Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

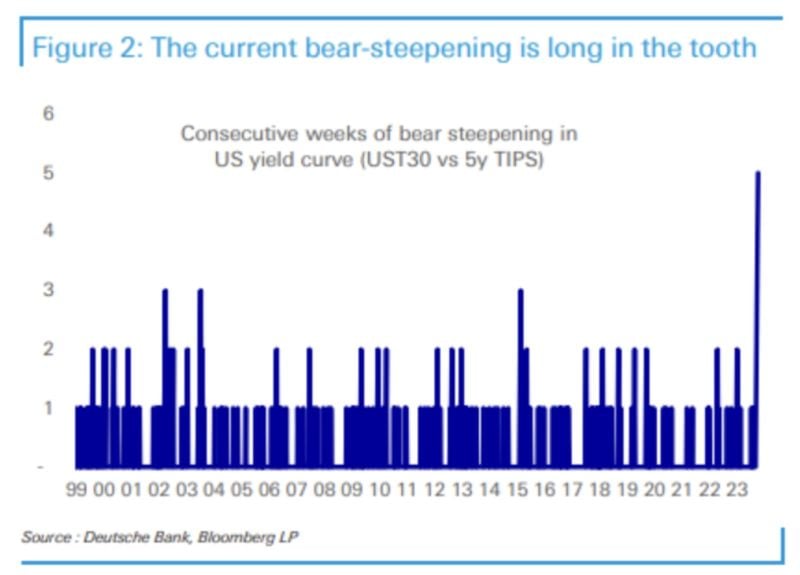

The Treasury Yield Curve has been steepening (i.e. uninverting) for 5 straight weeks, the longest streak in more than 25 years

Source: DB, Barchart

US 10-year Yield pullback from last week peak

US 10-year Yield pullback sharply from last week peak. After the Non-Farm Payrolls report on Friday, the US 10-year Govt Yield came close to hitting 4.9%. As of today, that Yield is down below 4.6%.

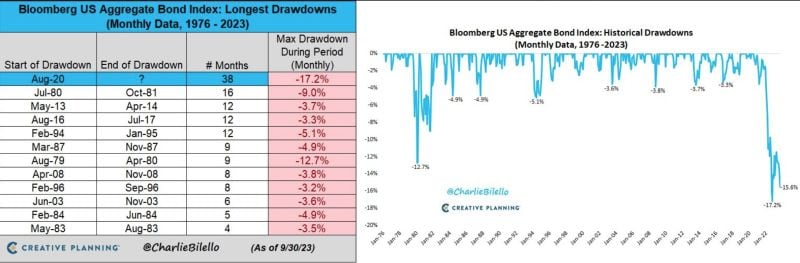

This is by far the longest bond bear market in history, at 38 months and counting...

Source: Charlie Bilello

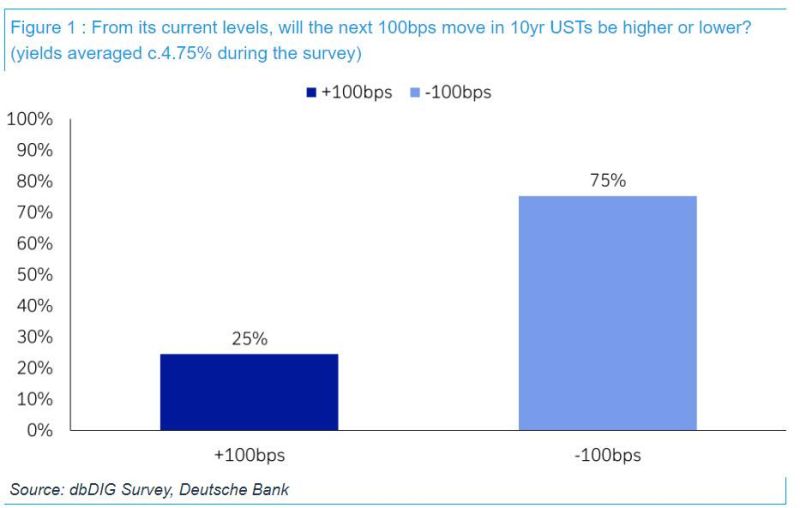

Vast majority on Wall Street think next 100bps move in 10Y yields is LOWER (and vast majority think the next 10% S&P 500 move will be LOWER)

The Deutsche Bank October 2023 global financial market survey, conducted between the 3rd and 6th of October, had 410 responses from around the world. - 75% think the next 100bps move in US 10yr yields is lower (average yield 4.75% during the survey). A big turnaround from June’s results where a small majority expected 4.5% before 2.5% when we were halfway between the two. Well done to that small majority as it got there in just 3 months. - 72% think the next 10% move in the S&P 500 will be lower. Slightly less than in June. In March 76% thought the next 10% move would be up so a different mood to earlier this year. Source: DB

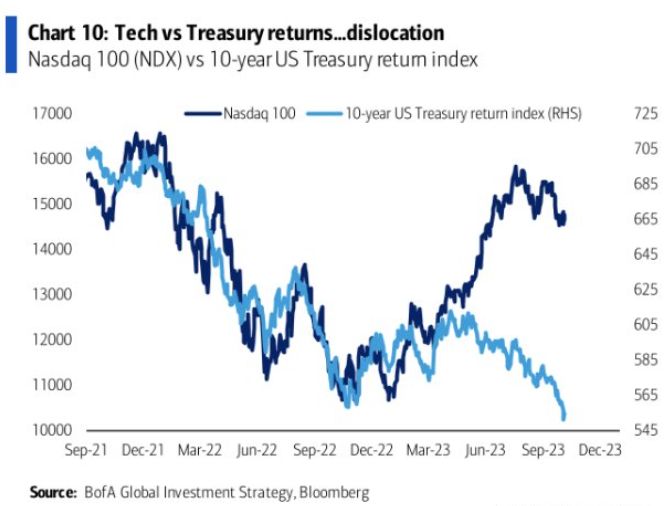

The gap between returns in tech stocks and US Treasuries has widened significantly since June

As bond prices continue to plummet but equities hold higher, this gap is getting larger. Source: BofA, The Kobeissi Letter

One bond market is defying global selloff with mega returns

As bond markets everywhere get battered by a cocktail of higher interest rates, deficit angst and hawkish central bankers, one class of debt instrument is handing creditors double-digit returns: catastrophe bonds.

Because of the way the bonds are structured, their coupons keep going up as Treasury yields rise, and investors get a sizable risk premium on their capital, as long as catastrophe doesn’t hit.

Source: SwissRe, Bloomberg

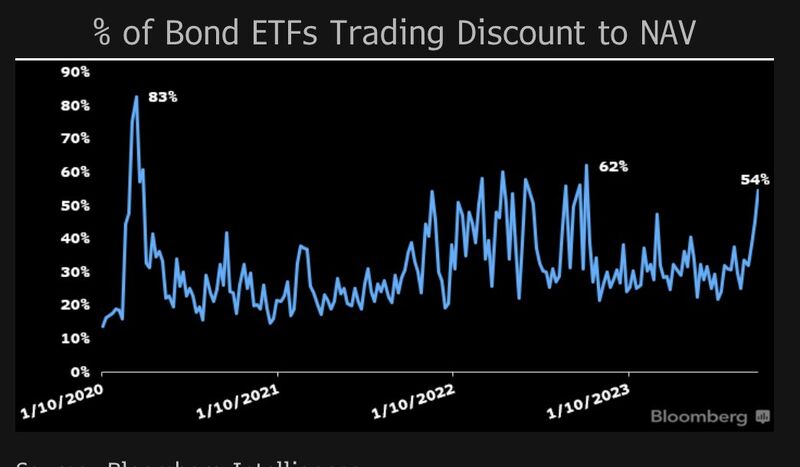

Over half of bond ETFs are now trading at a discount

Spikes in this number have been a pretty reliable bottom signal in the past. That said we not quite near the last two spikes but close.. Source: psarofagis thru Eric Balchunas, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks