Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Turkish Central Bank Implements another Significant Rate Hike!

The Turkish Central Bank (CBT) has taken another important step, raising its key rate by 2.5% to 17.5%. Though it slightly missed market expectations (18.5%), the chosen monetary policy path has instilled confidence among investors. This is evident as the 5-year Turkish Credit Default Swaps have hit a new low, not seen since November 2021. Furthermore, Turkish government and corporate bonds denominated in USD have demonstrated an impressive performance, gaining +6% in 2023. In addition to these developments, it is noteworthy that Turkey has recently received substantial economic support from the UAE, totaling more than $50 billion. Could this influx of support help mitigate the sharp weakness experienced by the Turkish Lira? Source : Bloomberg.

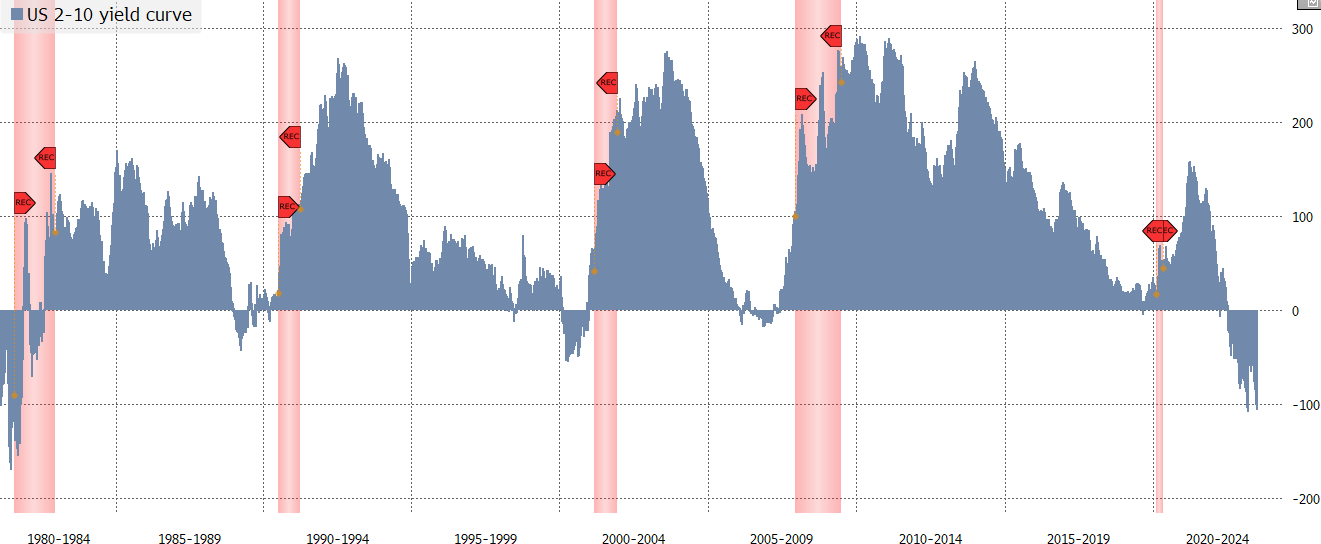

Is the yield curve a flawed recession indicator?

While the deeply inverted yield curve has stoked anxiety among investors about the prospect of a recession, Goldman Sachs has a different message: stop worrying about it. Indeed, the bank's Chief Economist Jan Hatzius just cut his assessment of the probability of a recession to 20% from 25%, following a lower-than-expected inflation report last week.

Options open interest, iShares 20+ year treasury bond etf

Call Open Interest in the iShares 20+ Year Treasury Bond ETF $TLT is more than triple the OI for Puts signaling that options traders are betting that interest rates are primed to drop. Source: Barchart

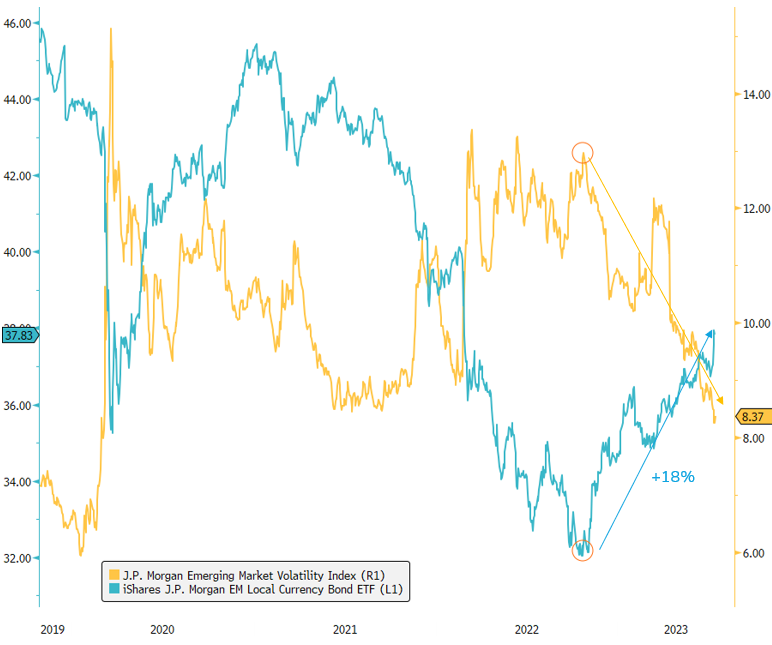

Emerging Market Local Currency Debt: Sustaining the Rally?

Emerging Market local currency debts have proven to be top performers (+18%) since reaching the peak in the 10-year US Treasury yield (4.25%) in October 2022, during this rate hike cycle. This specific segment of the fixed income market has offered attractive real rates, leading to the strengthening of EM currencies against the US Dollar. Notably, volatility in EM currencies has reached its lowest level since March 2020 and the global pandemic. As emerging market central banks prepare for potential monetary policy "pivot" (starting with Chile, Hungary and Brazil?), the question arises: will this trend continue? Or could we see a break in the rally, despite the favorable gap in nominal policy rates between EM and DM, while the gap in headline inflation reaches its tightest level? Source : Bloomberg

JP Morgan AM says global bond rally is just starting

The rally that erupted after this week’s US inflation report was the moment Wall Street veteran Bob Michele has been waiting for.

“More and more indicators are at levels you only see in recession. We are buying every backup in yields. The considerable central bank tightening is starting to bite hard in the real economy.”, said Michele

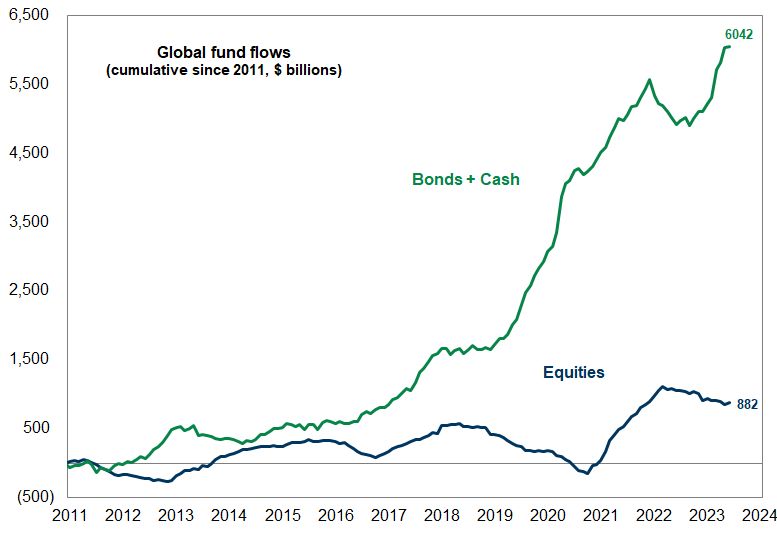

Is this the biggest risk for the equity "bears"

Is this the biggest risk for the equity "bears". As highlighted by Goldman, there is a $5 Trillion “wedge” between Money Market Funds and bonds vs. equities... As investors realize that the much feared recession is not happening, they might be willing to move from the sidelines back into risk assets. Goldman's Rubner calls it a "R.I.N.O market" (Recession In Name Only).

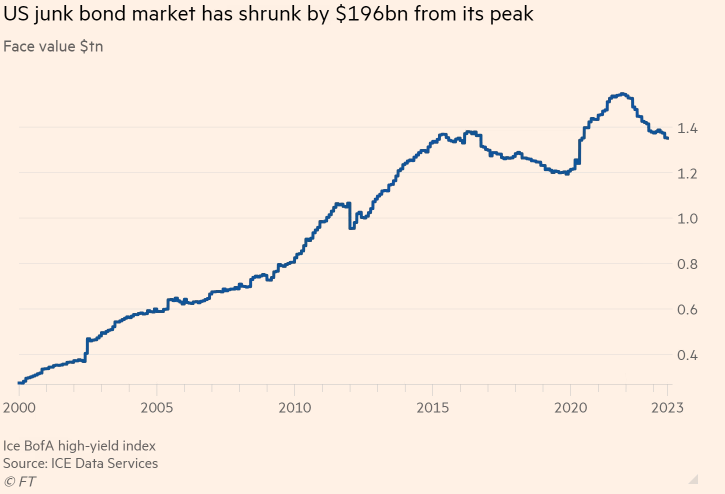

The $1.35tn US junk bond market has shrunk by 13% since all-time peak

High-yield market contracts 13% from 2021 peak amid fears of false signals about American economy’s health.

A steep rise in interest rates since early last year has helped deter companies from selling new bonds, while several companies have climbed out of the high-yield market into investment grade territory. The spread has simultaneously widened out to 4.05% from roughly 3%.

Source: Financial Times

Investing with intelligence

Our latest research, commentary and market outlooks