Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The slow-motion US banking crisis is still not out of the woods...

Indeed, US Money Market funds saw a third straight week of inflows ($29 billion this past week) to a new record high of $5.15 trillion...Retail money-market funds saw inflows for the 15th straight week (and institutional funds also saw a second straight week of inflows)... Usage of The Fed's emergency bank bailout facility rose by $606 million to a new record high at $106 billion... And as highlighted on the chart below, the decoupling between money-market fund inflows and bank deposits continues.. Could the current bloodbath in bonds be the catalyst for another round of pain? Source: www.zerohedge.com, Bloomberg

Bonds and equities re-correlate...The recent acceleration in yields appears to have had an effect on long-duration risk-assets...

Source: Bloomberg, www.zerohedge.com

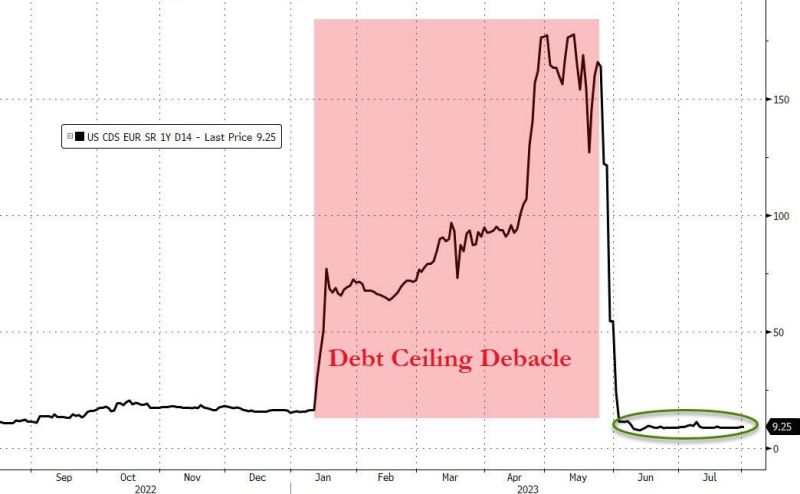

Note that US Sovereign risk (aka CDS on 1-year US Treasury) was completely unmoved by the Fitch downgrade.

Source: Bloomberg, www.zerohedge.com

Treasuries haven’t been this ineffective as a stock hedge since the 1990s. The one-month correlation between the two assets is now at its highest reading since 1996

Source: Lisa Abramowicz, Bloomberg

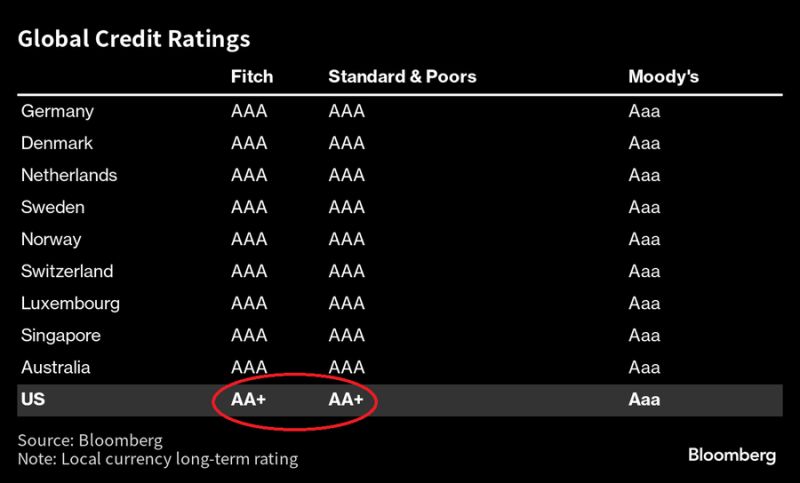

Who is left in the AAA club? (the US is now split-rated AA+)

Source: Jim Bianco, Bloomberg

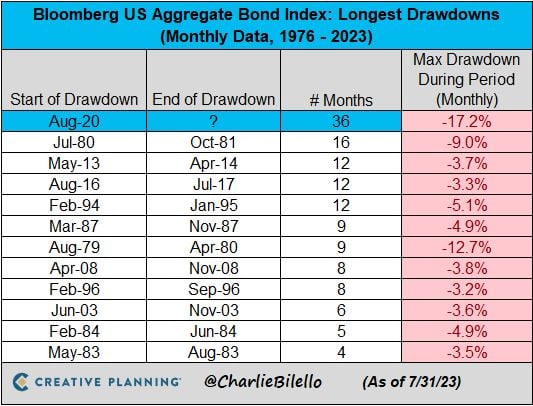

The US bond Market has now been in a drawdown for 3 years, by far the longest in history

Source: Charlie Bilello

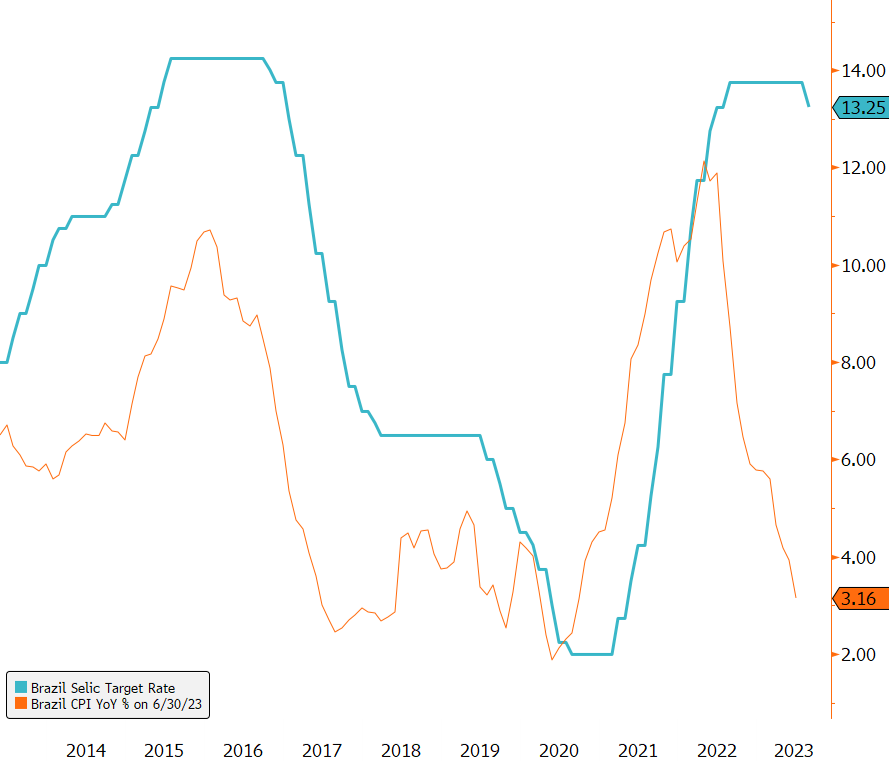

Banco Central do Brazil Surprises with a Larger-than-Expected Rate Cut!

Following the surprising rate cut by 100bps from Chile's Central Bank earlier this week, Banco Central do Brasil (BCB) has also made an unexpected move by announcing a rate cut of 50bps, surpassing market expectations of 25bps. The BCB President, Roberto Campos Neto, reduced the Selic to 13.25% yesterday, with a split decision among board members, four of whom voted for a smaller quarter-point cut. In a related statement, policymakers emphasized the improved consumer price outlook and the decline in longer-term inflation expectations. With Brazil's recent rating upgrade and positive progress in inflation, the country appears well-positioned to continue its path of prudent monetary policy decisions. Could we expect similar rate cuts from Peru and Mexico in the region? In any case, just as at the beginning of the tightening cycle, Latin American central banks are once again ahead of their developed counterparts. Source : Bloomberg.

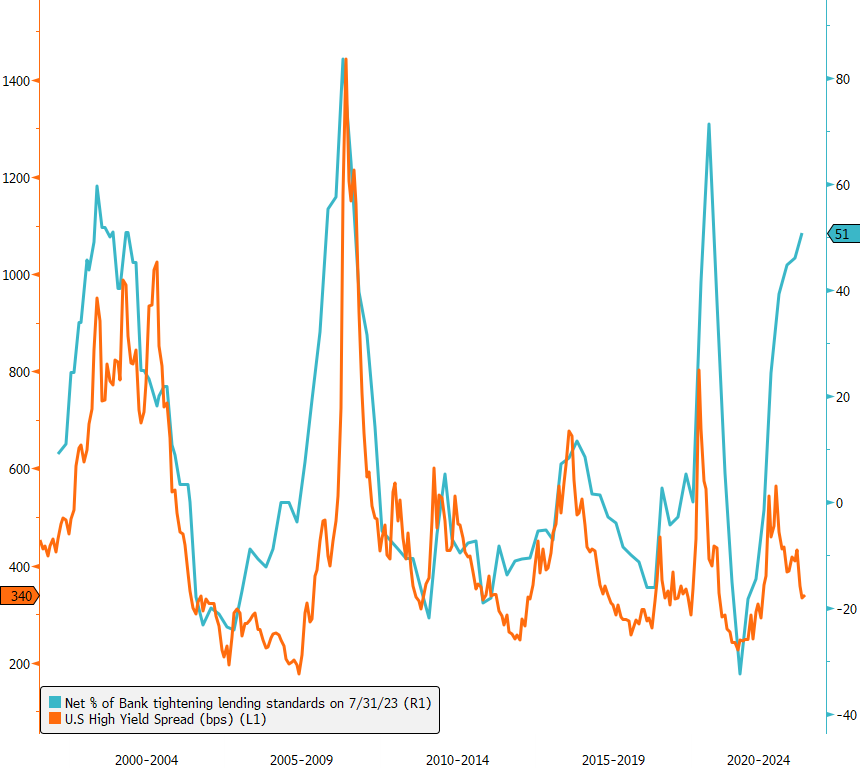

U.S. High Yield credit spreads : time for decompression?

The updated Fed's July senior loan officer survey reveals a notable trend—there's an even higher net share of banks tightening lending standards for C&I compared to the prior survey in April. Historically, this has had implications for US high yield credit spreads. But is this time different? Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks