Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

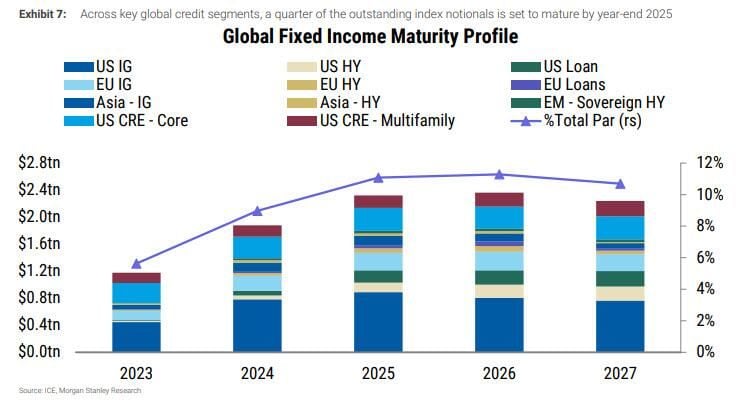

We are approaching quite a formidable global #debt maturity wall...

Source: Markets & Mayhem, Morgan Stanley

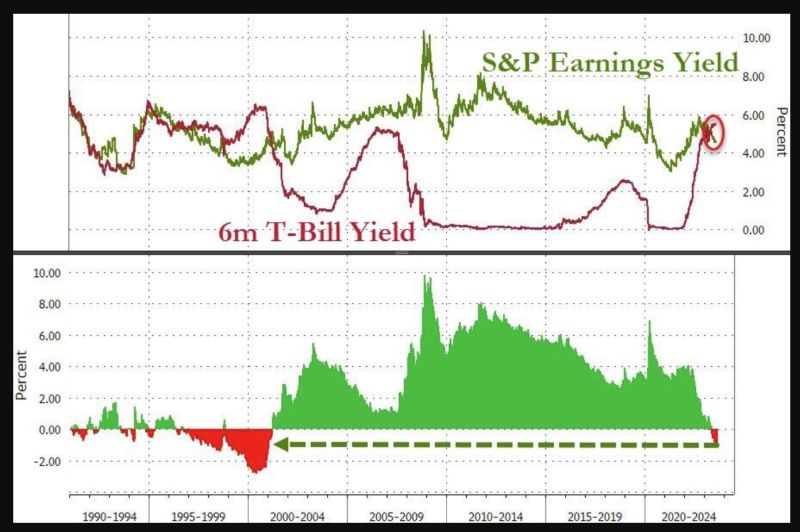

From T.I.N.A (There Is No Alternatives to Risk assets) to T.A.R.A (There Are Reasonable Alternatives)... 6-months US T-bills yield 94bps more than the S&P's earnings yield...

Source: Bloomberg

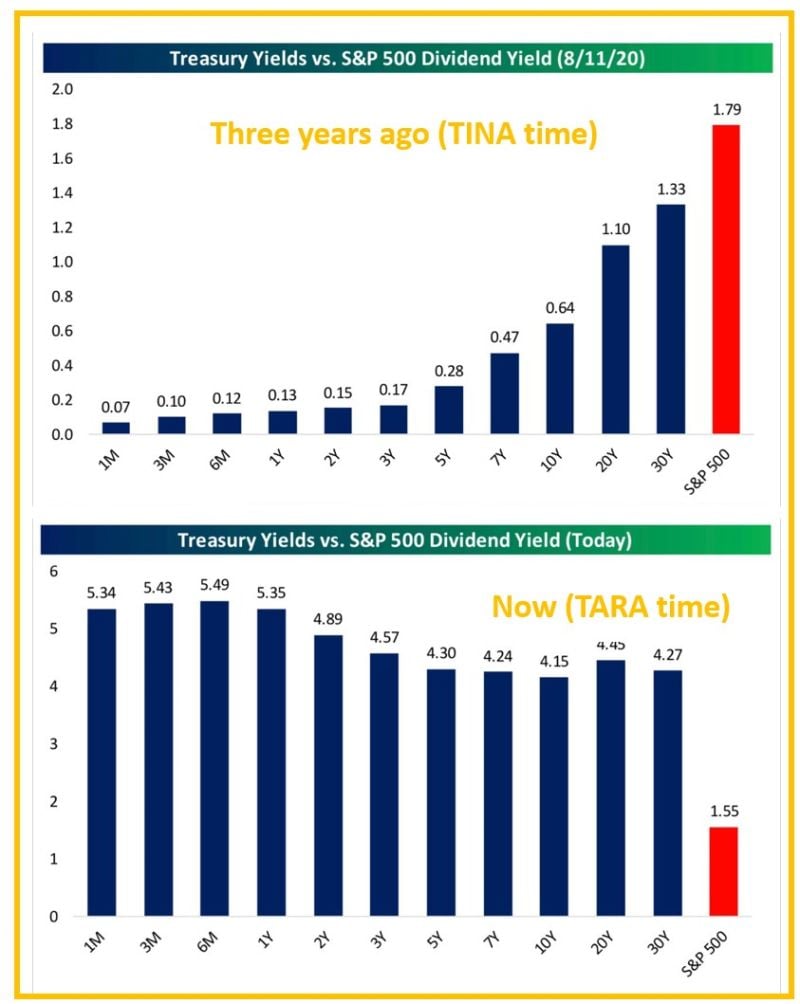

From T.I.N.A (There is No Alternatives to risk assets) to T.A.R.A (There Are Reasonable Alternatives, i.e bonds)

Three years ago in August 2020, the S&P’s dividend yield (in red below) was 1.8%, almost 50 bps higher than the highest yield on the treasury curve. Every treasury note with a duration shorter than 5 years had a yield below 0.2% and the 1-month was almost ZERO. Fast forward to today and the S&P’s dividend yield of 1.55% is 260 bps lower than the lowest point on the treasury curve right now (the 10-year at 4.15%). And the 1-month T-bill yielding at 5.34% is 380 basis points higher than the S&P’s dividend yield. Source: Bespoke

The comeback of bond vigilantes: US 10y real rates have jumped to 1.77%, almost the highest level since 2009

Source: Bloomberg, HolgerZ

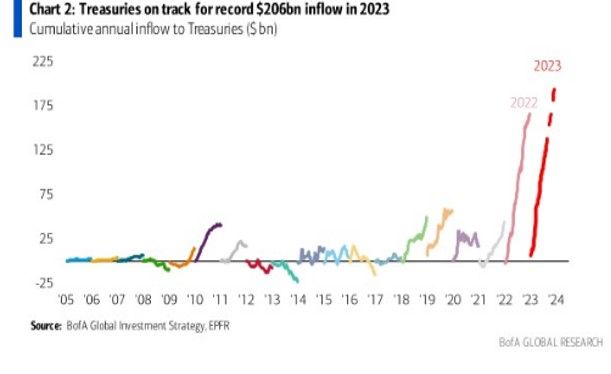

US Treasuries yields keep going up despite record INFLOWS. As shown by BofA, US Treasuries are on track for the largest inflow EVER ($127bn YTD is equivalent to $206bn annualized)

Yet, yields don’t fall as US 10-year hit 4.13% this week as inflation reports failed to reverse the trend. What will happen to yields if investors start to panic and dump their US Treasuries? Or should we on the contrary see the hefty yield paid by US Treasuries as a buffer which continues to attract yield chasers and thus prevent yields to rise too high and too quickly? Source: BofA

US money-market assets have reached a new record of $5.5 trillion

US Treasuries are on course for a record year of inflows as investors chasing some of the highest yields in months pile into #cash and #bonds, according to Bank of America Corp. strategists. Cash funds attracted $20.5 billion and investors poured $6.9 billion into bonds in the week through August 9, strategists led by Michael Hartnett wrote in a note, citing data from EPFR Global. Meanwhile, US #stocks had their first outflow in three weeks at $1.6 billion. Flows into Treasuries have reached $127 billion this year, set for an annualized record of $206 billion, BofA said. The buoyant demand shows how alluring fixed-income markets remain even as the bond rally and economic slowdown many were predicting last year has failed to materialize. The yield on 10-year US Treasuries was trading at around 4.09% on Friday, up from a low of around 3.25% in April, and near a 15-year high touched last year. Source: Bloomberg, Lisa Abramowicz

The decoupling between US money market fund inflows (in green) and bank deposits (in red) continues.

Source: www.zerohedge.com, Bloomberg

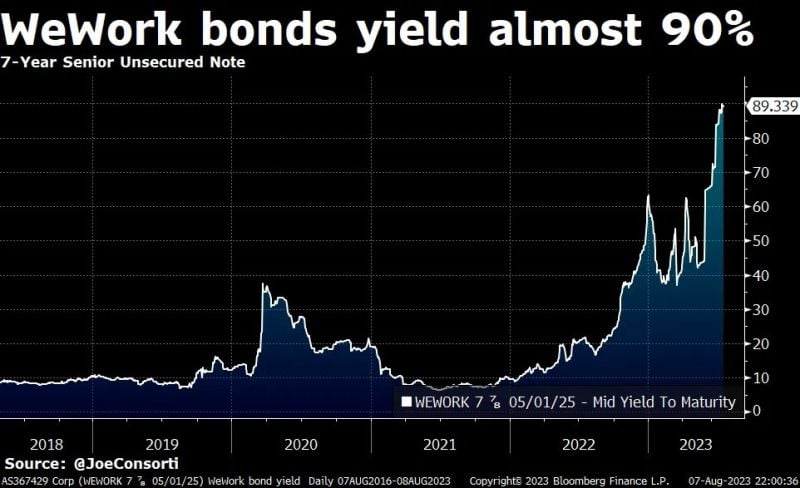

WeWork bonds yield almost 90%

When they mature in 2025, what will #wework do? Borrow again or sell its assets? tThere doesn't seem to be any 'soft landing' for US office space... Source: Joe Consorti, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks