Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

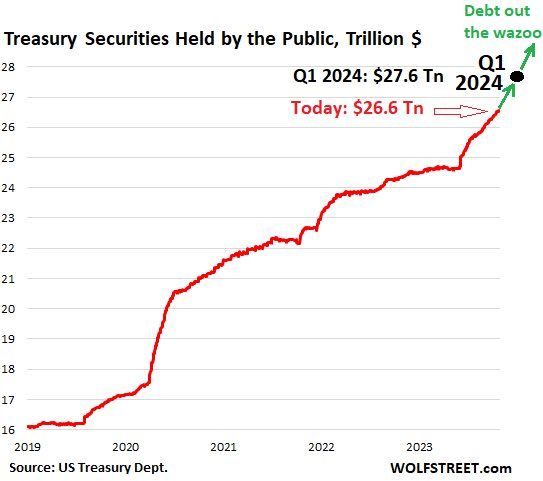

Marketable US Treasury Debt to Explode by $2.85 Trillion in the 10 Months from End of Debt Ceiling to March 31, 2024

In total, over those two quarters marketable debt will have increased by $1.59 trillion! This follows the $1.01 billion increase in Q3, and the surge in June after the debt ceiling ended. At the beginning of Q4, marketable debt outstanding was $26.04 trillion. The government will add $1.59 trillion to it, pushing it to $27.6 trillion by March 31, 2024. Source: Wolfstreet, WallStreetSilver

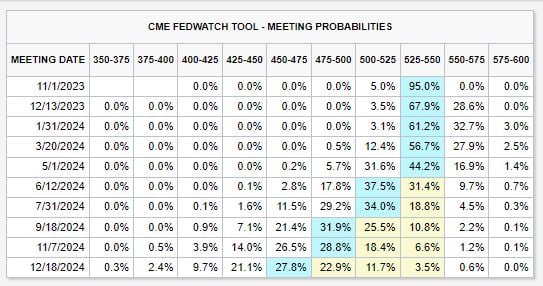

The US treasury curve is going in all directions

Interest rate futures are beginning to price-in a potential rate CUT this week, at a 5% chance. Meanwhile, the base case still shows rate cuts beginning in June 2024. However, odds of another HIKE in January 2024 are now up to ~36%... Source: The Kobeissi Letter

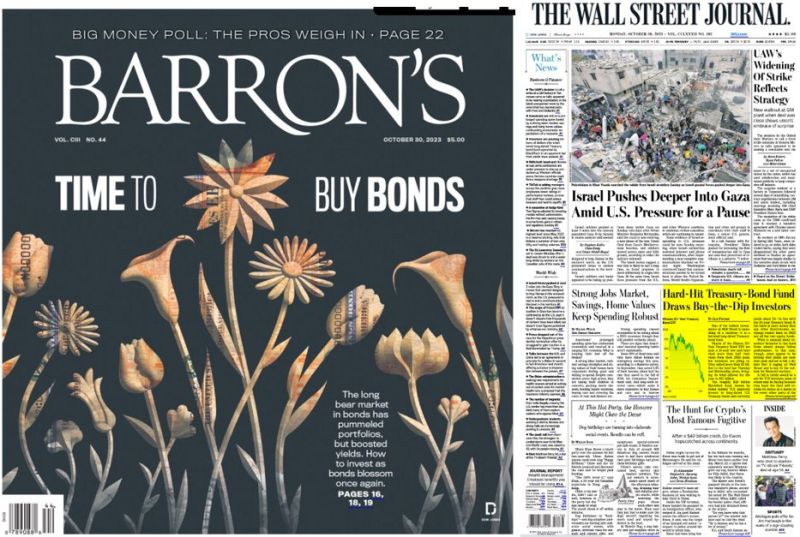

With the US 10-year yield close to 5%, long duration bonds start to look attractive

There is one issue though: sentiment on long-dated bonds look too optimistic E.g 1/ not a single sell-side analyst does have a 10-year target yield above 5% for the next 6 months; 2/ Long-dated bonds funds are enjoying record inflows; 3/ Magazine cover pages look upbeat on bonds (source: J-C Parets). The consensus is not always wrong but so much optimism is usually not a good sign from a contrarian perspective.

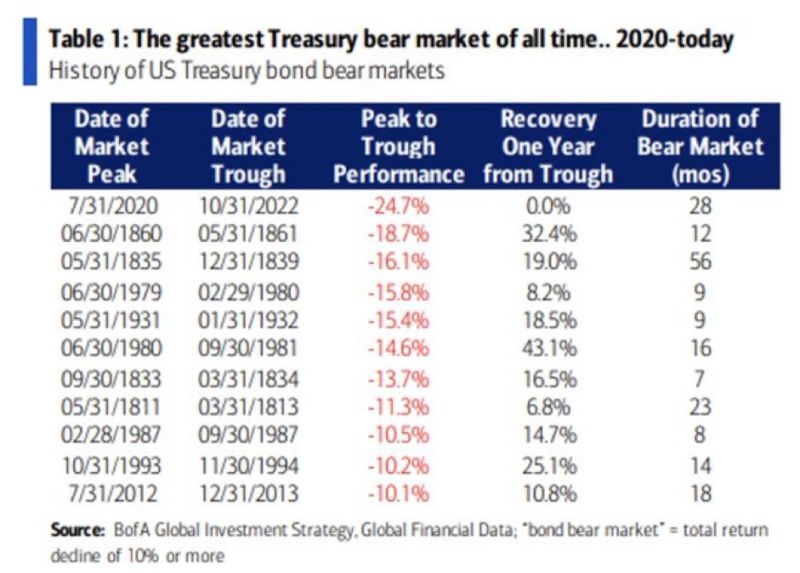

The Greatest Treasury Bear Market in History

Source: BofA, Barchart

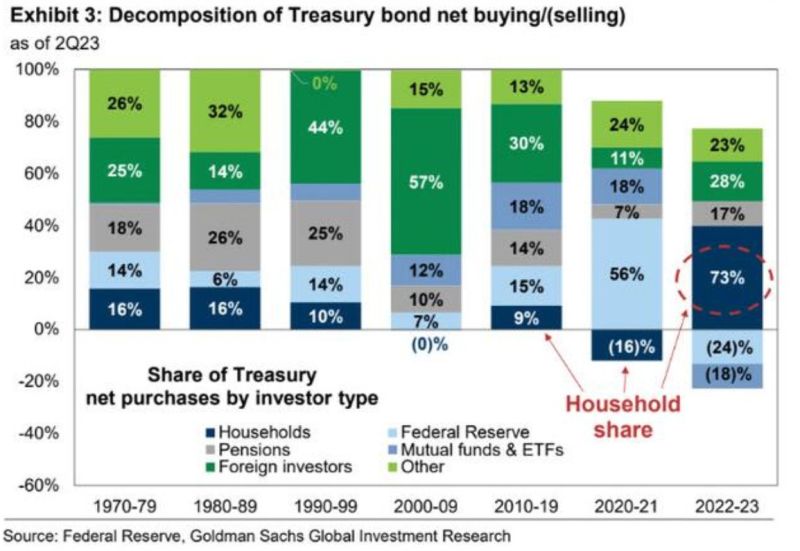

Adding to that Great Rotation theme is this chart

US households account for 73% of Treasury bond buying in 2022-2023 (so far) A lot of pain being experienced for those not willing to hold to maturity amid this bond blood bath... Source: Markets & Mayhem, Goldman Sachs

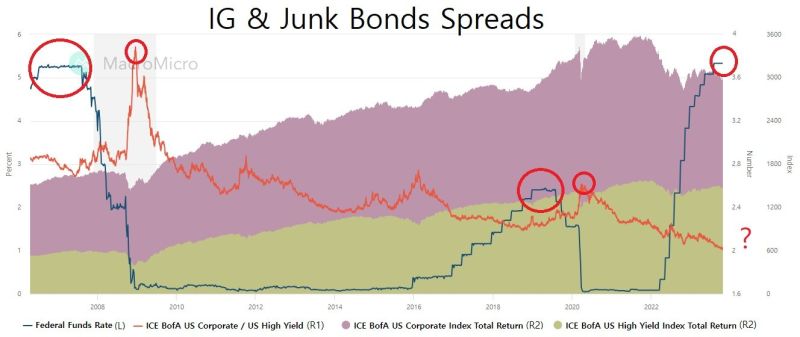

How long does it take for the FED to break the corporate bond market?

2008 : 1 year of plateau, resulted in credit event after another 1 full year. (Total 2 years) 2020 : 7 months of plateau, resulted in credit event after 6 months. (Total 13 months, 54% of 2008) 2023 : it's been 3 months into plateau so far. Chart made from MacroMicroMe - source: James Choi

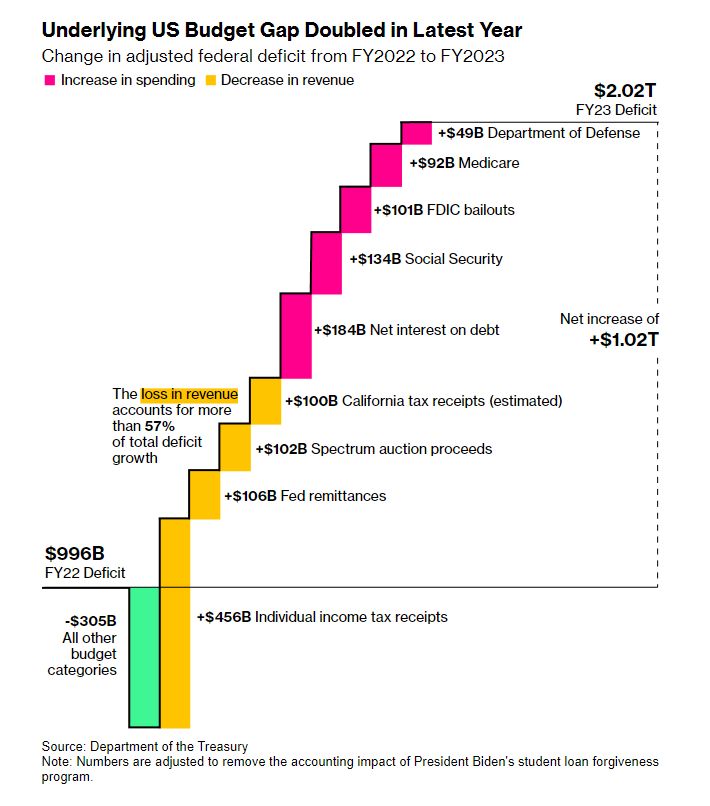

US deficit is doubling as US Economy grows shows why yields are at 5%

Source: Bitcoin magazine

Equities tend to sell off with bonds when interest rates rise beyond 5%

Source: GS, TME (European equities in this case)

Investing with intelligence

Our latest research, commentary and market outlooks