Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

More or less in tandem: US 10y yields and WTI oil price

Source: Bloomberg, HolgerZ

China's holdings of US Treasuries just reached its lowest level in 14 years

Now down almost $481B from peak levels. Source: Crescat Capital, Bloomberg

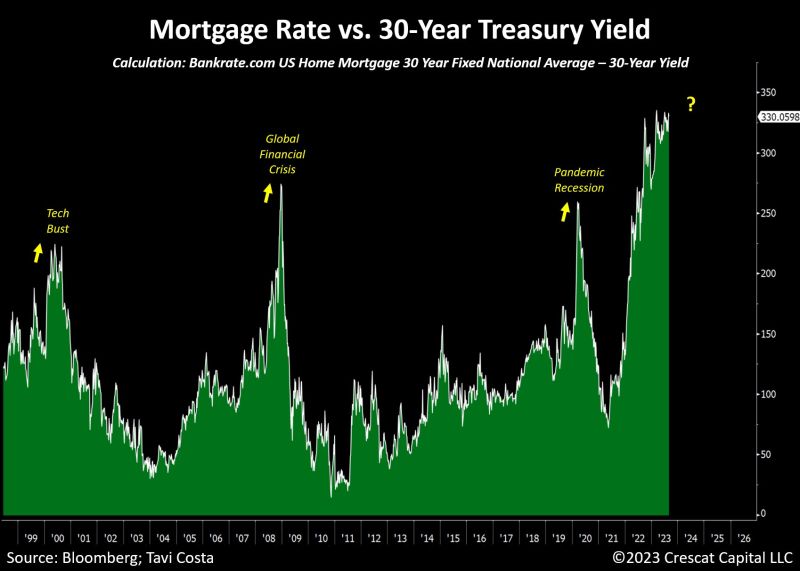

We are now seeing the widest spread between mortgage rates and 30-year risk-free rates in history

Should we see this as another barometer of credit tightness in the system? Source: Crescat Capital, Bloomberg

Recent Developments in the AT1/CoCo Bond Market: ZKB Unexpectedly Skips an AT1 Call!

After the Credit Suisse turmoil, the AT1/CoCo bond market is witnessing intriguing dynamics as Zürcher Kantonal Bank (ZKB) takes an unexpected turn by choosing to bypass an AT1 call. In a landscape where banks are carefully navigating refinancing challenges, this move adds a new layer of complexity to the market. ZKB's decision to forego the AT1 call comes in the wake of Banco Santander's similar choice, signaling a trend toward cautious financial strategies in the face of fluctuating market conditions. These recent developments are shedding light on the intricate decision-making processes that banks are employing to balance their financial stability and growth prospects.

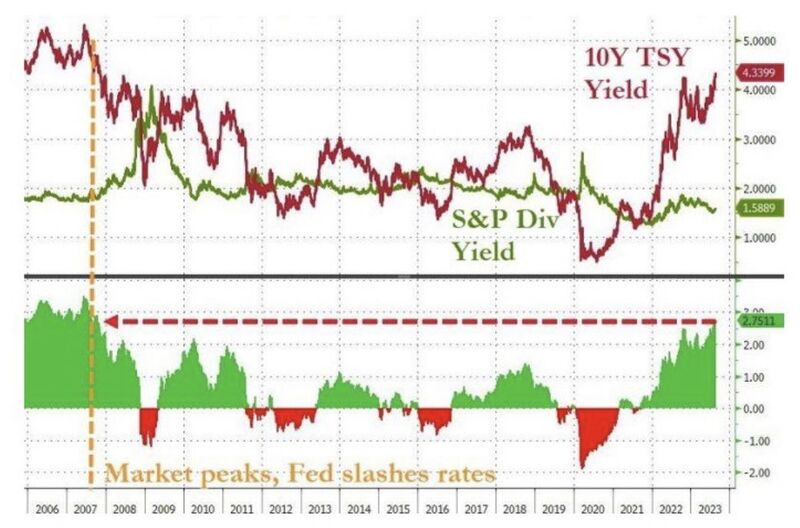

The last time 10Y yields were this far above $SPX dividend yields was September 2007, the month stocks peaked

Source: zerohedge

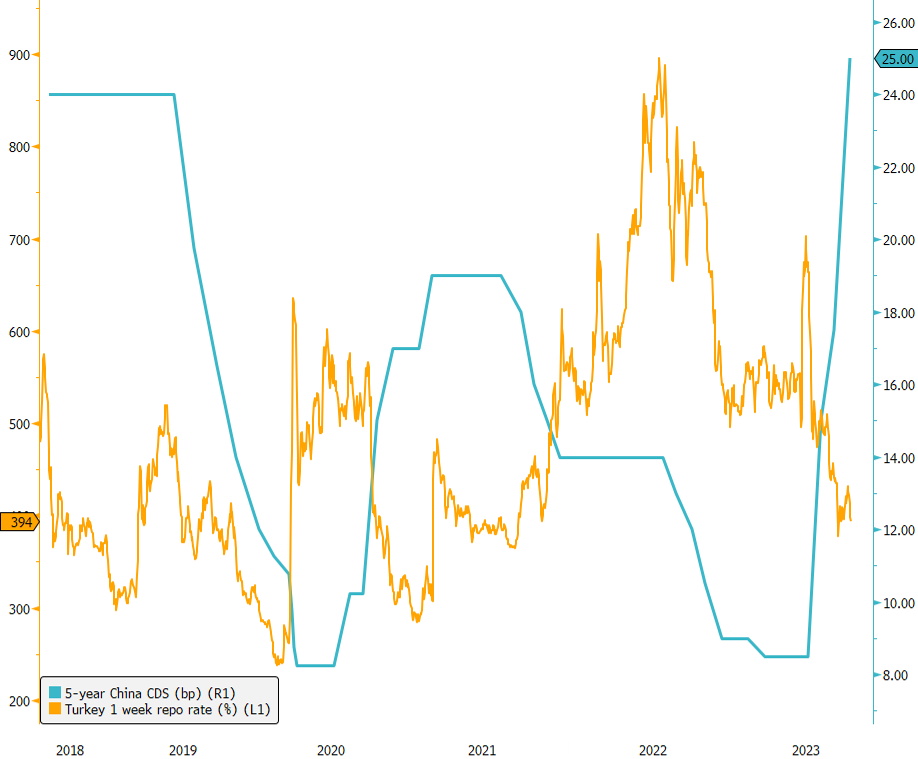

Turkey's Aggressive Rate Hike Triggers 5-Year CDS Drop!

The Turkey Central Bank has taken a significant step in its battle against inflation by implementing a supersized rate hike of 750bps, bringing rates to 25%. This move was unexpected, as the market had anticipated a more "modest" hike to 20%. Turkish fixed income assets have responded positively, with the Turkey 5-year CDS retreating below 400bps. Even Turkey's US Dollar-denominated bonds saw a boost from the news. With the Central Bank of Turkey adopting a more orthodox approach to its monetary policy, the question arises: can they successfully bring inflation back to reasonable levels? To provide context, the latest inflation figure for the month of July was at a staggering 47.8%... Source: Bloomberg

A fresh increase in the Atlanta Fed’s GDPNow model reinforces the reasoning behind hawkish-for-longer monetary policy, which is weighing on equities and bonds

The latest model estimate shows real 3Q GDP growth of 5.9%, up from 5.8% on Aug. 16 (it was less than 4% two weeks ago). Source: J-C Gand, Atlanta Fed

Since the COVID Crash lows in March 2020, US equity markets have more than doubled the performance of bonds

As shown below, that's the best performance ever over a similar time window, topping the strongest stocks-bonds outperformance from the tech bubble of the late 1990s and early 2000s. Source: Bespoke, J-C Gand

Investing with intelligence

Our latest research, commentary and market outlooks