Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

A government shutdown would reflect negatively on America’s credit rating, says Moody’s, the only remaining major credit grader to assign the US a top AAA rating

“While government debt service payments would not be impacted & a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years,” analysts led by William Foster wrote in a report Monday. Source: Bloomberg

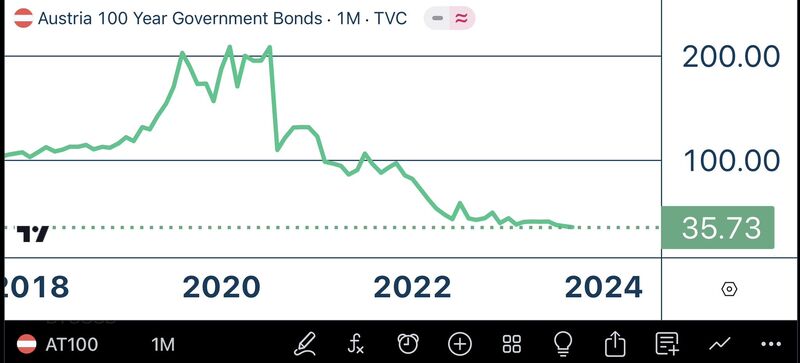

The Power of Duration! This is not the chart of an altcoin, this is the chart of Austria’s 100-year bond, down 82% from its 2021 peak!

Source: Jeroen Blokland

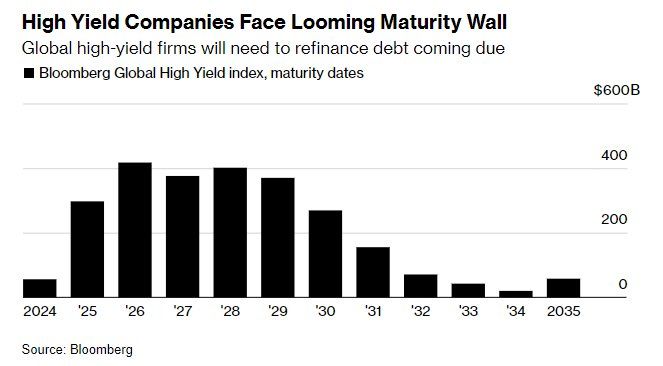

HIGH YIELD BONDS, THE BILL COMES DUE...

Global high yield bonds have been quite resilient so far in this cycle but the reality is that they will hit the maturity wall starting next year. And things will probably become more challenging whatever the economic scenario. If the economy does well and interest rates stay high for longer, the refinancing cost is likely to become more expensive. If the economy moves into recession, credit spreads are likely to go up hence still putting upward pressure on refinancing cost. So either way delinquencies are likely to increase. Source: Bloomberg

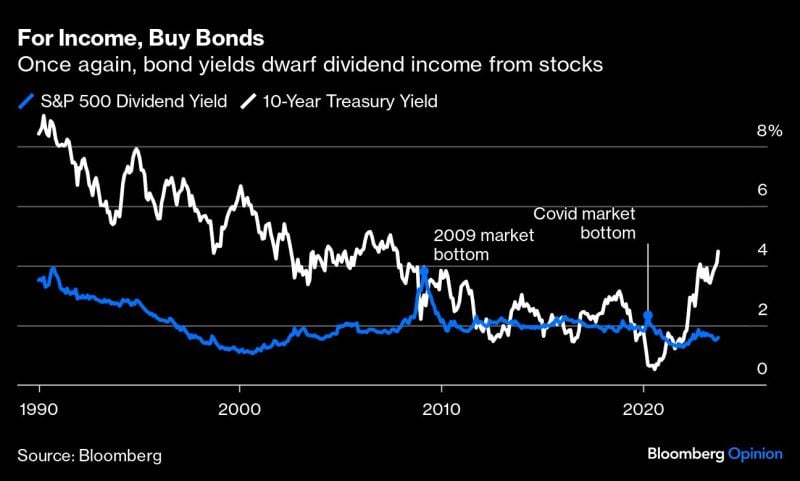

Treasury Yields now surpass Stock Dividend Yields by the widest margin since the Global Financial Crisis

Source: Bloomberg, Bar chart

Yields pushing higher

US 2Y yields hit their highest since July 2006 US 5Y yields highest since Aug 2007 US 10Y highest since Nov 2007 US 30Y highest since April 2011 Source: Bloomberg, www.zerohedge.com

Inflation fear is NOT the driver of rising yields

Indeed, 10y real yields (10y nominal yields - 10y inflation expectations) jumped to 2.11%, the highest since 2009. In other words, investors are demanding higher REAL yields in the face of political chaos in Washington and high debt. Source: Bloomberg, HolgerZ

The longest duration bond ETF is now down 60% from its peak in March 2020

How is that possible? The 30-Year Treasury yield has moved from an all-time low of 0.8% in March 2020 up to 4.6% today. Long duration + Rising interest rates from extremely low levels = Pain $ZROZ Source: Charlie Bilello

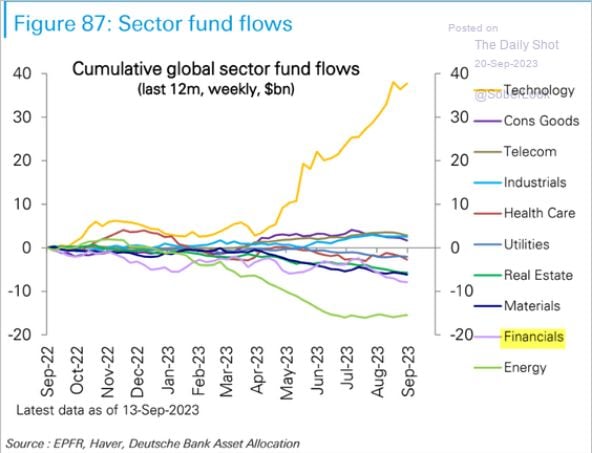

Sector fund flows

Long-only institutional & retail investors are all-in overweight tech and meaningfully underweight energy. Will elevated tech valuations, rising long-end yields, and rising oil prices trigger a squeeze in positioning? Source: The Daily Shot, EPFR, DB

Investing with intelligence

Our latest research, commentary and market outlooks