Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Markets are now betting on big rate cuts next year

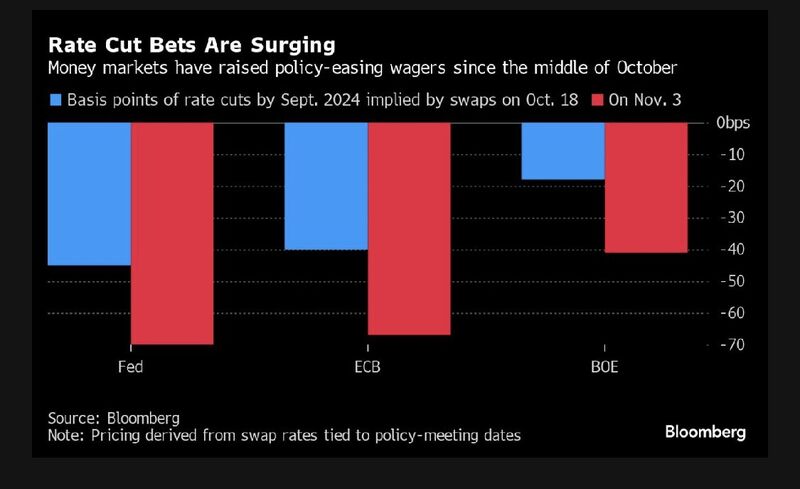

This chart shows that money markets have raised policy-easing wagers since the middle of October: by September 2024, the FED should have cut by 70 basis points, the ECB by 65 basis points and the BoE by 40 basis points. (pricing is derived from swap rates tied to policy-meeting dates) Source: Bloomberg

The Fed is now expected to start cutting rates in May 2024

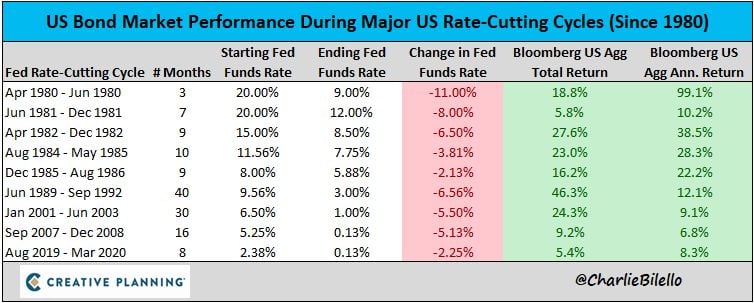

Here's how bonds have performed during prior rate-cutting cycles... Source: Charlie Bilello

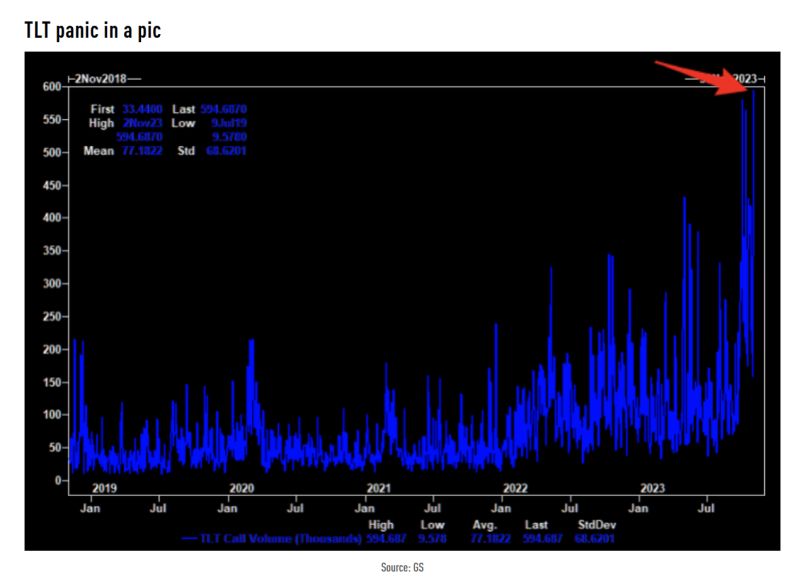

The crowd is piling into TLT (iShares US Treasuries 20y+ ETF) calls

Friday was the largest TLT call volume ever. Source: TME, GS

How low can the US 10-year bond yield go?

The US 10 year is breaking well below the short term trend line, hitting the 50 day right here. There is a small support here, but the bigger support is down around 4.3%. Note that the 200 day remains way lower, down around 3.95%. Source: TME

The 10-year note yield is now down ~35 basis points in just 5 days

This is the biggest pullback in treasury yields since the October 6th high. Let's keep in mind that it is not only due to a shift in Fed expectations, but rather a shift in US Treasury borrowing. As the US Treasury ramps up issuances of short-term debt, long-dated bonds are falling. However, higher for longer Fed policy seems to be setting a floor on this pullback. Source: The Kobeissi Letter

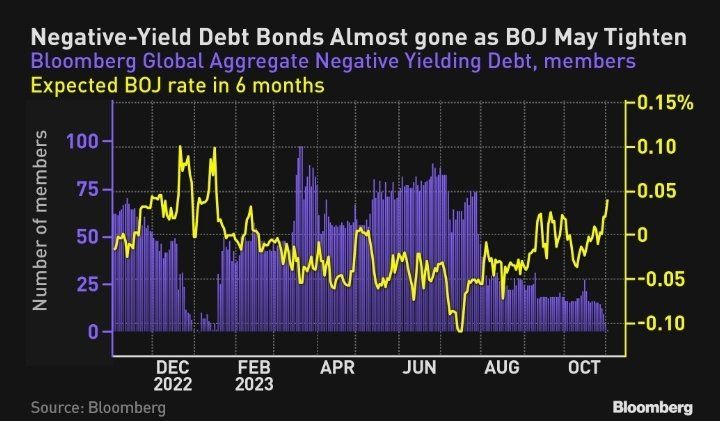

The negative bonds world is gone, with also a Japanese bond maturing in 24 trading at 0% yesterday

Source: From Macro to Micro

While there are reasons to turn tactically bullish on long dated US Treasuries ->

Let's not forget that Treasury supply (at the time of QT and waning demand stemming from China, Saudi and the likes) remains a headwind for the bond market

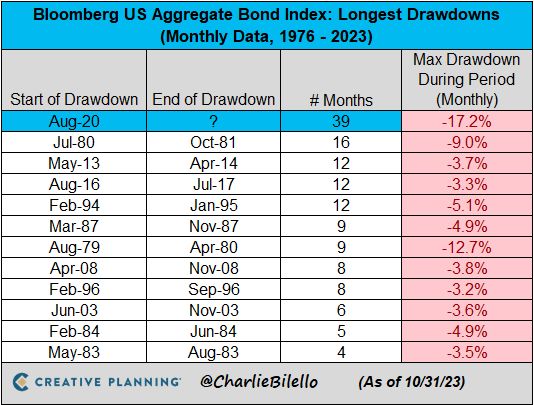

The US Bond Market has now been in a drawdown for 39 months, by far the longest bond bear market in history

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks