Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The new safety trade

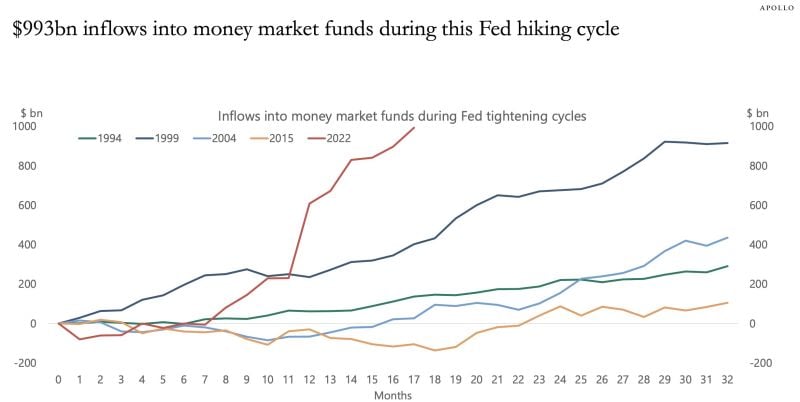

-> An incredible $993 billion has gone into money market funds since the Fed started raising rates in March 2020. Inflows to money market funds are well ahead those seen in 2015, 2004, 1999 and 1994 rate hike cycles. Why take risk on your "safety" trade when you can make 5% risk-free? Source: The Kobeissi Letter

Asset class and style returns by JP Morgan

As bonds and stocks fell simultaneously, commodities were the notable outperformer in Q3, returning 4.7% and echoing the market dynamics of 2022. Source: JP Morgan

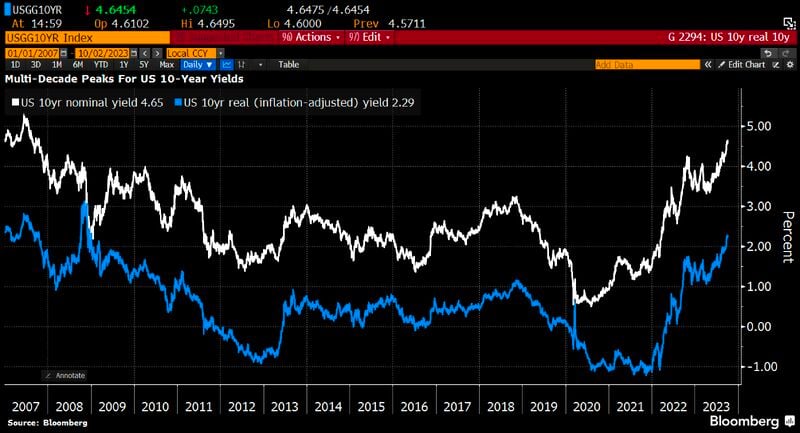

US 10y yields keep rising with most of the increase is due to the rise in real yields. US 10 year yields is now at 4.65%, 10 year real yields at 2.29%

Source: Bloomberg, HolgerZ

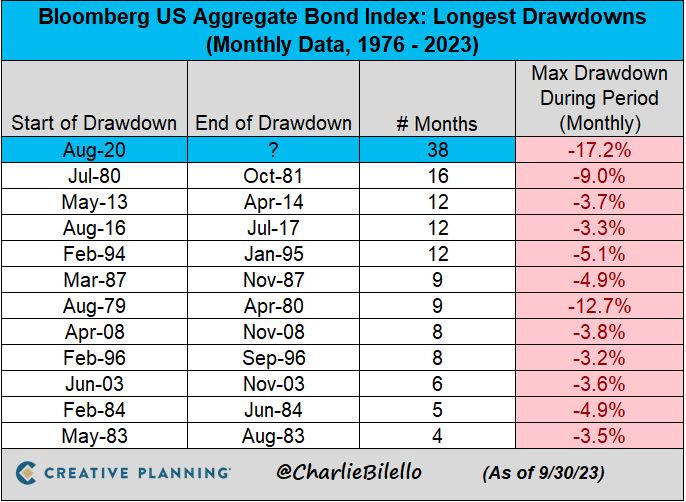

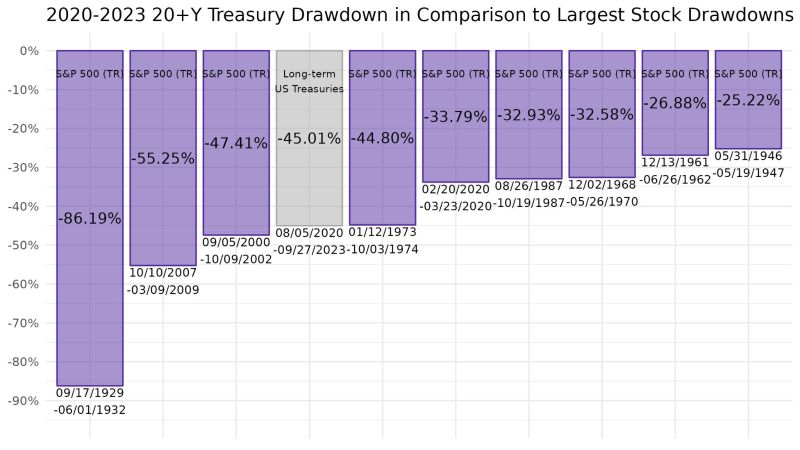

The US Bond Market has now been in a drawdown for 38 months, by far the longest bond bear market in history

The US Bond Market has now been in a drawdown for 38 months, by far the longest bond bear market in history

The S&P’s price has diverged from the trend for EPS estimates recently

The rise in bond yields probably explains this dichotomy

Is the golden era of 60/40s coming to an end?

And if equities / bonds correlation stay positive, which asset classes should be added to portfolios? hard assets and commodities? alternatives (private debt, private equities, etc.)? cash on an opportunistic basis? Source chart: Tavi Costa, Bloomberg

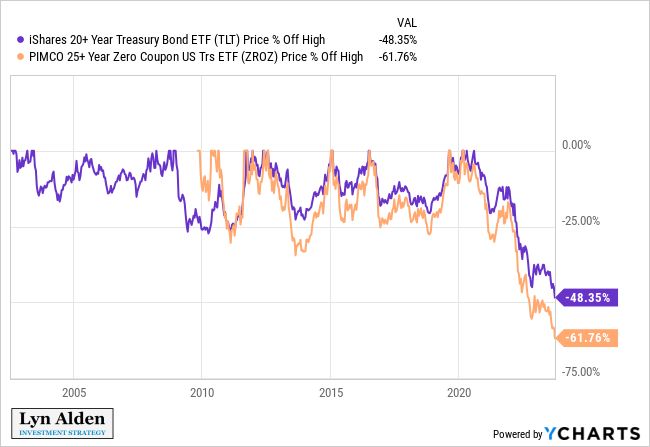

Yes you can lose a lot of money with bonds...

The Pimco 25+ Year Zero Coupon US Treasury ETF is off more than 60% from its high

If US Treasuries would the stock market, the current drawdown for long for the stock market in history

Source: Michael Gayed

Investing with intelligence

Our latest research, commentary and market outlooks