Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

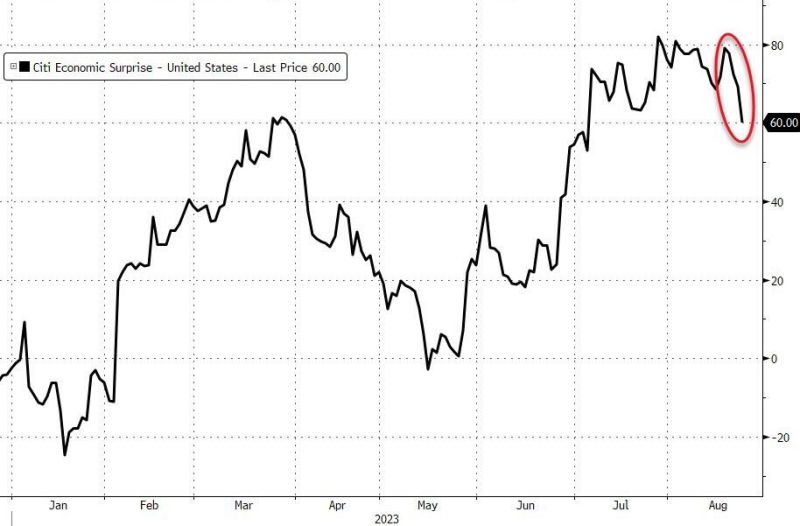

This week has seen the biggest set of 'bad news' since April...

And that bad news prompted a very aggressive bid for global bonds with USTs tumbling 8-12bps on the day, leaving the long-end down 9bps on the week (but 2Y +2bps still) Source: www.zerohedge.com, Bloomberg

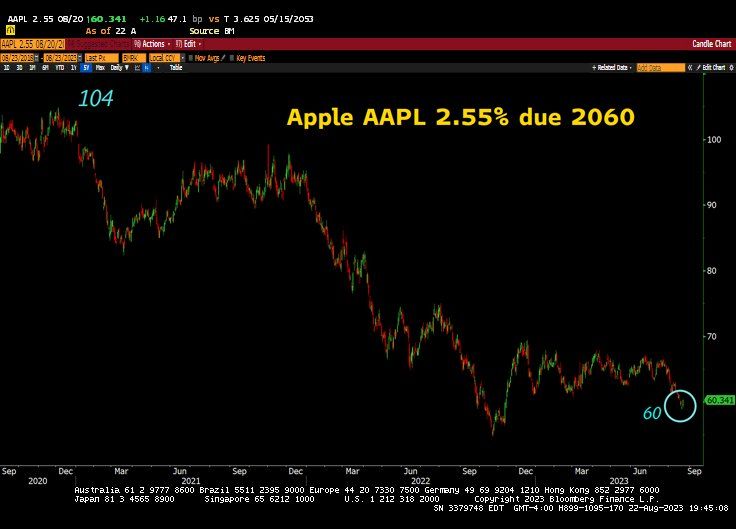

Duration risk in one chart. $1 million invested in this Apple AAPL bond is now worth $600k, duration risk is on stage here.

Now think of all those mortgage-backed securities on bank balance sheets... Source: Lawrence McDonald, Bloomberg

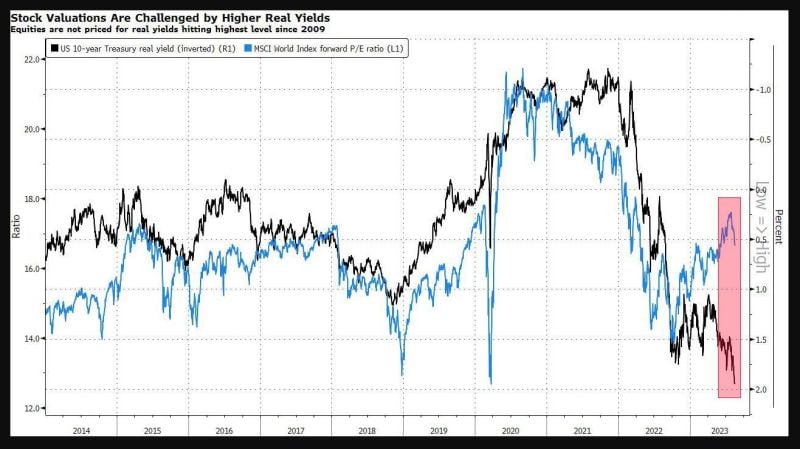

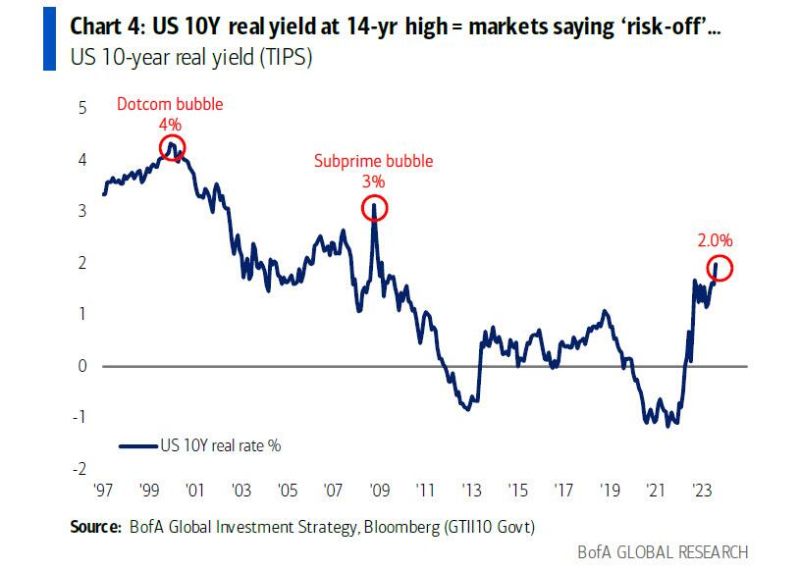

Higher real bond yields create a challenge for global equities valuations

Source: Bloomberg

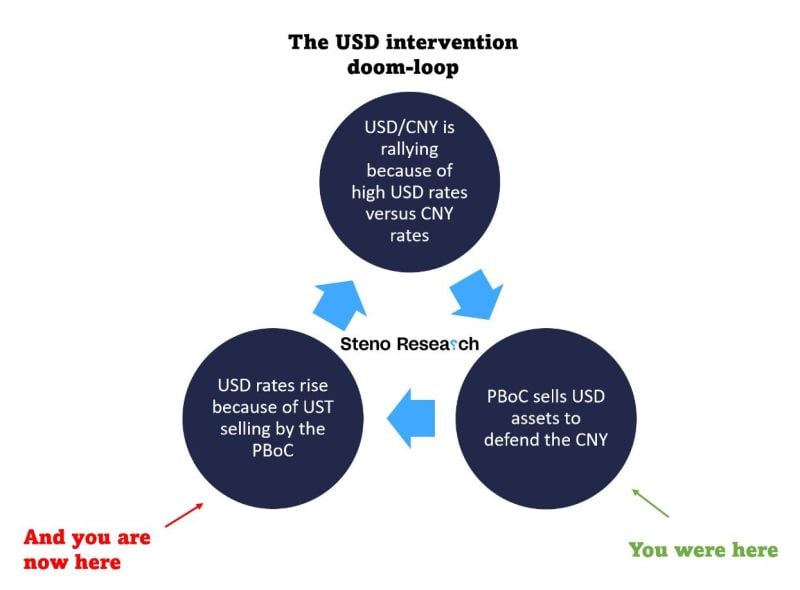

Nice one by Steno research

While there are some fundamental reasons for US Treasury yields to keep rising (check out the Atlanta Fed Nowcast model poiting towards nearly 6% annualized real GDP growth in 3Q), what is currently going in China probably has some impact as well Source: Stenio research

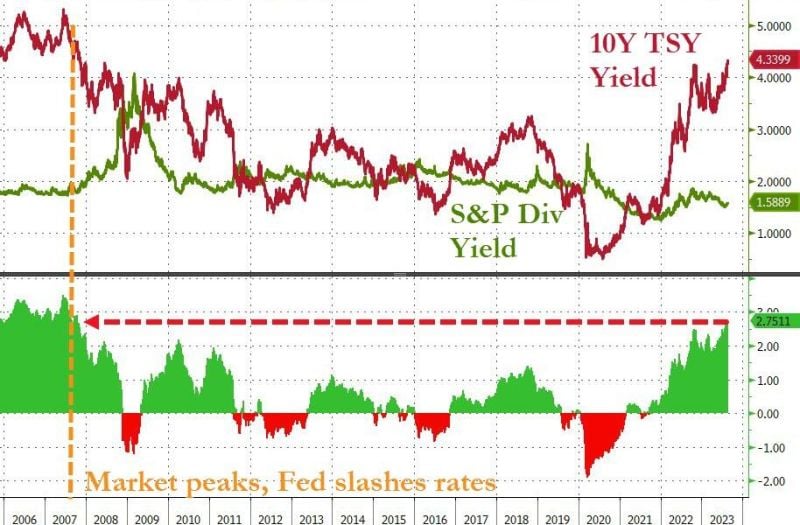

The last time US 10Y yields were this far above sp500 dividend yields was sept/oct 2007 (BNP Paribas funds liquidate, Fed slashes rates, market peaks...)

Source: Bloomberg, www.zerohedge.com

This is not the price chart of a meme stock going under or a "pump and dump" altcoin

This is the Austria AA+ 100 year bond being hammered by the rise of bond yields... The price of the 100 year Austrian government bond has plunged near all-time lows and is trading 72% below its All-Time-High. Source: Bloomberg, HolgerZ

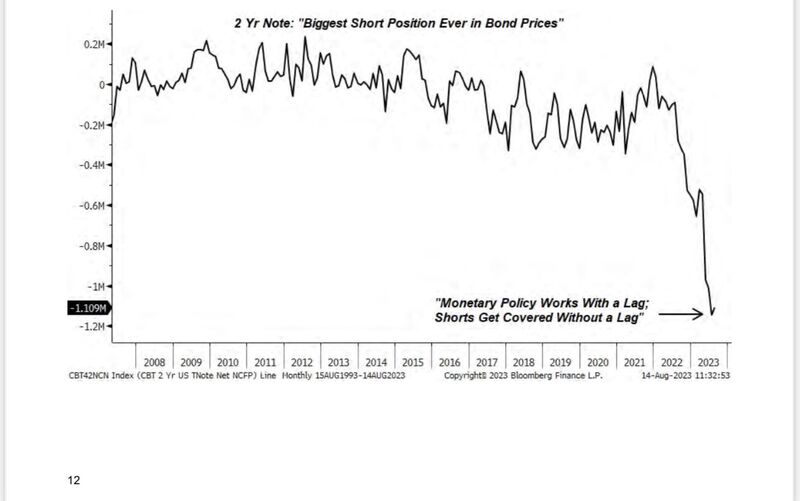

This is the largest short position ever in the US Treasuries 2 year note

Source: ISI chart

Investing with intelligence

Our latest research, commentary and market outlooks