levels!

The divergence between two widely recognized measures of volatility, the VIX index for Equity and the MOVE index for Rates, continues to be stark. In the U.S., equity volatility has reached new lows for 2023, while volatility in U.S. Treasuries remains persistently high. Calculating the ratio between the VIX and MOVE indexes reveals a significant trend—the lowest point since 1994/1995! Anticipate dynamic shifts in 2024! 📈 #MarketTrends #VolatilityAnalysis #Outlook2024

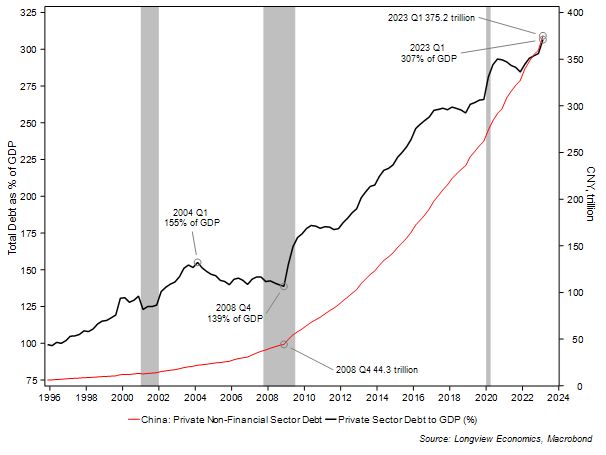

Chinese total private sector debt (level and relative to GDP). This helps explain why Moody's downgraded China's credit rating today...

Source: Longview Economics

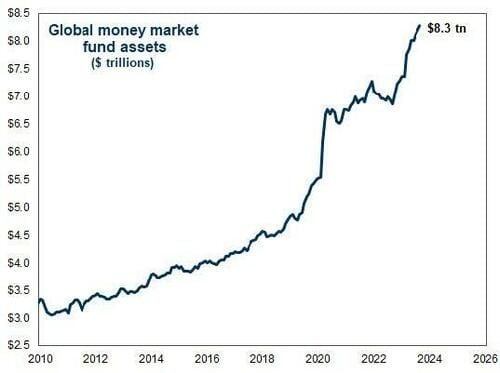

Global Money Market Funds All-Time High 🚨:

A record high $8.3 Trillion is parked in global money market funds according to Goldman Sachs. $5.73 Trillion of this are U.S. based funds. As global central banks cut rates, could this capital find its way back into equities? Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks